Cyclopedia

of

Commerce, Accountancy,

Business Administration

Volume 3

A General Reference Work on

ACCOUNTING, AUDITING, BOOKKEEPING, COMMERCIAL LAW, BUSINESS

MANAGEMENT, ADMINISTRATIVE AND INDUSTRIAL ORGANIZATION,

BANKING, ADVERTISING, SELLING, OFFICE AND FACTORY

RECORDS, COST KEEPING, SYSTEMATIZING, ETC.

Prepared by a Corps of

AUDITORS, ACCOUNTANTS, ATTORNEYS, AND SPECIALISTS IN BUSINESS METHODS AND MANAGEMENT

Illustrated with Over Two Thousand Engravings

TEN VOLUMES

CHICAGO

AMERICAN TECHNICAL SOCIETY

1910

Copyright, 1909

BY

AMERICAN SCHOOL OF CORRESPONDENCE

Copyright, 1909

BY

AMERICAN TECHNICAL SOCIETY

Entered at Stationers' Hall, London

All Rights Reserved

Authors and Collaborators

JAMES BRAY GRIFFITH, Managing Editor

Head, Dept. of Commerce, Accountancy, and Business Administration, American School of Correspondence.

ROBERT H. MONTGOMERY

Of the Firm of Lybrand, Ross Bros. & Montgomery, Certified Public Accountants.

Editor of the American Edition of Dicksee's Auditing.

Formerly Lecturer on Auditing at the Evening School of Accounts and Finance of the University of Pennsylvania, and the School of Commerce, Accounts, and Finance of the New York University.

ARTHUR LOWES DICKINSON, F. C. A., C. P. A.

Of the Firms of Jones, Caesar, Dickinson, Wilmot & Company, Certified Public Accountants, and Price, Waterhouse & Company, Chartered Accountants.

WILLIAM M. LYBRAND, C. P. A.

Of the Firm of Lybrand, Ross Bros. & Montgomery, Certified Public Accountants.

F. H. MACPHERSON, C. A., C. P. A.

Of the Firm of F. H. Macpherson & Co., Certified Public Accountants.

CHAS. A. SWEETLAND

Consulting Public Accountant.

Author of "Loose-Leaf Bookkeeping," and "Anti-Confusion Business Methods."

E. C. LANDIS

Of the System Department, Burroughs Adding Machine Company.

HARRIS C. TROW, S. B.

Editor-in-Chief, Textbook Department, American School of Correspondence.

CECIL B. SMEETON, F. I. A.

Public Accountant and Auditor.

President, Incorporated Accountants' Society of Illinois.

[3]Fellow, Institute of Accounts, New York.

JOHN A. CHAMBERLAIN, A. B., LL. B.

Of the Cleveland Bar.

Lecturer on Suretyship, Western Reserve Law School.

Author of "Principles of Business Law."

HUGH WRIGHT

Auditor, Westlake Construction Company.

GLENN M. HOBBS, Ph. D.

Secretary, American School of Correspondence.

JESSIE M. SHEPHERD, A. B.

Associate Editor, Textbook Department, American School of Correspondence.

GEORGE C. RUSSELL

Systematizer.

Formerly Manager, System Department, Elliott-Fisher Company.

OSCAR E. PERRIGO, M. E.

Specialist in Industrial Organization.

Author of "Machine-Shop Economics and Systems," etc.

DARWIN S. HATCH, B. S.

Assistant Editor, Textbook Department, American School of Correspondence.

CHAS. E. HATHAWAY

Cost Expert.

Chief Accountant, Fore River Shipbuilding Co.

CHAS. WILBUR LEIGH, B. S.

Associate Professor of Mathematics, Armour Institute of Technology.

L. W. LEWIS

Advertising Manager, The McCaskey Register Co.

MARTIN W. RUSSELL

[4]Registrar and Treasurer, American School of Correspondence.

HALBERT P. GILLETTE, C. E.

Managing Editor, Engineering-Contracting.

Author of "Handbook of Cost Data for Contractors and Engineers."

R. T. MILLER, JR., A. M., LL. B.

President, American School of Correspondence.

WILLIAM SCHUTTE

Manager of Advertising, National Cash Register Co.

E. ST. ELMO LEWIS

Advertising Manager, Burroughs Adding Machine Company.

Author of "The Credit Man and His Work" and "Financial Advertising."

RICHARD T. DANA

Consulting Engineer.

