The cover image was created by the transcriber and is placed in the public domain.

Title: Fifty years in Wall Street

Author: Henry Clews

Release date: March 25, 2023 [eBook #70377]

Language: English

Original publication: United States: Irving Publishing Company, 1908

Credits: MFR, Barry Abrahamsen, and the Online Distributed Proofreading Team at https://www.pgdp.net (This file was produced from images generously made available by The Internet Archive)

The cover image was created by the transcriber and is placed in the public domain.

FIFTY

YEARS IN

WALL STREET

By

HENRY CLEWS, LL.D.

Eng. by E. G. Williams & Bro. N.Y.

Henry Clews

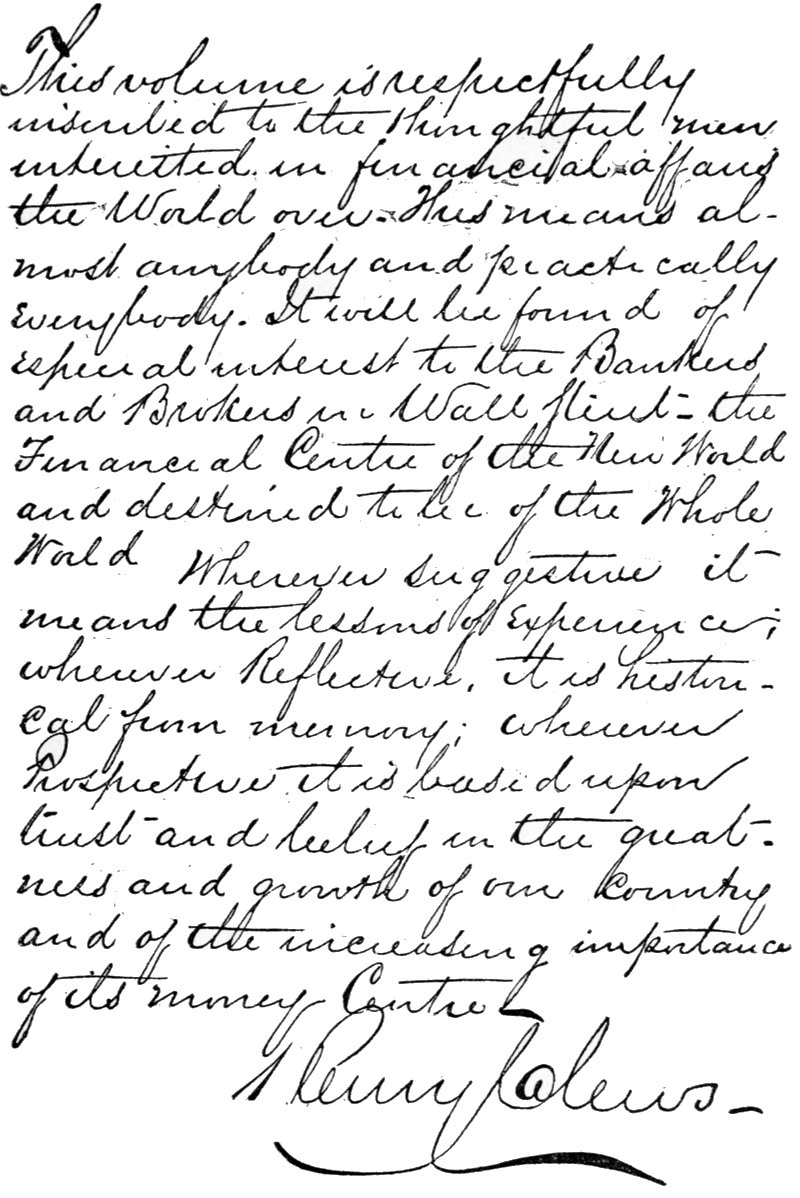

To My Readers:

The following pages are intended to throw some light on imperfectly known events connected with Wall Street speculations and investments, and also upon the condition and progress of the country from a financial standpoint, during the fifty years which I have experienced in the great money center.

The theme is worthy of an abler pen, but in the absence of other contributors to this branch of our National history, I venture the plain narrative of an active participator in the financial events of the time in which I have lived.

I have also made a brief retrospect of the history of Wall Street, and financial affairs connected therewith since the origin of the Stock Exchange in New York City.

In sketching the men and events of Wall Street, I have freely employed the vernacular of the speculative fraternity as being best adapted to a true picture of their characteristics, although probably not most consonant with literary propriety.

I have simply attempted to unfold a plain, unvarnished tale, drawing my material from experience and the records of reliable narrators.

New York, March 31, 1908.

| PAGE | |

| My Part in Marketing the United States Civil War Loans | xxxi |

| Results of the Panic of 1857.—Creating a Revolution in the Methods of Doing Business in Wall Street.—The Old “Fogies” of the Street, and How They were Surprised.—Their Prejudices and How they Originated.—The Struggle of the Young Bloods for Membership.—The Youthful Element in Finance Peculiar to this Country.—The Palmy Days of Little, Drew and Morse.—The Origin of “Corners,” and the “Option” Limit of Sixty Days | 5 |

| Clerical Obliquity of Judgment About Wall Street Affairs.—The Slanderous Eloquence of Talmage.—Wall Street a Great Distributor, as Exhibited in the Clearing House Transactions.—Popular Delusions in Regard to Speculation.—What Our Revolutionary Sires Advised About Improving the Industrial Arts, Showing the Striking Contrast Between Their Views and the Way Lord Salisbury Wanted to Fix Things for This Country | 13 |

| How to Take Advantage of Periodical Panics in Order to Make Money.—Wholesome Advice to Young Speculators.—Alleged “Points” from Big Speculators End in Loss or Disaster.—Professional Advice the Surest and Cheapest, and How and Where to Obtain It | 19 |

| viiiSons of Independent Gentlemen make very bad Clerks.—They become Unpopular with the Other Boys, and must Eventually Go.—Night Dancing and Late Suppers don’t Contribute to Business Success.—Give Merit its True Reward.—Keeping Worthless Pretense in its True Position.—Running Public Offices on Business Principles.—A Piece of Gratuitous Advice for the Administration.—A College Course not in General Calculated to make a Good Business Man.—The Question of Adaptability Important.—Children should be Encouraged in the Occupation for which they show a Preference.—Thoughts on the Army and Navy | 25 |

| Breach of Trust Rare Among Wall Street Men.—The English Clergyman’s Notion of Talmage’s Tirades Against Wall Street.—Adventurous Thieves Have No Sympathizers Among Wall Street Operators.—Early Training Necessary for Success in Speculation.—Ferdinand Ward’s Evil Genius.—A Great Business can only be Built up on Honest Principles.—Great Generals Make Poor Financiers, Through Want of Early Training.—Practical Business is the Best College | 33 |

| The Financiers of Wall Street Assist the Government in the Hour of the Country’s Peril.—The Issue of the Treasury Notes.—Jay Cooke’s Northern Pacific Scheme Precipitates the Panic of 1873.—Wall Street Has Played a Prominent Part in the Great Evolution and Progress of the Present Age | 39 |

| How Napoleon Defied the Monroe Doctrine.—The Banquet to Romero.—Speeches by Eminent Financiers, Jurists and Business Men.—The Eloquent Address of Romero Against French Intervention.—Napoleon shows his Animus by Destroying the Newspapers Containing the Report of the Banquet.—The Emperor Plotting with Representatives of the English Parliament to Aid the Confederates and Make War on the United States | 45 |

| ixHow the Imperial Pirates of France and England Were Frightened Off Through the Diplomacy of Seward.—Ominous Appearance of the Russian Fleet in American Waters.—Napoleon Aims at the Creation of an Empire West of the Mississippi, and the Restoration of the Old French Colonies.—Plotting with Slidell, Benjamin, Lindsay, Roebuck and Others.—Urging England to Recognize the Confederacy.—Disraeli Explains England’s Designs and Diplomacy.—After the Naval Victory of Farragut and the Capture of New Orleans England Hesitates Through Fear, and Napoleon Changes His Tactics.—Renewal of Intrigues Between England and France.—Their Dastardly Purposes Defeated by the Victories of Gettysburg, Vicksburg and the General Triumph of the Union Arms | 59 |

| The Depleted Condition of the Treasury when Mr. Chase took Office.—Preparations for War and Great Excitement in Washington.—Chivalrous Southerners in a Ferment.—Officials Up in Arms in Defence of their Menaced Positions.—Miscalculation with Regard to the Probable Duration of the War.—A Visit to Washington and an Interview with Secretary Chase.—Disappointment about the Sale of Government Bonds.—A Panic Precipitated in Wall Street.—Millionaires Reduced to Indigence in a Few Hours.—Miraculously Saved from the Wreck.—How it Happened | 73 |

| Secretary Chase Considers the Problem of Providing a National Currency.—How E. G. Spaulding takes a Prominent Part in the Discussion of the Bank Act.—The Act Founded on the Bank Act of the State of New York.—Effect of the Act upon the Credit of the Country.—A New System of Banking Required | 81 |

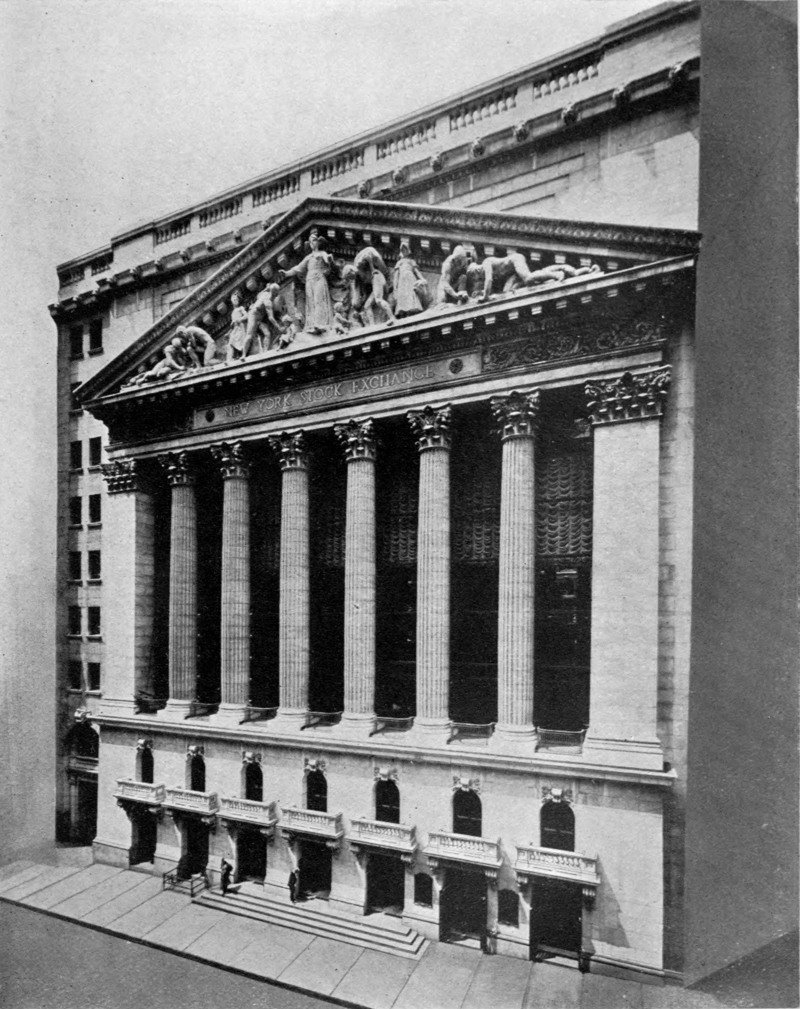

| History of the Organization for Ninety-four Years.—From a Button-Wood Tree to a Palace Costing Millions of Dollars.—Enormous Growth and Development of the Business.—How the Present Stock Exchange was Formed by the Consolidation of other Financial Bodies.—Patriotic Action During the War Period.—Reminiscences of Men and Events | 87 |