Chief Engineer, Construction Service Co.

P. H. BOGARDUS

Publicity Manager, American School of Correspondence.

WILLIAM G. NICHOLS

General Manufacturing Agent for the China Mfg. Co., The Webster Mfg. Co., and the Pembroke Mills.

Author of "Cost Finding" and "Cotton Mills."

C. H. HUNTER

Advertising Manager, Elliott-Fisher Co.

FRANK C. MORSE

Filing Expert.

Secretary, Browne-Morse Co.

H. E. K'BERG

Expert on Loose-Leaf Systems.

Formerly Manager, Business Systems Department, Burroughs Adding Machine Co.

EDWARD B. WAITE

Head, Instruction Department, American School of Correspondence.

Authorities Consulted

The editors have freely consulted the standard technical and business literature of America and Europe in the preparation of these volumes. They desire to express their indebtedness, particularly, to the following eminent authorities, whose well-known treatises should be in the library of everyone interested in modern business methods.

Grateful acknowledgment is made also of the valuable service rendered by the many manufacturers and specialists in office and factory methods, whose coöperation has made it possible to include in these volumes suitable illustrations of the latest equipment for office use; as well as those financial, mercantile, and manufacturing concerns who have supplied illustrations of offices, factories, shops, and buildings, typical of the commercial and industrial life of America.

JOSEPH HARDCASTLE, C. P. A.

Formerly Professor of Principles and Practice of Accounts, School of Commerce, Accounts, and Finance, New York University.

Author of "Accounts of Executors and Testamentary Trustees."

HORACE LUCIAN ARNOLD

Specialist in Factory Organization and Accounting.

Author of "The Complete Cost Keeper," and "Factory Manager and Accountant."

JOHN F. J. MULHALL, P. A.

Specialist in Corporation Accounts.

Author of "Quasi Public Corporation Accounting and Management."

SHERWIN CODY

Advertising and Sales Specialist.

Author of "How to Do Business by Letter," and "Art of Writing and Speaking the English Language."

FREDERICK TIPSON, C. P. A.

Author of "Theory of Accounts."

CHARLES BUXTON GOING

Managing Editor of The Engineering Magazine.

Associate in Mechanical Engineering, Columbia University.

Corresponding Member, Canadian Mining Institute.

F. E. WEBNER

Public Accountant.

Specialist in Factory Accounting.

[6]Contributor to The Engineering Press.

AMOS K. FISKE

Associate Editor of the New York Journal of Commerce.

Author of "The Modern Bank."

JOSEPH FRENCH JOHNSON

Dean of the New York University School of Commerce, Accounts, and Finance.

Editor, The Journal of Accountancy.

Author of "Money, Exchange, and Banking."

M. U. OVERLAND

Of the New York Bar.

Author of "Classified Corporation Laws of All the States."

THOMAS CONYNGTON

Of the New York Bar.

Author of "Corporate Management," "Corporate Organization," "The Modern Corporation," and "Partnership Relations."

THEOPHILUS PARSONS, LL. D.

Author of "The Laws of Business."

E. ST. ELMO LEWIS

Advertising Manager, Burroughs Adding Machine Company.

Formerly Manager of Publicity, National Cash Register Co.

Author of "The Credit Man and His Work," and "Financial Advertising."

T. E. YOUNG, B. A., F. R. A. S.

Ex-President of the Institute of Actuaries.

Member of the Actuary Society of America.

Author of "Insurance."

LAWRENCE R. DICKSEE, F. C. A.

Professor of Accounting at the University of Birmingham.

Author of "Advanced Accounting," "Auditing," "Bookkeeping for Company Secretary," etc.

FRANCIS W. PIXLEY

Author of "Auditors, Their Duties and Responsibilities," and "Accountancy."

CHARLES U. CARPENTER

General Manager, The Herring-Hall-Marvin Safe Co.

Formerly General Manager, National Cash Register Co.

[7]Author of "Profit Making Management."

C. E. KNOEPPEL

Specialist in Cost Analysis and Factory Betterment.

Author of "Systematic Foundry Operation and Foundry Costing," "Maximum Production through Organization and Supervision," and other papers.

HARRINGTON EMERSON, M. A.

Consulting Engineer.

Director of Organization and Betterment Work on the Santa Fe System.

Originator of the Emerson Efficiency System.

Author of "Efficiency as a Basis for Operation and Wages."

ELMER H. BEACH

Specialist in Accounting Methods.

Editor, Beach's Magazine of Business.

Founder of The Bookkeeper.

Editor of The American Business and Accounting Encyclopedia.

J. J. RAHILL, C. P. A.

Member, California Society of Public Accountants.

Author of "Corporation Accounting and Corporation Law."

FRANK BROOKER, C. P. A.

Ex-New York State Examiner of Certified Public Accountants.

Ex-President, American Association of Public Accountants.

Author of "American Accountants' Manual."

CLINTON E. WOODS, M. E.

Specialist in Industrial Organization.

Formerly Comptroller, Sears, Roebuck & Co.

Author of "Organizing a Factory," and "Woods' Reports."

CHARLES E. SPRAGUE, C. P. A.

President of the Union Dime Savings Bank, New York.

Author of "The Accountancy of Investment," "Extended Bond Tables," and "Problems and Studies in the Accountancy of Investment."

CHARLES WALDO HASKINS, C. P. A., L. H. M.

Author of "Business Education and Accountancy."

JOHN J. CRAWFORD

Author of "Bank Directors, Their Powers, Duties, and Liabilities."

DR. F. A. CLEVELAND

Of the Wharton School of Finance, University of Pennsylvania.

Author of "Funds and Their Uses."

THE SUPREME COURT BUILDING AT SPRINGFIELD, ILL.

Foreword

With the unprecedented increase in our commercial activities has come a demand for better business methods. Methods which were adequate for the business of a less active commercial era, have given way to systems and labor-saving ideas in keeping with the financial and industrial progress of the world.

Out of this progress has risen a new literature—the literature of business. But with the rapid advancement in the science of business, its literature can scarcely be said to have kept pace, at least, not to the same extent as in other sciences and professions. Much excellent material dealing with special phases of business activity has been prepared, but this is so scattered that the student desiring to acquire a comprehensive business library has found himself confronted by serious difficulties. He has been obliged, to a great extent, to make his selections blindly, resulting in many duplications of material without securing needed information on important phases of the subject.

In the belief that a demand exists for a library which shall embrace the best practice in all branches of business—from buying to selling, from simple bookkeeping to the administration of the financial affairs of a great corporation—these volumes have been prepared. Prepared primarily for[9] use as instruction books for the American School of Correspondence, the material from which the Cyclopedia has been compiled embraces the latest ideas with explanations of the most approved methods of modern business.

Editors and writers have been selected because of their familiarity with, and experience in handling various subjects pertaining to Commerce, Accountancy, and Business Administration. Writers with practical business experience have received preference over those with theoretical training; practicability has been considered of greater importance than literary excellence.

In addition to covering the entire general field of business, this Cyclopedia contains much specialized information not heretofore published in any form. This specialization is particularly apparent in those sections which treat of accounting and methods of management for Department Stores, Contractors, Publishers and Printers, Insurance, and Real Estate. The value of this information will be recognized by every student of business.

The principal value which is claimed for this Cyclopedia is as a reference work, but, comprising as it does the material used by the School in its correspondence courses, it is offered with the confident expectation that it will prove of great value to the trained man who desires to become conversant with phases of business practice with which he is unfamiliar, and to those holding advanced clerical and managerial positions.

In conclusion, grateful acknowledgment is made to authors and collaborators, to whose hearty coöperation the excellence of this work is due.

Table of Contents

(For professional standing of authors, see list of Authors and Collaborators in front of volume.)

VOLUME III

| Law of Contracts and Agency | By John A. Chamberlain | Page 11 |

| Law in General—Contracts—Consideration—Revocation—Illegal Contracts—Mistake—Assignments—Discharge of Contract—Warranty—Recision—Remedies for Breach—Forms of Contracts—Appointment of Agents—Sub-Agents—Factors—Brokers—Auctioneers—Real Estate Brokers | ||

| Law of Partnership and Corporations | By John A. Chamberlain | Page 77 |

| Creation of Partnership—Agreements—Rights and Liabilities—Change of Membership—Survivorship—Dissolution—Powers of Corporations—Capital Stock—Calls and Assessments—Watered Stock—Common and Preferred Stock—Dividends—Officers and Agents | ||

| Law of Negotiable Instruments, Banking, and Insurance | By John A. Chamberlain | Page 112 |