| The Senate Committee on “Corners” and “Futures.”—Speculation Beneficial to the Country at Large.—A Regulator of Values, and an Important Agent in the Prevention of Panics.-“Corners” in all kinds of Business.—How A. T. Stewart made “Corners.”—All Importing Firms deal in “Futures.”—Legislation Against “Corners” would stop Enterprise and cause Stagnation in Business.—Only the Conspirators themselves get hurt in “Corners.”—The Black Friday “Corner.”—Speculation in Grain Beneficial to Consumers | 95 |

| The Great Hudson “Corner.”—Commodore Vanderbilt the “Boss” of the Situation.—The “Corner” Forced upon Him.—How he Managed the Trick of getting the Bears to “Turn” the Stock, and then caught them.—His able Device of Unloading while Forcing the Bears to Cover at High Figures.—The Harlem “Corner.”—The Common Council Betrayed the Commodore, but were Caught in their own Trap, and Lost Millions.—The Legislature Attempt the same Game, and meet with a Similar Fate | 107 |

| Drew, like Vanderbilt, an Example of Great Success without Education.—Controlled more Ready Cash than any man in America.—Drew goes Down as Gould Rises.-“His Touch is Death.”—Prediction of Drew’s Fall.—His Thirteen Millions Vanish.—How he caught the Operators in “Oshkosh” by the Handkerchief Trick.—The Beginning of “Uncle Daniel’s” Troubles.—The Convertible Bond Trick.—The “Corner” of 1866.—Millions Lost and Won in a Day.—Interesting Anecdote of the Youth who Speculated outside the Pool, and was Fed by Drew’s Brokers | 117 |

| xiVanderbilt Essays to Swallow Erie, and Has a Narrow Escape from Choking.—He Tries to make Drew Commit Financial Suicide.—Manipulating the Stock Market and the Law Courts at the Same Time.—Attempts to “Tie Up” the Hands of Drew.—Manufacturing Bonds with the Erie Paper Mill and Printing Press.—Fisk Steals the Books and Evades the Injunction.—Drew Throws Fifty Thousand Shares on the Market and Defeats the Commodore.—The “Corner” is Broken and Becomes a Boomerang.—Vanderbilt’s Fury Knows no Bounds.—In his Rage he Applies to the Courts.—The Clique’s Inglorious Flight to Jersey City.—Drew Crosses the Ferry with Seven Millions of Vanderbilt’s Money.—The Commodore’s Attempt to Reach the Refugees.—A Detective Bribes a Waiter at Taylor’s Hotel, who Delivers the Commodore’s Letter, which Brings Drew to Terms.—Senator Mattoon gets on the right side of Both Parties | 127 |

| A Harmonious Understanding with the Commodore.—How the Compromise was Effected.—An Interesting Interview with Fisk and Gould in the Commodore’s Bed-Room.—How Richard Schell Raised the Wind for the Commodore.—Drew’s Share of the Spoils.—He Tries to Retire from Wall Street, but Can’t.—The Settlement that Cost Erie Nine Millions.—Gould and Fisk “Water” Erie again, to the Extent of Twenty-three Millions, but leave Drew out.-“Uncle Daniel” Returns to the Street.—He is Inveigled into a Blind Pool by Gould and Fisk, Loses a Million and Retreats from the Pool.—He then Operates Alone on the “Short” Side and Throws Away Millions.—He Tries Prayer but it “Availeth Not.”-“It’s no Use, Brother, the Market Still Goes Up.”—Praying and Watching the Ticker.—Hopelessly “Cornered” and Ruined by his Former Pupils and Partners | 137 |

| xiiIncidents in the Early Life of Drew; and How he Began to Make Money.—He Borrows Money from Henry Astor, Buys Cattle in Ohio and Drives them over the Alleghany Mountains under Great Hardship and Suffering.—His Great Career as a Steamboat Man, and his Opposition to Vanderbilt.—His Marriage and Family.—He Builds and Endows Religious and Educational Institutions.—Returns to his Old Home after his Speculative Fall, but can find No Rest so Far away from Wall Street.—His Hopes through Wm. H. Vanderbilt of another Start in Life.—His Bankruptcy, Liabilities and Wardrobe.—His Sudden but Peaceful End.—Characteristic Stories of his Eccentricities | 147 |

| Not Accidental Freaks of the Market.—We are Still a Nation of Pioneers.—The Question of Panics Peculiarly American.—Violent Oscillations in Trade Owing to the Great Mass of New and Immature Undertakings.—Uncertainty about the Intrinsic Value of Properties.—Sudden Shrinkage of Railroad Properties a Fruitful Cause of Panics.—Risks and Panics Inseparable from Pioneering Enterprise.—We are Becoming Less Dependent on the Money Markets of Europe.—In Panics much Depends upon the Prudence and Self-control of the Money-Lenders.—The Law which Compels a Reserve Fund in the National Banks is at Certain Crises a Provocative of Panics.—George I. Seney.—John C. Eno.—Ferdinand Ward.—The Clearing House as a Preventive of Panics | 157 |

| The Panic of 1837.—How it was Brought About.—The State Banks.—How they Expanded their Loans under Government Patronage.—Speculation was Stimulated and Values Became Inflated.—President Jackson’s “Specie Circular” Precipitates the Panic.—Bank Contractions and Consequent Failures.—Mixing up Business and Politics.—A General Collapse, with Intense Suffering | 175 |

| The Great Black Friday Scheme originates in patriotic motives. Advising Boutwell and Grant to sell Gold.—The part Jim Fisk played in the Speculative Drama.-“Gone where the Woodbine Twineth.”—A general state of Chaos in Wall Street.—How the Israelite Fainted.-“What ish the prish now?”—Gould the Head Centre of the Plot to “Corner” Gold.—How he Managed to Draw Ample Means from Erie.—Gould and Fisk Attempt to Manipulate President Grant and Compromise him and his Family in the Plot.—Scenes and Incidents of the Great Speculative Drama | 181 |

| Inadequate Information.—False Information.—Defects of News Agencies.—Insufficiency of Margins.—Dangers of Personal Idiosyncrasies.—Operating in Season and out of Season.—Necessity of Intelligence, Judgment and Nerve.—An Ideal Standard.—What Makes a King Among Speculators? | 201 |

| Return of the Renowned Speculator to Wall Street.—Recalling the Famous “Blind” Pool in Northern Pacific.—How Villard Captured Northern Pacific.—Pursuing the Tactics of Old Vanderbilt.—Raising Twelve Million Dollars on Paper Credit.—Villard Emerges from the “Blind” Pool a Great Railroad Magnate.—He Inflates his Great Scheme from Nothing to One Hundred Million Dollars.—His Unique Methods of Watering Stock as Compared with those of George I. Seney | 209 |

| Peculiar Power and Methods of the Prince of Swindlers.—How he Duped Astute Financiers and Business Men of all Sorts, and Secured the Support of Eminent Statesmen and Leading Bank Officers, whom he Robbed of Millions of Money.—The most Artful Dodger of Modern Times.—The Truth about the Swindle Practiced upon General Grant and his Family. | 215 |

| How Mr. Smith Started in Life and became a Successful Operator.—His connection with the Tweed “Ring,” and how he and the Famous “Boss” made Lucky Speculations, through the use of the City Funds, in Making a Tight Money Market.—On the Verge of Ruin in a Pool with W. K. Vanderbilt.—He is Converted to the Bear Side by Woerishoffer, and Again Makes Money, but by Persistence in his Bearish Policy Ruins himself and Drags Wm. Heath & Co. down also | 223 |

| He Starts in Speculation as a “Curbstone” Broker.—A Lucky Hit in a Mining Stock Puts Him on the Road to be a Millionaire.—His Speculative Encounter with the Bonanza Kings.—He Makes Four Millions, and Major Selover brings him to Wall Street, where they Form an Alliance with Gould, Who “Euchres” Both of Them.—Selover Drops Gould in an Area Way.—Keene Goes Alone and Adds Nine Millions More to His Fortune.—He Then Speculates Recklessly in Everything.—Suffers a Sudden Reversal and Gets Swamped.—Overwhelming Disaster in a Bear Campaign, Led by Gould and Cammack, in which Keene Loses Seven Millions.—His Desperate Attempts to Recover a Part Entail Further Losses, and He Approaches the End of His Thirteen Millions.—His Princely Liberality and Social Relations with Sam Ward and Others | 229 |

| Deceptive Financiering.—Over-Capitalization.—Stock “Watering.”—Financial Reconstructions.—Losses to the Public.—Profits of Constructors.—Bad Reputation of our Railroad Securities.—Unjust and Dangerous Distribution of the Public Wealth | 241 |

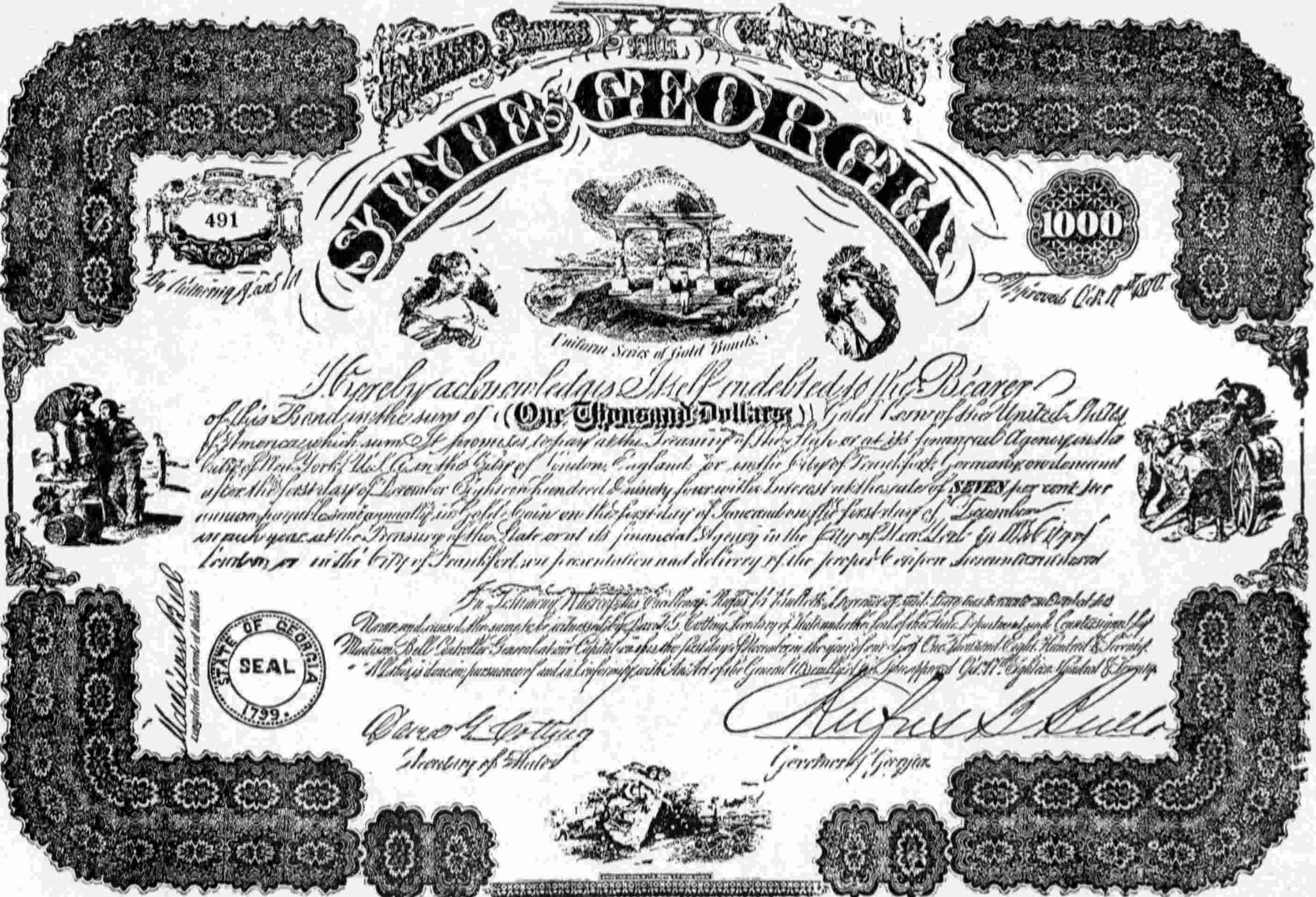

| How a Sovereign Southern State Cheated the Northern Men who Helped Her in Distress.—A New Way to Pay Old Debts.—Cancellation by Repudiation of Just Claims for Cash Loaned to Sustain the State Government, Build Public Schools and Make Needed Improvements.—Bottom Facts of the Outrage.—The Recent Attempt to Place a New Issue of Georgia Bonds on the Market while the Old ones Remain Unpaid.—The Case before the Attorney-General of the State of New York.—He Examines the Legal Status of the Bonds in Connection with the Savings Banks.—His Decision Prohibits these Institutions from Investing the Hard Earnings of the Working People in these Doubtful and Dangerous Securities.—A Bold Effort to have the Fresh Issue of Georgia Paper put upon the List of Legitimate Securities of the New York Stock Exchange Firmly Opposed and Eventually Frustrated | 255 |