| Negotiability and Assignability—Law Merchant—Notes, Drafts, Bills of Exchange, and Checks—Bonds—Indorsement—Forgery—Fraud and Duress—Consideration—Defences—Dishonor and Protest—Functions and Powers of Banks—Deposits—Loans and Credits—Discount—Exchange—Interest—Insurance Contracts—Policies—Suretyship—Subrogation—Indemnity | ||

| Law of Sales, Mortgages, and Carriers | By John A. Chamberlain | Page 179 |

| Sale, Barter, and Bailment—When Title Passes—Effect of Fraud—Warranties—Seller's Lien—Title to Property Bailed—Degree of Care Required—Pledges—Collateral Securities—Redemption—Mortgages—Form of Mortgages—Foreclosure—Title to Goods after Delivery—Stoppage in Transitu—Interstate Commerce Act—Passengers—Baggage | ||

| Law of Real Property | By John A. Chamberlain | Page 236 |

| Crops and Emblements—Party Walls—Fixtures—Fences—Private Ways and Highways—Varieties of Estates—Waste—Deeds—Possession—Deeds and Mortgages—Transfer of Mortgages and Mortgaged Premises—Satisfaction—Redemption—Foreclosure—Parties to Trusts—Varieties of Trusts—Rights of Tenant—Rent—Distress—Leases—Actions for Possession—Trade Marks | ||

| Law of Wills and Legal Actions | By John A. Chamberlain | Page 287 |

| Parties and Terms in Wills—Publication—Revocation and Alteration—Advancement, Abatement, and Ademption—Form of Wills—Varieties of Courts—Legal Actions and Their Enforcement | ||

| Index | Page 311 | |

THE BUILDING OF THE LAW SCHOOL OF THE UNIVERSITY OF CHICAGO

COMMERCIAL LAW

PART I

LAW IN GENERAL

1. Rights. Men are endowed with certain individual rights. These rights are principally of two classes, personal and property. Men have the right to live in peace and quietude. In so far as it does not interfere with the same privilege on the part of others they have the right to be unmolested in the pursuit of happiness. They have the right to defend themselves against the attacks of others, to satisfy bodily hunger and thirst, and to preserve their bodies in health and strength.

Besides these personal rights, men have the right to acquire and keep property. This right is also subject to the limitation of not interfering with the same privilege on the part of others. Men have the right to acquire property, both chattel and real. For the purpose of rendering their existence and enjoyment secure, they have the right to keep the title and possession of this property in themselves.

In primitive times, property rights were few. Personal rights were recognized and enforced by might. As the requirements of civilized life became more complex, property rights were needed and recognized. Rules of conduct and rules for the holding and transfer of property were recognized and enforced. Might ceased to be the principal method of enforcing rights. Rules began to be recognized and enforced with regard to persons and property. These rules are known as laws.

2. Law. Law may be defined to be a rule of human conduct. It may be said to embrace all rules of human conduct recognized by courts of law. Laws are necessary to enable men to enforce and enjoy their rights, both personal and property. Customs of men become rules by which human affairs are regulated. Men may disagree as to what their rights are, or as to their exact scope or limitations. In this event, rules of conduct or laws must determine their[12] scope and limitations. Disputes among men arise about their personal or property rights. The rules recognized by the courts in settling these disputes are laws. These rules or laws relate both to persons and property. A law which prohibits murder is a rule by which the state protects the lives of its citizens; a law which prohibits theft is a rule for the protection of property.

3. Sources of Law. Law is derived from the customs of the people and from the written declarations or agreements of the people or their representatives. The customs of the people, constituting a large part of our law, are found principally in the decisions of courts. Each state of this country prints and keeps a permanent record of at least the most important decisions of its court of last resort. Many decisions of lower courts are printed and preserved. Every law library of importance has the printed reports of the supreme court of each state of this country; as well as the reports of the higher courts of most of the countries where the English language is spoken or officially recognized. The reports of the higher courts of England, Ireland, Canada, Australia, and of many of the island possessions of this country and of England, are found in most law libraries. The second source of law is the written declaration of the people or their representatives. These declarations consist of legislative acts, treaties and constitutions. In this country, legislative acts may be either national or state. Many statutes are nothing more than recognized customs enacted into written laws. Other statutes are variations or restrictions of recognized customs. National legislative acts are numbered consecutively, printed and bound into volumes known as the Federal Statutes. Each state numbers its statutes consecutively and prints and binds them into volumes known as the State Statutes.