| “Swinging Around the Circle.”—How Mr. Johnson Came to Visit New York on His Remarkable Tour.—The Grand Reception at Delmonico’s.—The President Loses His Temper at Albany and Becomes an Object of Public Ridicule.—His Proclamation of “My Policy” Ironically Received.—Returns to Washington Disgraced.—The Massacre of New Orleans.—The Impeachment of the President | 289 |

| How the War Democrat, General Dix, was Elected Governor by the Republican Party.—The Candidates of Senator Conkling Rejected.—How Dix was Sprung on the Convention, to the Consternation of the Caucus.—Judge Robertson’s Disappointment.—Exciting Scenes in the Convention.—General Dix declines the Nomination, but Reconsiders and Accepts on the Advice of His Wife and General Grant.—How Dix’s Election Ensures Grant’s Second Term as President | 297 |

| A Chapter of Secret History.—Conkling gets the Credit for Dix’s Nomination and His “Silence Gives Consent” to the Honor.—Robertson Regards Him as a Marplot.—The Senator Innocently Condemned.—The Misunderstanding which Defeated Grant for the Third Term, and Elected Garfield.—How the Noble “306” were Discomfited.-“Anything to Beat Grant.”—The Stalwarts and the Half Breeds.-“Me Too.”—The Excitement which Aroused Guiteau’s Murderous Spirit to Kill Garfield | 307 |

| xviThe Best Man for the Position and Most Deserving of the Honor.—How the “Boom” was Worked up in Favor of Grant.—The Great Financiers and Speculators all Come to the Front in the Interest of the Nation’s Prosperity and of the Man who had Saved the Country.—The Great Mass Meeting at Cooper Union.—Why A. T. Stewart Refused to Preside.—The Results of the Mass Meeting and how they were Appreciated by the Friends of the Candidate, Leading Representatives of the Business Community and the Public Press Generally, Irrespective of Party | 313 |

| The Ring Makes Itself Useful in Speculative Deals.—How Tweed and His “Heelers” Manipulated the Money Market.—The Ring Conspiring to Organize a Panic for Political Purposes.—The Plot to Gain a Democratic Victory Defeated and a Panic Averted Through President Grant and Secretary Boutwell, who were Apprised of the Danger by Wall Street Men.—How the Committee of “Seventy” Originated.—The Taxpayers Terrorized by Boss Tweed and his Minions.—How “Slippery Dick” got Himself Whitewashed.—Offering the Office of City Chamberlain as a Bribe to Compromise Matters.—How the Hon. Samuel Jones Tilden, as Counsel to the Committee, Obtained His Great Start in Life | 327 |

| How Tilden began to make His Fortune in Connection with William H. Havemeyer.—Tilden’s great Fort in Politics.—He Improves His Opportunity with the Discernment of Genius.—How Tilden became one of the Counsel of the “Committee of Seventy.”—His Political Elevation and Fame dating from this Lucky Event.—The Sage of Greystone a Truly Great Man.—Attains Marvellous Success by His own Industry and Brain Power.—He not only Deserved Success and Respect, but Commanded them.—How his Large Generosity was Manifested in His Last Will and Testament.—The Attempt to Break that Precious Public Document | 337 |

| Ferryman.—Steamboat Owner.—Runs a Great Commercial Fleet.—The First and Greatest of Railroad Kings.—The Harlem “Corner.”—Reorganization of N. Y. Central.—How He Milked the Street, and Euchred His Co-Speculators.—His Fortune.—Its Vast Increase by Wm. H. | 345 |

| A Builder instead of a Destroyer of Public Values.—His Respect for Public Opinion on the Subject of Monopolies.—His first Experience in Railroad Management.—How he Improved the Harlem Railroad Property.—His great Executive Power manifested in every stage of advance until he became President of the Vanderbilt Consolidated System.—An Indefatigable Worker.—His habit of Scrutinizing Every Detail.—His Prudent Action in the Great Strike of 1877, and its Good Results.—Settled all misunderstandings by Peace and Arbitration.—Makes Princely Presents to his Sisters.—The Singular Gratitude of a Brother-In-Law.—How he Compromises by a Gift of a Million with Young Corneel.—Gladstone’s idea of the Vanderbilt Fortune.—Interview of Chauncey M. Depew with the G. O. M. on the subject.—The great Vanderbilt Mansion and the Celebrated Ball.—The Immense Picture Gallery.—Mr. Vanderbilt Visits some of the Famous Artists.—His Love of Fast Horses.—A Patron of Public Institutions.—His Gift to the Waiter Students.—While Sensitive to Public Opinion, has no fear of Threats or Blackmailers.—The Public be Damned.—Explanation of the rash Expression.—The Purchase of “Nickel Plate.”—His Declining Health and Last Days.—His Will, and Wise Method of Distributing 200 Millions.—Effects of this Colossal Fortune on Public Sentiment | 355 |

| The Eccentricities of Cornelius Jeremiah Vanderbilt, and his Marvellous Power for Borrowing Money.—He Exercises Wonderful Influence over Greeley and Colfax.—A Dinner at the Club with Young “Corneel” and the Famous “Smiler.”-“Corneel” tries to make himself Solid with Jay Cooke.—The Commodore Refuses to Pay Greeley.-“Who the Devil Asked You?” retorted Greeley.-“Corneel’s” marriage to a Charming and Devoted Woman.—How She Softened the Obdurate Heart of her Father-in-Law | 375 |

| xviiiRemarkable for Physical and Intellectual Ability.—The Mixture of Races and the Law of Selection.—The Wonderful Will and the Wise Distribution of Two Hundred Millions.—Tastes, Habits and Social Proclivities of the Young Vanderbilts.—The Married Relations of Some of Them.—Being Happily Assorted they Make Good Husbands.—Their Property Regarded as a Great Trust.—Their Railroad System and its Great Army of Employes.—The Young Men Cautious About Speculating, and Conservative in their Expenses Generally | 387 |

| The Beginning of the Financial Career of the Great House of Rothschild.—The Hessian Blood Money was the Great Foundation of their Fortune.—How the Firm of the Five Original Brothers was Constituted.—Nathan the Greatest Speculator of the Family.—His Career in Great Britain, and how he Misrepresented the Result of the “Battle of Waterloo” for Speculative Purposes.—Creating a Panic on the London Stock Exchange.—His Terror of being Assassinated.—His Death Causes a Panic on the London Exchange and the Bourses | 397 |

| The Unique Character of Travers.—His Versatile Attainments.—Although of a Genial and Humorous Disposition, He was Always a Bear.—How He was the Means of Preserving the Commercial Supremacy of New York.—He Squashes the English Bravado, and Saves the Oratorical Honor of Our Country.—Has the Oyster Brains?—It Must have Brains, for it Knows Enough to Sh-sh-shut Up.—The Dog and the Rat.—I d-d-don’t want to Buy the D-d-dog; I will Buy the R-r-rat.—Travers on the Royal Stand at the Derby.—How He was Euchred by the Pool-Seller.—My Proxy in a Speech at the Union Club.—If You are a S-s-self-made Man, Wh-wh-y the D-devil didn’t You put more H-hair on the Top of Your Head?—Other Witticisms, &c.—Death of the Great Wit and Humorist, and some of His Last Witty Sayings | 407 |

| xixThe Career of Charles F. Woerishoffer and the Resultant Effect upon Succeeding Generations.—The Peculiar Power of the Great Leader of the Bear Element in Wall Street.—His Methods as Compared with Those of Other Wreckers of Values.—A Bismarck Idea of Aggressiveness the Ruling Element of His Business Life.—His Grand Attack on the Villard Properties, and the Consequence Thereof.—His Benefactions to Faithful Friends | 425 |

| Wall Street no Place for Women.—They Lack the Mental Equipment.—False Defenses of Feminine Financiers.—The Claflin Sisters and Commodore Vanderbilt.—Fortune and Reputation Alike Endangered | 437 |

| Eastward the Star of Wealth and the Tide of Beauty Take their Course.—Influence of the Fair Sex on this Tendency, and Why.—New York the Great Magnet of the Country.—Swinging into the Tide of Fashion.—Collis P. Huntington.—His Career from Penury to the Possessor of Thirty Millions.—Leland Stanford.—first a Lawyer in Albany, and afterward a Speculator on the Pacific Coast.—Has Rolled Up nearly Forty Millions.—D. O. Mills.—An Astute and Bold Financier.—Courage and Caution Combined.—His Rapid Rise in California.—He Makes a Fortune by Investing in Lake Shore Stock.—Princes of the Pacific Slope.—Mackay, Flood and Fair.—Their Rise and Progress.—William Sharon.—A Brief Account of His Great Success.—Wm. C. Ralston and His Daring Speculations.—Begins a Poor New York Boy, and Makes a Fortune in California.—John P. Jones.—His Eventful Career and Political Progress.-“Lucky” Baldwin.—His Business Ability and Advancement.—Lucky Speculations.—Amasses Ten or fifteen Millions.—William A. Stewart.—Discovers the Eureka Placer Diggings.—His Success as a Lawyer and in Mining Enterprises.—James Lick.—One of the Most Eccentric of the California Magnates.—Real Estate Speculations.—His Bequest to the Author of the “Star Spangled Banner.”—John W. Shaw, Speculator and Lawyer | 447 |

| xxVastness of our Railroad System.—Its Cost.—Fall in the Rate of Interest.—Tendency to a Four Per Cent. Rate on Railroad Bonds.—Effect of the Change on Stocks.—Prospective Speculation.—Some Social Inequities to be Adjusted through Cheaper Transportation | 475 |

| Its Fundamental Importance.—Dangers of Neglecting it.—Attempts at Evasion.—How it must be Finally met.—Silver Paper Currency Schemes, and their Futility | 481 |

| Harmony Between the Representatives of Capital and Labor Necessary for Business Prosperity.—If Manufacturers should Combine to Regulate Wages the Arrangement could only be Temporary.—The Workingmen are Taken Care of by the Natural Laws of Trade.—Competition among the Capitalists Sustains the Rate of Wages.—Opinion of John Stuart Mill on this Subject.—Compelling a Uniform Rate of Pay is a Gross Injustice to the Most Skilful Workmen.—The Tendency of the Trades Unions to Debar the Workingman from Social Elevation.—The Power of the Unions Brought to a Test.—The Universal Failure of the Strikes.—Revolutionary Demands of the Knights of Labor.—Gould and the Strikes on the Missouri Pacific, &c., &c. | 491 |

| A Resume in Brief of the Leading Events Connected with Wall Street Affairs for Seventy-seven Years | 503 |

| Great as an Achievement of Art, but Greater as the Embodiment of the Idea of Universal Freedom the World Over.—It is a Poetic Idea of a Universal Republic.—Enlightenment of the World Must Result in the Freedom of Man | 525 |

| xxiHow the Fortunes of the Astors were Made.—George Peabody and His Philanthropic Schemes.—Johns Hopkins and his Peculiarities.—A. T. Stewart and his Abortive Plans.—A Sculptor’s Opinion of his Head.—Eccentricities of Stephen Girard, and How he Treated his Poor Sister.—His Penurious Habits and Great Donations.—James Lenox and the Library which he Left.—How Peter Cooper Made his Fortune, and his Liberal Gifts to the Cause of Education.—Samuel J. Tilden’s Munificent Bequests.—The Vanderbilt Clinic.—Lick, Corcoran, Stevens and Catharine Wolf | 529 |

| The Preservation of the Union a Great Blessing.—To Let them “Secesh” would have been National Suicide.—How Immigration has Assisted National Prosperity.—Rescued from the Dynastic Oppression of European Governments.—Showing Good Fellowship towards the Southern People and Aiding them in their Internal Improvements.—The South, Immediately after the War, had Greater Advantages than the North for Making Material Progress.—The Business of the North was Inflated.—The States of Georgia and Alabama Offered Inviting Fields for Investment.—Issuing State Securities, Cheating and Repudiating.—President Johnson Chiefly to Blame for the Breach of Faith with Investors who were Swindled out of their Money.—Revenge and Avarice Unite in Financial Repudiation | 541 |

| Alfred Sully, his Origin and Successful Career.—Calvin S. Brice, a Financier of Ability.—General Samuel Thomas, Prominent in the Southern Railroad System.—General Thomas M. Logan, a Successful Man in Railroading and Mining.—Financial Chieftains of Baltimore.—The Garretts.—Their Great Success as Railroad Managers.—Portrait of Robert Garrett | 553 |

| xxiiHow the System of Settling Disputes and Misunderstandings by Arbitration has Worked in the Stock Exchange.—Why not Extend the System to Business Matters Generally?—Its Great Advantages over Going to Law.—It is Cheap and has no Vexatious Delays.—Trial by Jury a Partial Failure.—Some Prominent Cases in Point.—Jury “Fixing” and its Consequences.—How Juries are Swayed by their Sympathies.—A Curious Miscarriage of Justice before a Referee.—The Little Game of the Diamond Broker | 561 |

| Its Past, Its Present, Its Future.—Banking Decadence.—Growth of Interior Centres.—Obstruction from the National Bank Laws.—Relief Demanded.—Requirements of the Future | 577 |

| The Shock of Every Calamity Felt in Wall Street.—Earthquakes the only Disasters which seem to Defy the Power of Precaution.—Becoming a Subject of Serious Thought for Wall Street Men and Business Men.—The Volcanic Theory of Earthquakes.—Other Causes at Work Producing these Terrific Upheavals.—Why Charleston was more Severely Shaken Up than New York.—Why the Southern Earthquake did not Strike Wall Street with Great Force.—Earthquakes Likely to Become the Great Disasters of the Future | 589 |

| The American Representative of the Rothschilds.—Begins Life in the Rothschilds’ House in Frankfort.—Consul General to Austria and Minister to the Hague.—A Great Financier and a Connoisseur in Art | 595 |

| Increase of Population and the Growing Pressure upon the Means of Subsistence.—Education and Moral Improvement the True Remedy for Existing or Threatened Evils.—Errors of Communism and Socialism.—How Socialistic Leaders and Philosophers Recognize the Truth.—Growth of Population Does Not Mean Poverty | 599 |

| xxiiiHow Wall Street Bankers’ Nerves are Tried.—Fine Humor, Jocular Dispositions, and Scholarly Taste of Operators.—George Gould as a Future Financial Power.—American Nobility Compared with European Aristocracy.—How the Irish Can Assist to Purge Great Britain of her Bilious Incubus of Nobility.—The Natural Nobility of Our Own Country and Their Destiny | 603 |

| What We Are.—What We are Preparing For.—What We are Destined to Do and to Become.—We are Entering on an Era of Seeming Impossibilities.—Yet the Inconceivable Will be Realized | 611 |

| His Birth and Early Education.—Clerk in a Country Store.—He Invents a Mouse Trap.—Becomes a Civil Engineer and Surveys Delaware County.—Writes a Book and Sells it.—Gets a Partnership in a Pennsylvania Tannery and soon Buys his Partner Out.—He comes to New York to Sell his Leather, falls in Love with a Leather Merchant’s Daughter and Marries her.—Settles in the Metropolis and begins to Deal in Railroads.—Buys a Bankrupt Road from his Father-in-law, Reorganizes it and Sells it at a Considerable Profit.—Henceforth he makes his Money Dealing in Railroads.—His Method of Buying, Reorganizing and Selling Out at a Large Profit.—How he Managed Erie in connection with Fisk and Drew.—His Operations on Black Friday.—Checkmated by Commodore Vanderbilt and obliged to Settle.—He makes Millions out of Wabash and Kansas & Texas.—His Venture in Union Pacific.—His Construction Companies.—Organization of American Union Telegraph, and his Method of Absorbing and Getting Control of Western Union.—The Strike of the Telegraphers and his Great Encounter with the Knights of Labor and Trades Unionist.—Gould’s First Yachting Expedition.—An exceedingly Humorous Story of his early Experience on the Water.—His Status as a Factor in Railroad Management | 619 |

| xxivCyrus W. Field.—Russell Sage.—Addison Cammack.—The Jerome Brothers.—Moses Taylor.—Chauncey M. Depew.—Austin Corbin.—Anthony J. Drexel.—John A. Stewart.—Hon. Levi P. Morton.—Philip D. Armour.—Stedman, the Poet.—Stephen V. White.—H. Victor Newcombe.—James M. Brown.—Former Giants of the Street.—Henry Keep.—Anthony W. Morse | 659 |

| James B. and John H. Clews | 683 |

| A Remarkable Chapter of History | 685 |

| Booms in Wall Street | 700 |

| A Glimpse into the Future | 716 |

| My Christmas Address to Customers, December 24, 1906 | 724 |

| Edward H. Harriman | 726 |

| The Ups and Downs of Wall Street | 728 |

| Recent Wall Street Booms | 744 |

| Wall Street’s Wild Speculation, 1900-1904 | 755 |

| Review of the Panic Year, 1903 | 771 |

| Leading Wall Street Events up to the Fall of 1907 | 774 |

| The Great Crisis of 1907 | 790 |

| The Causes of the Crisis of 1907 | 797 |

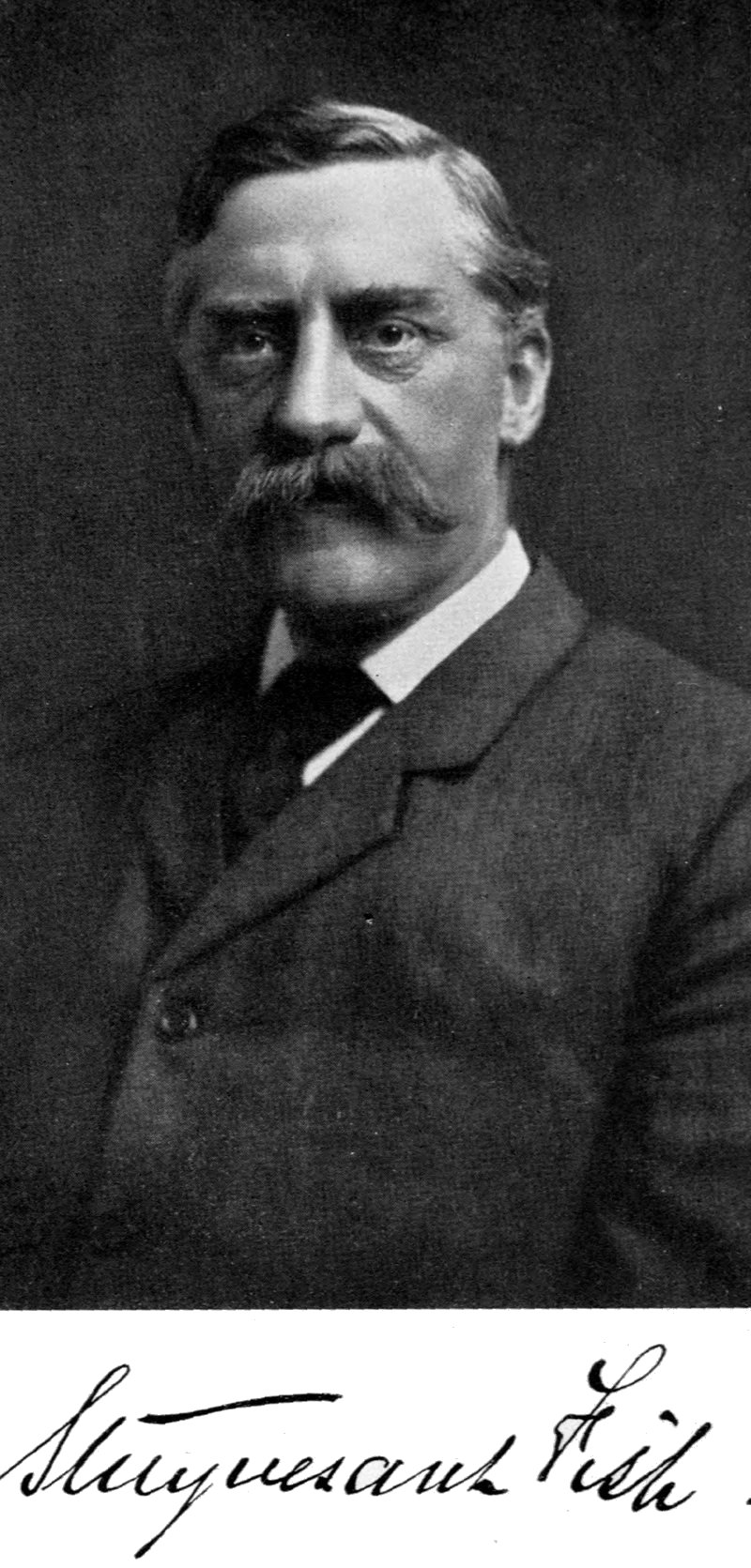

| Charles M. Schwab.—Daniel Gray Reid.—Thomas Fortune Ryan.—John Warne Gates.—August Belmont.—William H. Moore.—Anthony Nicholas Brady.—Stuyvesant Fish | 801 |

| Needed Publicity and Reform in Corporations | 807 |

| The Monetary Situation and its Remedies | 822 |

| Individuality versus Socialism | 836 |

| Great Wealth and Social Unrest | 855 |

| The Financial Situation | 879 |

| Table showing Dates of Admission of the Members of the New York Stock Exchange | 913 |

| England and Russia in our Great Civil War and the War between Russia and Japan | 917 |

| The Crisis of 1907 and its Causes. Was President Roosevelt to Blame? | 927 |

| Our Great American Panics from First to Last | 943 |

| Wall Street as It Really Is. A Vindication | 955 |

| The Financial and Trade Situation, Past, Present and Future, Reviewing the Crisis of 1907, with Causes and Remedies | 964 |