4. Divisions of the Law. There are two great divisions of the law, written and unwritten. The greater portion of the law consists of the customs of the people, as evidenced and preserved by the written decisions of the courts. These customs, to be recognized as law, need not be found in written decisions, but the most important ones have become embodied therein. New customs are necessary and are recognized to meet new and changing conditions. These new customs are continually adding to our unwritten law. While this great portion of the law is called unwritten law, the greater portion of it[13] actually is in writing, and is preserved in permanent form by our court reports, both national and state.

The second division of law is known as written law. It consists of treaties, constitutions, and legislative acts. Treaties are international compacts. Legislative acts are the laws passed by the people or their representatives. In this country they consist of the laws passed by the United States Congress, and by the representative bodies of each state. Constitutions, in this country, consist of the State Constitutions and the United States Constitution. In England the constitution is not written, but is a part of the unwritten law of the land.

5. Classification of Law. A number of useful classifications of the law are recognized. Any classification is more or less arbitrary, and no classification has been recognized universally.

Law may be classified as public, administrative, and private. Public law embraces the law of nations, called international law; the laws regulating the enforcement and recognition of constitutional provisions, called constitutional law; and the laws protecting citizens against the actions of dangerous characters, called criminal laws.

The public as a unit is said to be interested in public law. Public laws are recognized and enforced in theory, at least, for the benefit of the public and not for any particular individual. For example, if a murder is committed, the state through its officers prosecutes and punishes the criminal on the theory that a wrong has been done the state. The heirs or representatives of the person murdered can sue and recover money compensation, called damages, from the murderer, but the state punishes the criminal. This work does not treat of public law.

Administrative law, sometimes called Law of Procedure, embraces the rules and regulations relating to the enforcement of personal and property rights. The laws relating to courts, the method and manner of starting legal actions, the trial of cases, and the rendering and enforcement of judgments are common examples of Administrative Law. Private law embraces the law of contracts and of torts.

Contracts consist of agreements of every nature. The great majority of dealings of men are carried out by means of contracts.[14] This is the most important, as well as the most extensive subject known to the law.

Torts embrace all private wrongs not arising out of contracts. Any injury inflicted by one person upon the person or property of another, which is not a breach of contract, is a tort. Tort is the French word for private wrong. If A carelessly drives his automobile into B's wagon, he commits a tort. If A carelessly drives his horse over B's field, he commits a tort. If A wrongfully strikes B, he commits a tort. Torts and crimes frequently over-lap. The same act may constitute a tort and a crime. If A drives his automobile faster than the laws of the state or city permit, and while so doing runs over and injures B, he commits both a tort and a crime. He is liable to the state for imprisonment or fine for the crime, and he is liable to B in money for damages for the tort.

The same act may constitute a crime, a breach of contract, and a tort. If A, engaged as a chauffeur to operate an automobile carefully and skillfully, violates the speed law, and in so doing runs over and injures B, he commits a crime and is liable to the state for punishment or fine. He is also liable in damages to B for the tort committed, and is liable in damages to his employer for breach of contract. This work has largely to do with the law of contracts and torts.

The term Commercial Law, applied to this work, is a term used arbitrarily to embrace the laws relating to commercial affairs. It has no distinct place in the general classification of law.

CONTRACTS

6. Contract, Defined and Discussed. A contract has been defined to be an agreement between two or more competent parties, enforceable in a court of law, and based upon a sufficient consideration, to do or not to do a particular thing.

The law relating to contracts is the most important, as well as the most extensive, branch of commercial law. It touches, directly or indirectly, most of the dealings of men. It is the legal basis of all business transactions.

In the daily routine of their life, most families make many contracts. By reading the morning paper left at his door, a person impliedly agrees to pay the publisher the customary price. By ordering[15] the daily supply of groceries by telephone, the housewife impliedly contracts to pay for their value, upon delivery, or at the customary time of payment. By purchasing a number of car tickets from the street car conductor, a person makes a contract. By ordering a lunch, a person impliedly agrees to pay the customary price. In the more important business transactions, formal contracts are written out and signed. In these transactions the parties endeavor to define their duties and obligations clearly and expressly, in order that they may understand each other and in order that neither can dishonestly claim that the contract contains a certain provision or condition. Contracts are legal or illegal, void or voidable, depending upon their form and nature. An understanding of the necessary elements of valid contract is the foundation, to the understanding of commercial law.