| American Social Conditions | 1001 |

| Financial and Trade Situation and Prospects | 1014 |

| Peace Assurances from Japan | 1033 |

| The Emperor of Japan | 1037 |

| The National Corporation Problem | 1045 |

| Conclusion | 1063 |

| PAGE. | |

| Henry Clews | Frontispiece |

| Mills Building | 5 |

| Parents of Henry Clews | 7 |

| Birthplace of Henry Clews | 9 |

| Map of U. S. by Henry Clews | 11 |

| Jacob Little | 13 |

| Salmon P. Chase | 39 |

| John Sherman | 73 |

| E. G. Spaulding | 81 |

| New York Stock Exchange (exterior) | 87 |

| New York Stock Exchange (interior) | 91 |

| Daniel Drew | 117 |

| George I. Seney | 175 |

| Henry Villard | 209 |

| Georgia State Bond | 255 |

| Samuel J. Tilden | 337 |

| Commodore Vanderbilt | 345 |

| W. H. Vanderbilt | 355 |

| Cornelius Vanderbilt | 387 |

| W. K. Vanderbilt | 389 |

| F. W. Vanderbilt | 393 |

| Three Rothschilds | 397 |

| Nathan Rothschild | 401 |

| W. R. Travers | 407 |

| C. P. Huntington | 451 |

| Leland Stanford | 455 |

| D. O. Mills | 457 |

| Charles Crocker | 459 |

| John W. Mackay | 461 |

| James C. Flood | 463 |

| James G. Fair | 465 |

| Robert Garrett | 553 |

| August Belmont | 595 |

| George J. Gould | 607 |

| Jay Gould | 619 |

| Cyrus W. Field | 659 |

| P. D. Armour | 661 |

| Levi P. Morton | 663 |

| J. A. Stewart | 665 |

| A. J. Drexel | 667 |

| Leonard W. Jerome | 669 |

| Addison Cammack | 671 |

| Russell Sage | 673 |

| Chauncey M. Depew | 675 |

| James M. Brown | 677 |

| E. C. Stedman | 679 |

| H. Victor Newcombe | 681 |

| Moses Taylor | 683 |

| Thomas L. James | 685 |

| John H. Clews | 687 |

| James B. Clews | 689 |

| Roswell P. Flower | 691 |

| J. Pierpont Morgan | 693 |

| John D. Rockefeller | 701 |

| William Rockefeller | 713 |

| Henry H. Rogers | 729 |

| John D. Archbold | 735 |

| Edward H. Harriman | 793 |

| Wm. H. Moore | 821 |

| Daniel G. Reid | 843 |

| Thomas F. Ryan | 849 |

| John W. Gates | 853 |

| Chas. M. Schwab | 869 |

| August Belmont | 879 |

| Anthony N. Brady | 881 |

| Stuyvesant Fish | 903 |

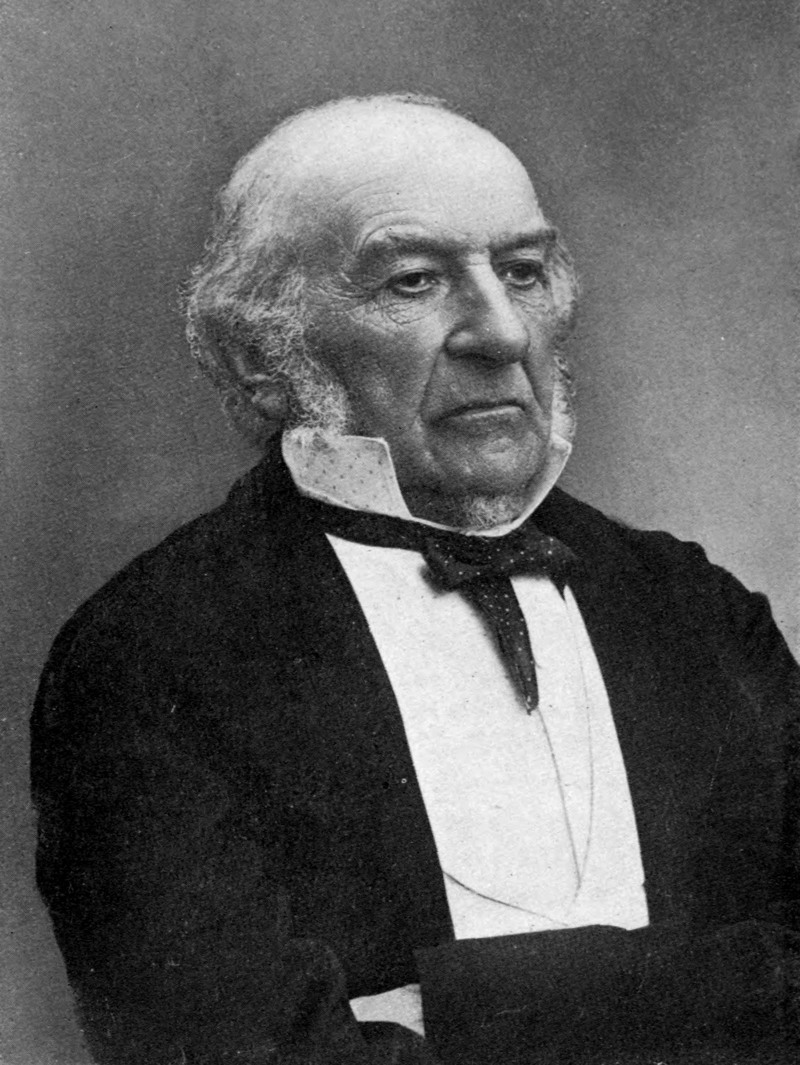

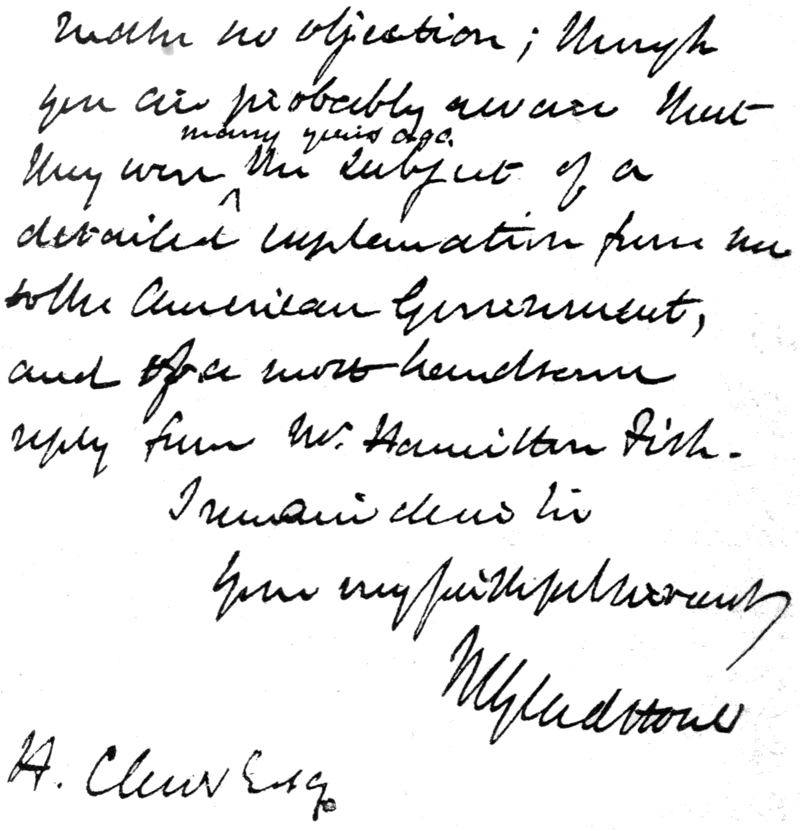

| William E. Gladstone | 921 |

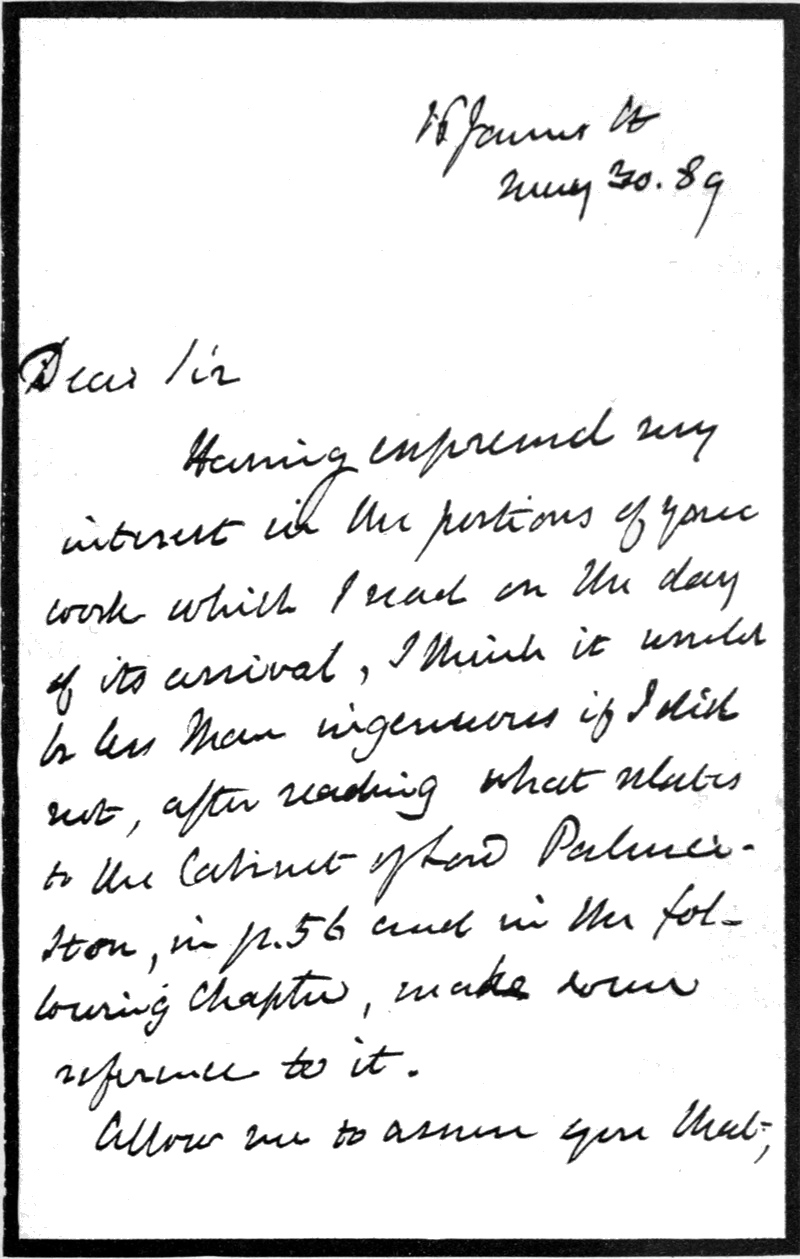

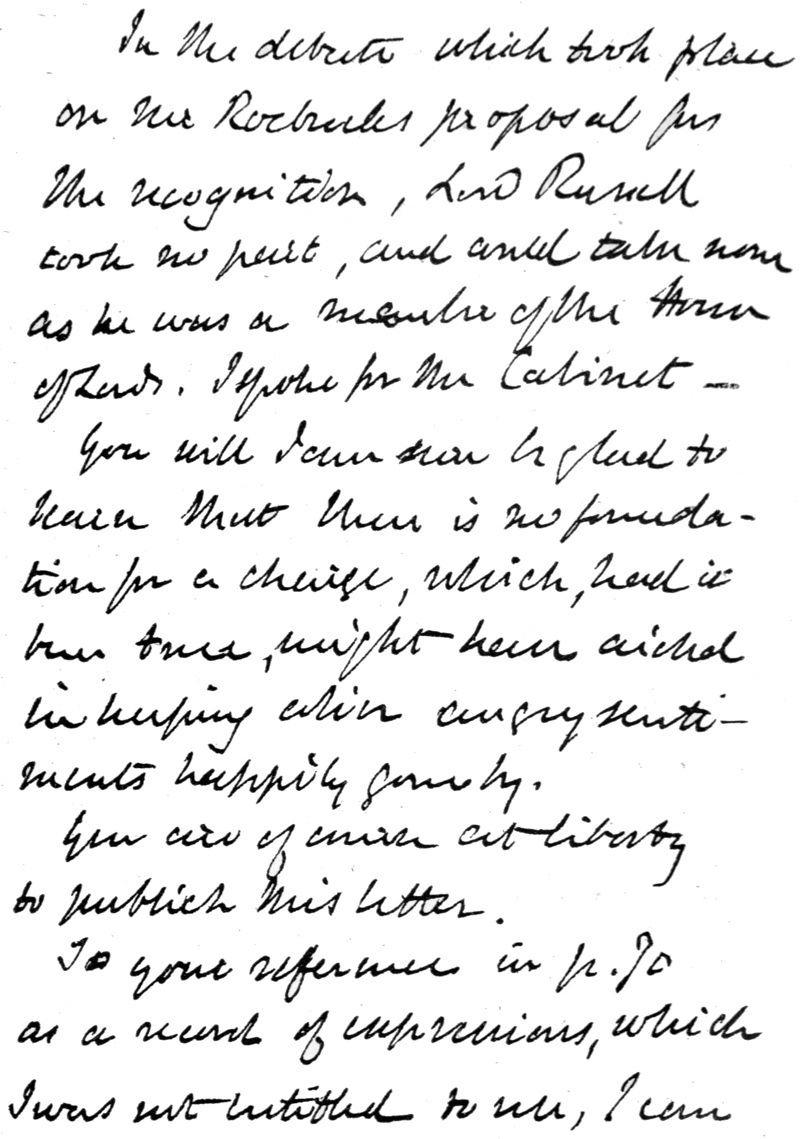

| Fac-simile, Gladstone letter | 923 |

My Dear Friends:

I have attempted, in the following pages, to relate in a simple and comprehensive manner, without any aim at elaboration, the leading features of the most prominent events that have come within the sphere of my personal knowledge and experience during the twenty-eight years of my busy life in Wall street. I have never kept a diary regularly, but have been occasionally in the habit of preserving certain memoranda in the form of letters, and a few scraps from the newspapers at various times. With these imperfect mementoes, I have revived my recollection to dictate to my stenographer the matter which these pages contain, in a somewhat crude form and unfinished style. In fact, I have not aimed at either finish or effect, not having time for it, but have simply made a collection of important facts in my own experience that may help the future historian of Wall Street to preserve for the use, knowledge and edification of posterity some of the most conspicuous features and events in the history of the place that is yet destined to be the great financial centre of the world.

If I can only succeed, out of all the poorly-arranged material I have gathered, in furnishing the historian of the future with a few facts for a portion of one of his chapters, I shall have some claim upon the gratitude of posterity.

In my description of Drew, Vanderbilt, Gould, Travers, xxviiiKeene, Conkling and others, I have followed the advice which Oliver Cromwell gave his portrait painter: “Paint me as I am,” he said. “If you leave out a scar or a wrinkle, I shall not pay you a farthing.” I have given my opinion of men and things also without any superstitious regard for the proverb de mortuis nil nisi bonum.

I have also endeavored to refrain from setting down aught in malice. Many of those referred to are now dead.

When any of those gentlemen of whom I have had occasion to speak, who still survive, shall write a book, they can indulge in the same privilege with my name that I have done with theirs, whether I am living or dead at the time.

I shall ask no indulgence for myself that I don’t accord to others.

I have expressed my opinions freely from a Wall Street point of view, from the standpoint of the much-abused operator and broker, and “bloated bondholder.”

I have endeavored to enlighten the public on the true status of Wall Street, as the very backbone of the country’s progress and prosperity, instead of misrepresenting it as a den of gamblers, according to the ignorant and somewhat popular prejudice of the majority who have attempted to write or speak on the subject. This feeling has been largely fostered by clergymen, on hearsay evidence, as well as by the practices of professional swindlers, who have been smuggled into Wall Street from time to time, but who have no legitimate connection therewith any more than they have with the church, which repudiates them as soon as it discovers them.

In fact, the great aim of the book is to place Wall Street in its true light before the eyes of the world, and help to efface the many wrong impressions the community have received regarding the method of doing business in the great financial mart to which the settlement of accounts in all our industry, trade and commerce naturally converges.

xxixI have endeavored to correct the utterly erroneous impression that prevails outside Wall Street, in regard to the nature of speculation, showing that it is virtually a great productive force in our political and social economy, and that without it railroad enterprise and other branches of industrial development which have so largely increased the wealth of the nation, would have made but slow progress.

To preserve and inculcate these ideas by putting them in what I hope may be a permanent form, is another object of publishing this volume. I know you can sympathize with me in this effort to set public opinion right, as many of you have long been making strenuous endeavors after success in the same direction.

To put the whole matter, then, into one short and comprehensive clause, my cardinal object in this book is to give the general public a clearer insight of the reputed mystery and true inwardness of Wall Street affairs.

In my relation of certain reminiscences of Wall Street, and in discussing the checkered career of certain brokers, operators and politicians, I have endeavored to be guided by a historic aphorism of Lord Macaulay:

“No past event has any intrinsic importance,” says the great essayist, litterateur, historian and statesman. “The knowledge of it is valuable,” he adds, “only as it leads us to form just calculations with respect to the future.”

In the samples of my experience which I have given in this book I have aimed, to some extent, at this rendition of the noble purposes of history and biography in their philosophic and scientific application of teaching by example. If I have fallen far short of this high ideal of the British Essayist, as I humbly feel that I have, I must throw myself on the kind indulgence of the readers, and ask them to take the will for the deed. For the presentation of the facts themselves I crave no indulgence. They are gems worthy of preservation in the light xxxof the above definition. I only submit that the setting might be much better.

My chapters on politics may be considered foreign to the main issue, but as many of the events therein described were intimately connected with my business career, I think they are not much of a digression.

To a very large majority of Americans now living the great Civil War—waged from 1861 to 1865—between the North and the South is only known as a matter of history. But it was the greatest war the world ever witnessed, involving the loss of nearly a million of men, and I have a vivid recollection of it, for I was an actor in it, from its beginning to its end, to the extent of providing some of the sinews of war for the United States Government, without which it could not have defeated the armies of secession, and preserved the Union.

From the time that Abraham Lincoln was elected to the Presidency of the United States, in November, 1860, the South began to prepare for secession from the North, peaceably if the North consented, but by war if it resisted. It was bent on this course because it foresaw in a Republican administration at Washington its practical loss of control of Congress and the spoils of office—in fact, of the Government itself—that it had so long enjoyed under Democratic administrations. James Buchanan’s term as President having expired on March 4, 1861, Abraham Lincoln was then inaugurated as his successor. It angered the South to see a Republican succeed a Democrat in the White House, and it precipitated the tremendous conflict that followed, by seizing Fort Moultrie, in Charleston Harbor, and firing on Fort Sumter. Fort Moultrie’s guns awoke the North to action, and made it a determined unit in defense of the flag that had xxxiibeen fired upon, and its cry was, “The Union must and shall be preserved!”

As this was the most eventful and critical period in our national history since 1776, and so many know it only by what they have read of it, I will give a general idea of its salient features bearing upon the Government finances and the war loans.

When, after the bombardment of Fort Sumter by Fort Moultrie, on April 14, 1861, Major Robert Anderson, the Union commander, accepted, under the stern necessities of the situation, General Beauregard’s terms of evacuation, the die was cast.

The North picked up the gauntlet of war with patriotic enthusiasm, and the great conflict had begun. But when our troops marched out of that dismantled stronghold of the Union, with drums beating and colors flying, it is safe to say that few or none, either in the North or the South, foresaw the long and mighty struggle that would, for four eventful years, follow the bombardment of Fort Sumter, during which gold would become demonetized before the end of the year. It did so on December 30, 1861, and in the darkest days of the conflict commanded a premium as high as one hundred and eighty-five per cent. over United States legal tender notes, making these worth only 54 1/20 cents in gold, while United States bonds were selling for about 60 cents on the dollar in gold.

When the New York Clearing House agreed, on the date named, to suspend specie payments, the example was at once followed by all the banks in the country, and gold immediately began to command a small premium. None supposed then that the suspension would continue for eighteen years.

In England, during the long suspension from 1797 to 1821—through the Napoleonic wars—the premium on gold never rose above forty-one per cent., and that was in 1814, the year before the end of hostilities. This was owing to the policy of William Pitt and his successors in the management of the British finances. They raised all the money needed for war xxxiiipurposes by taxation and loans, thus restricting the paper money issues, so as to prevent currency inflation, whereas we pursued the opposite course.

When Fort Sumter was fired upon, my firm—Livermore, Clews & Co.—was already prominent in Wall Street, and I immediately began to devise ways and means to help the Government to raise the money that I saw would be necessary to prosecute the war for the Union which this bombardment made inevitable. Fort Moultrie’s guns had united the North in a call to arms, and men by tens of thousands left the farm, the loom, the office, and the store, from Maine to Indiana, to join the Union army.

Money, therefore, was needed by the United States Government, and very large amounts of it, to equip troops and purchase munitions of war.

As James Buchanan was then President, and, like a long line of his predecessors, a Democrat, he had several Southerners in his Cabinet. These promptly resigned their places and went South, including the Secretary of the Treasury, Howell Cobb, who left with surprising suddenness, and the office was filled for a brief period by General John A. Dix, as acting Secretary.

But before leaving, Howell Cobb had offered and sold to Wall Street bankers $20,000,000 of United States five per cent. bonds at 105, authorized, of course, by an old law. Owing, however, to the heavy decline in securities, and general depression following the outbreak of the war, only about one-quarter of these bonds were taken and paid for by those who had subscribed for them; and nothing was done by the Government to enforce the completion of the purchase by those who had defaulted under the severe stress of the times.

Their default was a serious matter for the Government at that time, as it left the funds in the Treasury in a very depleted condition, and interest payments on the public debt were about to fall due, which it had no money in its vaults to provide for. At this crisis John J. Cisco, the United States Sub-treasurer in New York, was instructed, from Washington, xxxivto call a meeting of the principal Wall Street bankers at the Sub-treasury, and after stating the situation to them, to ask for an emergency loan on one-year United States notes, and let them fix the rate of interest themselves to correspond with the state of the money market.

Money was then loaning at about twelve per cent. per annum in Wall Street. So when the bankers who responded to Mr. Cisco’s call, myself among the number, assembled at the Sub-treasury, they, after full discussion, agreed to take the amount of notes offered, and at this rate of interest. It was a very high rate for the Government to pay, too high under ordinary circumstances, but the emergency justified it; and Mr. Cisco approved of it, in view of the market rate and the notes running for one year only. My firm took a considerable amount of them and induced others to do so also, and we did so, presumably like the rest of the buyers, not merely because the rate agreed upon was so high, but because we felt it a duty to help the Government; and at all times thereafter during that critical period we worked no less diligently to uphold the public credit.

The Government recognized that a default in its interest payments would have been disastrous to the public credit, and a stumbling block in the way of raising money to prosecute the war, besides causing general depression of business. It therefore had to be prevented at all hazards.

Had these notes not been taken, the Treasury would undoubtedly have been left without the means of paying this interest when due. Consequently, it gratified me to feel that I had been instrumental in inducing others to subscribe for a part of this urgently needed loan.

Soon afterwards Mr. Salmon P. Chase was appointed Secretary of the Treasury by President Lincoln.