7. Offer, Acceptance and Agreement. To constitute a transaction a valid contract, there must be an offer on the one hand, and an acceptance on the other. This necessitates at least two parties to every contract. One must make a proposition, the other must accept it. The acceptance must be of the exact terms of the offer, to constitute a legal acceptance. If the attempted acceptance is not made in the precise terms of the offer, it constitutes a counter offer, which, to constitute a contract must, in turn, be accepted by the original offeror.

If A offers B one hundred dollars for B's horse, and B in turn agrees to take one hundred dollars, the transaction constitutes a valid contract. If A offers B one hundred dollars for B's horse, and B in turn offers to sell the horse for one hundred and twenty dollars, the transaction does not constitute a contract, for the reason that A's offer has not been accepted. B, however, makes a counter offer, which if not assented to by A, constitutes no contract. If, however, A agrees to accept B's offer to sell the horse for one hundred and twenty dollars, this constitutes a valid contract, in which B is the offeror and A the acceptor. These counter offers in response to offers may go on indefinitely without constituting contracts. So long as the response to the offer varies the terms of the offer, it constitutes a counter offer, and not an acceptance. To constitute an acceptance, the exact terms of the offer must be agreed to.

Courts lay down the principle that there must be a meeting of[16] the minds of the contracting parties, to constitute the transaction a valid contract. This means that the offer must be accepted in its precise terms. The minds of the contracting parties cannot meet, unless the acceptance is of the exact terms of the offer. This principle is sometimes called mutuality. An acceptance must be communicated to the offeror. A mere mental operation, or an attempted acceptance, not communicated to the offeror, does not constitute a legal acceptance.

The offer, or acceptance, may be in the form of an act as well as by verbal or written communication. If a person orders a barrel of flour of his grocer, the order constitutes the offer, and the delivery of the flour and the receipt of same by the purchaser, constitutes the acceptance. The purchaser is bound to pay the market price for the flour, regardless of the fact that the price has not been mentioned.

An offer can be recalled at any time before acceptance. To recall an offer, the offeror must communicate his intention so to do, to the acceptor before acceptance. Agreements to hold offers open for a stipulated time are recognized. These options are, in themselves contracts, and to be binding must contain all the essential elements of a contract.

An offer which has been accepted constitutes an agreement. An agreement, as the word suggests, means a meeting of the minds of two or more parties. The word is frequently used as synonymous with contract, but it is merely an element of a contract. While there must be an agreement in every contract, an agreement of itself does not constitute a contract. There may be an agreement between persons under legal age, but this agreement does not constitute a contract.

Besides an agreement, or meeting of the minds, a contract must have competent parties, a legal valuable consideration, and a lawful object. These are often called the elements of a contract.

8. Parties to a Contract. A contract must have at least two competent parties. Each party to a contract may consist of one or more persons.

To be competent to make a contract, a party must be of legal age. Legal age is twenty-one years for males, and ordinarily, eighteen for females. Legal age is fixed by statutes of the different states. These statutes differ somewhat as to the legal age of females. Some[17] fix it at twenty-one, others at eighteen, and some even younger than eighteen, in case of marriage. Intoxicated persons, insane persons and idiots are not competent to make contracts. Artificial persons or corporations can make contracts within the scope of the powers given them by the state.

A person who does not voluntarily consent to the terms of a contract is not a party to it. Where fraud or duress is used in obtaining a party's consent to a contract, the contract is at least voidable. It is not enforceable if the defrauded party objects on that ground.

9. Consideration. Consideration may be good or valuable. Good consideration consists of love and affection existing between near relations. Good consideration is a sufficient consideration to support a deed given by one relative to another. But this is the only kind of contract supported by a good consideration.

Valuable consideration has been defined to consist of some right, interest, profit or benefit, accruing to the promisor, or some forbearance, detriment, loss or responsibility, given, suffered or undertaken by the party, to whom the promise is given. In short it is a benefit to the promisor, or a detriment to the promisee. All contracts, with the exception of sealed instruments, must be supported by a valuable consideration. Sealed instruments, except where abrogated by statute, import a consideration.

A promises to sell his watch to B for ten dollars. B accepts the offer by offering to pay A ten dollars. There is a valuable consideration, consisting of B's promise to pay A ten dollars.

A promises B two dollars if B will guard A's house for two hours. There may be no actual benefit resulting to A, since it may have been unnecessary to have the house guarded. But if B guards the house for two hours, A is legally bound to pay him the contract price of two dollars. The valuable consideration is the detriment or responsibility of B in guarding the house for two hours.