Not long afterwards Secretary Chase came to the Sub-treasury and invited bids for $20,000,000 of six per cent. United States bonds maturing in 1884. These were authorized by an old law. He accepted all bids at 94 and over, but rejected all under 94, the result of which was that considerably xxxvmore than a third of the 1884’s remained unsold. This was to be regretted, because the Treasury was in great need of money. I therefore quickly bestirred myself to form a combination to purchase the unsold bonds of 1884 at 94, my firm being willing to take a liberal share of them, and I succeeded in getting subscriptions from banks and capitalists who had not bought any of those sold, for the unsold amount, subject to my own discretion as to the advisability of taking the bonds, after going to Washington and conferring with Secretary Chase.

So I immediately went there by night train and saw the Secretary early in the morning at the Treasury, and told him I had come on behalf of the combination I had formed, to make him a direct offer at his own price—94—for the unsold 1884 bonds. He was evidently pleased and surprised by the apparent improvement in the demand for them. He said, however, with a fine sense of probity, and consideration for the rights of others, that while he was glad I had come to Washington, and made the proposition to take the balance, he did not think it would be fair to those who had bid and whose bids were thrown out, to sell the rest of the issue without first notifying them of the new offer, and giving them the option of taking what they wanted at the price I offered—94.

He asked me to call again the next morning, after he had given the matter further consideration, and I did so. But meanwhile I had talked with many Southern politicians and office-holders, Peter G. Washington, one of the Virginia Washingtons, among them, and seen so much of the extensive war preparations which were being made in and about Washington, that I came to the conclusion that a long and very bitter war lay before us, notwithstanding that Mr. Chase had the day previously assured me that it would all blow over, with peace restored, within sixty days, a prediction that was echoed by Secretary of State Seward a little later. I was particularly impressed by what Mr. Washington, himself a prominent Government official, had told me of Southern sentiment and Southern determination to fight till all was xxxvilost or gained, and by his and other Southerners’ absolute but mistaken confidence that the South would establish its own Confederacy, however long a war it might take to do it. The South in seceding from the Union expected to be able to establish a slave oligarchy, for in Lincoln’s election it foresaw the doom of slavery, as both he and the Republican party were pledged to work for its abolition. Yancey and the other leading Southern “fire eaters” were responsible for this false view.

When I made my second call upon Mr. Chase, I said: “Since I saw you yesterday, Mr. Secretary, I have heard so much in conversation with Southern politicians and office-holders at the hotels, and seen and heard so much of the extensive war preparations on both sides, that I am convinced the war will be a long one, and I fear we shall see much lower prices for Government bonds and securities of all kinds. Feeling as I do, therefore, in justice to those I represent and who have given me full power to use my own discretion in the matter, I must withdraw the offer I made you yesterday. Had you accepted my offer at the time, of course I would have considered the transaction closed, and taken the bonds without question, but as it is, you will admit I am under no obligation, and free to retire.”

“Oh, certainly,” said Mr. Chase, “but I think you are making a mistake, for the war will be over in sixty days and these bonds will go to par!”

But my sober second thought and foresight, based upon what I had seen and heard, and the information I had gleaned in Washington, served me well, and my associates in the combination had reason to thank me for my sagacious action, as the bonds soon afterwards declined to 84; and the Union disaster at the battle of Bull Run, fought at Manassas on July 21, 1861, aroused the North to a realization of the gravity and vastness of the conflict far more than any of the warfare that had preceded it had done; at the same time it made it more determined than before to prosecute the war till the South was conquered into submission to the Union forces.

xxxviiMr. Chase’s second act, in replenishing the Treasury’s funds, was to offer for subscription six per cent. United States notes, receivable for all payments, including customs duties, authority to issue which already existed. He found difficulties in the way, however, and, after conferring with the Sub-treasurer, Mr. John J. Cisco, who recommended the appointment of three Wall Street banking houses to act as Government agents for their sale, on commission, namely, Morris Ketchum & Co., Read, Drexel & Van Vleck, and Livermore, Clews & Co., he appointed them. These were the first and sole Government agents for the sale of its securities that had been thus far selected, and they all appreciated the compliment, and did their work well, for they promptly sold all the notes, of this issue, the Secretary had offered.

Mr. Chase throughout made strenuous efforts to supply the Government with the means for carrying on the war, and he was loyally aided by the banking interests of New York, a fact which he recognized and acknowledged to me and others in appreciative terms.

On a subsequent memorable occasion, in the summer of 1861, Secretary Chase appeared at the Sub-treasury after Sub-treasurer John J. Cisco had called, at his request, a number of leading bankers and capitalists to meet and confer with him. When we assembled there he said to us, in his stately and impressive manner, “Gentlemen, the Government needs and must have fifty millions of dollars, and it wants it at once to meet war expenses. For this I am prepared to issue that amount of Treasury notes of the two hundred and fifty million issue just authorized by Congress—by the act of July 17, 1861—bearing interest at 7 3/10 per cent. I am no financier, so I cannot tell you how to raise the money, but you distinguished leaders in the world of finance well know what means to adopt to get it. So I leave it in your hands entirely. All I need say further is to repeat that the Government must have fifty millions of dollars, and I leave it to you to find the way to procure it.”

Then Mr. Chase sat down, and all of us who were present xxxviiicompared notes with each other in conversation about the room; that is, we talked the matter over for nearly twenty minutes. The result of the conference was then announced by our spokesman, Moses Taylor, who said, addressing Mr. Chase:

“Mr. Secretary, we have decided to subscribe for the fifty millions of United States Government securities that you offer, and to place that amount at your disposal immediately! So you can begin to draw against it to-morrow!”

A general clapping of hands followed this prompt announcement, and Mr. Chase responded by saying:

“Gentlemen, I thank you on behalf of the Government for your public spirit in helping it so generously and so promptly in this emergency.”

The whole scene was of rare and stirring interest, and momentous consequences hinged upon its result. As a drama drawn from real life it would have been effective if represented on the stage, with the large and portly form and massive head of Secretary Chase as its leading feature.

This was the first lot, or installment, of the $250,000,000 issue of 7-30 Treasury notes put on the market.

Of these, the Secretary had the privilege of issuing $50,000,000, payable in coin at the Sub-treasuries in New York, Boston, and Philadelphia, without interest, to be used as currency.

After disposing of the first 50,000,000 of 7-30 notes, as I have described, Secretary Chase communicated with the banks concerning the sale of the remainder, with the view chiefly of saving the payment of commission to the agents. But he was unable in that way to make sales on satisfactory terms to them. So he added to the three Government agents originally appointed for the sale of its securities, Fisk & Hatch, and Vermilye & Co., of New York, and Jay Cooke & Co., of Philadelphia, and told them the “7-30” notes would be delivered to them as fast as called for at the New York Sub-treasury.

Thereupon the New York agents held a meeting, at which xxxixit was agreed that Jay Cooke, of Philadelphia, should be at the head of the agency system and take charge of the advertising of the 7-30 loan, or, in other words, that Jay Cooke should act as Chairman of the agency system. The agreement also specified the commission rates and other details for the purpose of avoiding cutting, or clashing, between the agents. To this organization and agreement Mr. Chase assented; and all the agents made strenuous efforts to make sales from the word go.

Jay Cooke & Co. had no office in New York at that time, nor did they establish one till after the end of the war. This really led to their designation as the head of the agency system, as the selection of a New York firm would have created jealousy among the New York firms.

After all the 7-30s authorized to be issued were sold, came the 5-20 loans, which were sold through the same Government agency system, and the 5-20s were as successful as the 7-30s had been.

Mr. Munson B. Field, Assistant Secretary of the Treasury under Salmon P. Chase, had an examination made of the books at Washington, at my request, to see which individual firm of the Government agents sold the most United States 7-30s and 5-20s, and he reported that Livermore, Clews & Co. had the highest record. But I am willing that the credit should be shared equally by the four United States war loan banking firms, viz.: Jay Cooke & Co.; Livermore, Clews & Co.; Vermilye & Co., and Fisk & Hatch, as all did equally good and earnest work in financing the Government during the Civil War. Certainly the four firms are entitled to equal credit, and no one to a greater extent than the others. There was sufficient glory achieved by the magnificently patriotic work done by these four firms to admit of dividing the honors, so that I do not hesitate to say that they did immensely valuable service to the Nation, and made for themselves a proud National record, which should be always greatly appreciated by the American people, as it was at the time by the Government authorities in Washington. The Government xlwas thus enabled to clothe and feed a million of soldiers in arms on the battlefield, fighting for the salvation of the Nation, and these finally brought the war to a victorious end, thus perpetuating the best form of government known to man.

I may here mention that Secretary Chase said:

“If it had not been for Jay Cooke and Henry Clews, I should never have been able to sell enough of the 7-30 notes and 5-20 bonds to carry on the war.”

This remark of his was generally published at the time in the newspapers.

The Government had sold through its agents $150,000,000 of the 7-30 notes before the suspension of specie payments, an event that was hastened by the Secretary’s withdrawal from the banks into the Sub-treasuries of most of the proceeds of the sales, his call for payment from the agents to the Treasury being in three installments: on August 19th, October 1st, and November 2d. Moreover, the hoarding and exportation of gold were largely stimulated by the anticipation of specie suspension, and, after it occurred, gold suddenly disappeared from circulation.

This obviously involved a corresponding contraction of the circulating medium, and Mr. Chase, to neutralize it, and supply the place of the demonetized coin, issued the $50,000,000 of non-interest-bearing notes, which were called United States Demand Notes. He did this also to obviate the necessity of the State Banks issuing more of their own notes, as well as to raise money to meet the rapidly increasing demands of the Treasury.

Congress, seeing that this contraction tended to produce stringency in the money market, and handicapped the Government’s agents in the sale of its securities, had, on August 5, 1861, suspended the act of August 6, 1846, “providing for the better organization of the Treasury, and for the collection, safe-keeping, and disbursement of the public revenue.” It did this so as to permit the Secretary of the Treasury to deposit any of the money obtained on authorized loans in such xlisolvent specie-paying banks as he might select, and, in addition, it expressed this in a resolution. The resolution was promptly acted upon by Secretary Chase, and this, and a later law, governed the policy of the Treasury ever afterwards. Monetary stringency was thus avoided by the Treasury keeping as much of its money in the banks as it could, and so locking up as little as possible in the Treasury and Sub-treasuries. The evil effects of the Sub-treasuries system in locking money out of circulation was thus practically acknowledged and guarded against.

When the sale of the 7-30s had been completed by the Government agents, there was great pressure brought to bear by the banks throughout the country, who were backed by many influential newspapers, in favor of giving the sale of the 5-20s to the banks instead of to the Government agents. The pressure upon Secretary Chase became so great that he concluded to try the experiment, and authorized all the banks throughout the country to sell the 5-20s. After giving them every opportunity to supersede the agency system, as previously adopted with the six per cent. and the 7-30 Treasury notes, the Secretary was finally compelled to abandon the banks and go back again to the agents, who took hold with vigor and made the sale of the 5-20s as brilliant a success as they had previously made that of the 7-30s. We were friendless in Europe, but we overcame this by patriotism and energy at home.

After a time, some of the banks, and there were only State Banks then, threw out the Demand Notes, and so it became necessary to enforce their circulation. To accomplish this, Secretary Chase asked Congress to make them a legal tender for the payment of all debts, public and private, excepting customs duties, and interest on the public debt, payable in coin.

Congress, therefore, on February 25, 1862, remedied the difficulty by passing the Legal Tender Act, making these and all the United States notes lawful money. In the same act it authorized the issue of $150,000,000 of new non-interestbearing xliilegal tender notes. The provision for the payment in coin of customs duties and interest on the bonded debt was obviously as necessary as it was wise, as customs duties furnished the means for paying the interest in specie; and the fact of its being payable in gold created a demand for our bonds in other countries, as well as at home, which would not have existed on paper money interest.

Before long, the whole of the authorized $250,000,000 of 7-30 notes had been sold to the public through the Government agents; and later, from time to time, Congress authorized large additional amounts of these till finally they reached their maximum, in August, 1865, when $830,000,000 of them were outstanding.

At the same date, also, the Government bond issues, which had kept pace with the 7-30 note issues, and simultaneously reached their maximum, showed immense totals. There were then outstanding $514,880,500, of 5-20 bonds, and $172,770,100 of 10-40 bonds. Among our own people patriotism and profit combined to make these great United States loans doubly attractive, and the Government agents used their best efforts to stimulate the demand for them both at home and abroad. Livermore, Clews & Co., in particular, sold large amounts of these in England and other foreign countries, where they ultimately proved extremely profitable investments. To meet the demands of the war, we—the Government agents—were as anxious as the Secretary of the Treasury himself, and never were men more successful in accomplishing their object and doing good work than we were. There was patriotism worthy of Patrick Henry, as well as profit, in this, and Wall Street can lay the flattering unction to its soul that it rendered, through the Government agents, the best of good service to the Government in this time of peril to the Union.

As General Grant said long afterwards to me, we were not fighting for the Union as soldiers in the field, but we served it equally well by helping it in its struggle for money to prosecute the war; and I felt proud of the active part I took xliiiin thus helping to preserve the Union as one of its army in civil life.

The campaign in Virginia having proved prolific of disaster to the Union army, Congress, on July 11, 1862, authorized the issue of a hundred and fifty millions more of non-interest-bearing United States legal tender notes, and on January 17, 1863, another hundred millions to which it added $50,000,000 on March 3d, in the same year, making $450,000,000 of legal tender notes, or greenbacks, fifty of which were to be held as a Treasury reserve, for the redemption of temporary loan certificates.

This was the maximum issue of non-interest-bearing legal tender notes at any time, and by the act of January 28, 1865 Congress restricted the total to $400,000,000, and there it remained till Hugh McCulloch became Secretary of the Treasury, early in 1865.

Secretary Chase had meanwhile become Chief Justice of the United States Supreme Court, and Thomas Fessenden, who succeeded him as Secretary, had resigned. Mr. McCulloch began to contract the legal tender notes, and had withdrawn $44,000,000 before Congress interfered to prohibit any further contraction. It did this in response to a general protest against any further curtailment of the greenbacks in circulation.

From that time until the panic of 1873 their amount remained at $356,000,000. In the interval Mr. Boutwell had succeeded Mr. McCulloch, and Mr. Richardson had succeeded Mr. Boutwell as Secretary. Mr. Richardson, under diminished customs and revenue receipts, and the stress of the panic, restored to circulation $26,000,000 of the $44,000,000 of legal tender notes that had been withdrawn by Mr. McCulloch, whereupon Congress, on June 22, 1874, provided that the greenbacks in circulation should remain fixed at the then existing total of $382,000,000.

The same law which thus legalized the reissue of the $26,000,000 of legal tender notes by Secretary Boutwell abolished the National Bank reserve, previously required to xlivbe kept on bank-note circulation, and for this substituted the provision that the banks were to deposit five per cent. in legal tender notes of the amount of their own note issues with the United States Treasurer at Washington for the redemption of their notes.

This law is still in force, and the establishment of the Redemption Bureau at Washington has resulted, ever since, in daily receipts by it of mutilated bank notes to be replaced by new notes, in addition to the ebb and flow caused by banks increasing or reducing their circulation. The five per cent. in legal tender deposited is counted by them as part of their legal reserve. But the necessity of sending the notes to Washington, and of receiving them therefrom, involves trouble and loss of time to the banks, and also prevents the banks from contracting their circulation when the demand for it is light and increasing it when heavy, as freely and promptly as they would if every Sub-treasury was made a redemption point for National Banks. Congress ought therefore to authorize the equipment of the Sub-treasuries with redemption bureaus for the banks in their respective districts, in order to facilitate this ebb and flow of bank-note issues, and so increase the much needed elasticity of the currency.

In addition to United States legal tender notes, large amounts of interest-bearing legal tender notes were issued during the war. On September 1, 1865, when the currency, like the whole National debt, reached its greatest amount of inflation, the noninterest-bearing legal tender notes and fractional currency stood at $459,505,311, the three years six per cent. compound interest legal tender notes at more than $217,000,000, and the one and two years five per cent. legal tender notes at nearly $34,000,000, the whole aggregating $685,236,269 issued by the Treasury.

There were also outstanding $107,000,000 of temporary loan certificates. These, being payable after ten days’ notice, were treated as greenbacks by the banks, and counted as part of their lawful money reserve, while the remainder circulated as currency, and so practically increased the xlvvolume of paper money. At the same time the new National Bank law had put in circulation $170,000,000 of National Bank notes; and more than $70,000,000 of State Bank notes were still circulating. The last named were, however, soon taxed out of existence by Congress. The grand total of the issues enumerated was ten hundred and sixty-seven millions of paper money in circulation. Nor was this all, for there were then outstanding $85,000,000 of one-year certificates of indebtedness; and the $830,000,000 of 7-30 notes, called 7-30s, outstanding were extensively used as money, and so tended to increase the inflation of the currency and prices.

It will be seen therefore that the inflation of the currency was really much larger than it appeared to be by the Public Debt statements at that time. But so rapid was the contraction during the eight years following, through the maturity and cancellation of interest-bearing notes and certificates, that it is safe to say we had from sixty to seventy-five per cent. less paper, used as money, in circulation when the panic of 1873 commenced than we had in September, 1865, and to this enormous contraction of our medium of exchange that disastrous panic, the worst this country ever had, was largely due. It was, I repeat, the worst in its effects that this country ever experienced, not excepting the panics of 1837 and 1857, and was aggravated by the Franco-German War, that practically shut American securities out of the European markets, which had previously taken them freely. This was a severe blow to the American bankers who had undertaken to finance the railways then in process of construction in different parts of the country, and who had relied upon finding both home and foreign markets for the sale of the bonds issued against the completed mileage of these railways, and it led to much embarrassment and a number of failures. The depression following this panic of 1873—in which Jay Cooke & Co. failed owing to their having undertaken to finance the Northern Pacific—was prolonged, and prosperity did not really return to us as a Nation till after the resumption of specie payments in 1879. Meanwhile, xlvinearly all the uncompleted railways in the country had been reorganized through foreclosures that wiped out hundreds of millions.

Our National debt, which had increased from $64,000,000 on June 30, 1860, and $88,409,387 on June 30, 1861, to $2,845,907,626 on September 1, 1865, had then been very largely reduced, for it was only $2,140,695,365 on September 1, 1873. The debt and the currency had gone up and down together under the influence of a common cause. Not till specie payments were resumed by the Government and the banks did gold cease to command a premium. With this the Gold Room became a thing of the past.

The great activity and the enormous sales of the Government agents may be inferred from the maximum amounts I have quoted, of the 7-30 notes, and the 5-20 and 10-40 bonds outstanding five months after Lee surrendered to Grant at Appomattox on April 9, 1865.

The total debt on which interest was payable in coin then amounted to $1,116,658,100, while that bearing interest in lawful money was $1,874,478,100, the first calling for $65,001,570 in gold annually, and the other for $72,527,646 of greenback currency.

That great event—Lee’s surrender to Grant—that ended the war, was the fitting prelude to General Grant’s election to the Presidency. It made it certain that no other Republican candidate for the office of President of the United States would have any chance of success at the next general election, and, of course, no Democratic candidate could be elected. Grant became our great National hero, and the country glorified him for his splendid war record.

But soon after the memorable historical scene at Appomattox, while the country was rejoicing over the advent of peace, with the Union restored, there came that terrible tragedy at Ford’s Theater in Washington, when President Lincoln, on April 14, 1865, was assassinated by John Wilkes Booth, and on the following day Vice President Andrew Johnson was sworn in as President.

xlviiThen, indeed, the Nation was plunged into mourning, and mourning emblems from ocean to ocean testified to the National grief.

I will not dwell on the stormy career of Andrew Johnson as President, and the impeachment proceedings against him, that for a long time made both branches of Congress seething cauldrons of excitement. But it was a happy relief to the country when his term expired and General Grant succeeded to the Presidency on March 4, 1869, with Schuyler Colfax as Vice President. The Democratic candidates who had run against General Grant in the campaign in which he was elected in November, 1868, were Horatio Seymour and General Francis P. Blair, Jr. But the popularity of Grant was so overwhelming that his election was a foregone conclusion.

Till within a short time of its final termination the duration of the war was a matter of much uncertainty, and its ultimate result had long been the subject of doubt and gloomy forebodings by many who failed to see that the superior money power and resources of the North were sure to conquer and crown the Union with victory in the end. Our currency, greatly inflated though it was, remained good throughout the trying ordeal, whereas that of the Confederate States became utterly discredited and worthless, thus repeating the history of the French assignats.

A new era opened in our history with the ending of the war, and our currency, which, of course, had previously no circulation in the South, began to circulate there. This, of itself, was equivalent to extensive contraction. The currency of one section had now to supply the currency needs of both sections, and for a long time the drain of money from the North to the South was felt in the money market.

The country was somewhat like a sick man accustomed to and dependent on stimulants, to withdraw which suddenly would have been perilous. Many in Congress recognized this danger, for it was a noticeable feature of the debates on the subject that not a few of those who had been strongly opposed to our excessive issues of paper money during the war, and xlviiiwarned the country against them, were among those who opposed violent contraction as being a remedy worse than the disease. The radical contractionists, however, failed to see, or refused to acknowledge, that the arguments which would have applied to the rising tide of the currency while the war continued, and there was danger of indefinite further inflation, did not apply with equal force to the altered condition of affairs.

Although schemes of radical contraction were rejected, even the moderate measure of contraction that was adopted proved too severe to be endured without much complaining from business interests, so hard and painful is the process of contraction, whereas that of inflation is always pleasant and easy.

In later years I became very well acquainted with General Grant, and toward the end of his first term of the Presidency, when a good deal of opposition was manifested to his renomination by the press, including the New York Evening Post, I made strenuous efforts to secure his renomination. To that end I organized a public meeting at the Cooper Institute, and induced William E. Dodge to act as Chairman. It was a great popular success, and Grant’s renomination was unanimously advocated with immense enthusiasm. The Evening Post then said that after such an overwhelming demonstration it was evident that public sentiment was on the side of Grant, and that it was useless to oppose his renomination. He was accordingly renominated by the Republican Party and triumphantly reëlected. His second term as President began on March 4, 1873, and he retired from the Presidency four years later.

General Grant was well aware of the part I took at this meeting, which, many said, turned the scale in favor of his renomination when it was doubtful and trembling in the balance, and he also knew of my services in connection with the Government war loans, and in organizing various public meetings to celebrate Union victories and stimulate recruiting for the army. He said that I deserved some public recognition xlixof my public services in supplying the sinews of war, and asked me how I would like to be Secretary of the Treasury, but I said I preferred Wall Street. Therefore, later on, he appointed me Fiscal Agent for the United States Government in all foreign countries, in place of Baring Brothers, of London, who had been its fiscal agents up to that time, since the Bank of England had acted in that capacity.

When it became certain that General Grant’s death was very near, I was anxious to see him once more, and also a strong advocate of his burial in the city of New York, where his tomb would be a conspicuous monument, to be seen by all, instead of burying him almost out of sight in Arlington Cemetery or at West Point, which places were strongly urged. The States of Ohio and Illinois also claimed him, as did the city of St. Louis. They all made strenuous efforts to obtain the family’s consent, as well as his, through committees sent to Mount McGregor for that purpose.