Mutual promises constitute a valuable consideration. If A promises B two dollars if B will work for him next Thursday, and B promises A to work for him next Thursday, the contract is mutual, and is supported by a valuable consideration. The consideration consists of the promise on the part of each of the contracting parties.

A past consideration will not support a contract. By a past consideration, is meant a benefit received in the past, for which no legal liability was incurred or exists. A gives B, his son, five hundred[18] dollars. One year later, in consideration of the past gift, B promises to construct a dam for A. The consideration is past and does not support the attempted contract.

A consideration, to be valuable and sufficient to support a contract, need not be adequate. A mutual promise, no matter how slight or trivial, or the payment of anything valuable to the promisor, is sufficient. Sometimes the inadequacy of the consideration tends to prove fraud in the making of the contract. When it is sought to avoid a contract on the ground of fraud, the inadequacy of the consideration may be considered in connection with the question of fraud. When fraud does not enter into the question, adequacy of the consideration is not questioned.

A sells B one hundred acres of land. The deed recites a consideration of one dollar. The deed of transfer is good and the smallness of the sum named does not affect the contract.

A promise to do something which one is already legally bound to do does not constitute a valuable consideration to a contract. A owes B one hundred dollars upon a promissory note. The note is past due and A fails to pay it. A promises to pay the note within ten days, on condition that B promise to give A a barrel of apples. B agrees. A cannot compel B to deliver the barrel of apples, nor has A any defense to the payment of the promissory note, since his promise to pay the note was a promise to do something he was already bound to do.

An illegal consideration does not support a contract. Any consideration contrary to established law is illegal. A promising to pay B one thousand dollars if B will burn C's barn is an example of illegal consideration.

10. Express and Implied Contracts. Some contracts expressly set forth the exact terms and conditions to be performed by both the contracting parties. For example, A makes a contract with B, by the terms of which, B is to construct a house for A. The contract is carefully prepared in writing, B is to receive five thousand dollars ($5,000.00) when the house is completed, and the contract contains provisions as to the details of the work and materials. Such a contract is called an express contract by reason of the terms having been expressly agreed upon by the parties. A contract need not be in writing to be express. The parties may enter into an express contract orally as well. Few contracts are made, however, in which some[19] things are not implied. For example, in the contract for the building of a house it is practically impossible, or at least, is impracticable, to set forth in exact detail all the duties of the builder. For example, it would be unnecessary to give the size of the nails and number or quantity of same to be used. The contract impliedly requires the builders to use the proper size and quantity. A contract, however, in which the parties endeavor to set forth the principal things to be done, is known as an express contract.

An implied contract is one in which the parties do not expressly agree upon some of the important terms. A, a contractor, orders of B one thousand feet (1,000 ft.) of No. 1 white pine ship lap siding. The price is not mentioned. B delivers the lumber and A by implication is obliged to pay B the reasonable value thereof. The greater portion of business contracts are implied. An implied contract should not be confused with uncertain contracts. Uncertain contracts are void by reason of their uncertainty. A offers B one thousand dollars for five acres of land. B accepts the offer. In case the parties had no particular five acres of land in mind, the contract is void by reason of this uncertainty. The parties' minds did not meet on the question of what particular piece of land was to be transferred. In most implied contracts the article to be delivered is a part of a large quantity, and the particular part does not matter. Articles ordered from stock, such as groceries, shingles, slate, cement and lumber are common examples of this principal.

11. Unilateral and Bilateral, Executory and Executed Contracts. The mutuality or meeting of the minds, constituting one of the essential elements of the contract, may result from an express promise for a promise, or from an act performed in response to a promise. A promises to sell his automobile to B on the following day for five thousand dollars ($5,000.00). B promises to pay A five thousand dollars ($5,000.00) the following day. The mutuality consists of the mutual promises of A and B. Such contracts are known in law as bilateral contracts.

A promises to pay B one thousand dollars ($1,000.00) if B will move his house to the rear of A's lot. B, without promising to do so, moves the house. This act on the part of B constitutes the acceptance of the contract and completes the mutuality. Such contracts are known in law as unilateral contracts.

A contract to be performed in the future is known as an executory contract. A promises to pay B seventy-five dollars, if he will work on A's farm during the month of August of the following year. B accepts A's offer and promises to work for A as proposed. The contract is to be performed at a subsequent date, and constitutes an executory contract.

An executed contract is one which is performed. A promises to sell his bicycle to B for fifty dollars ($50.00); B pays the fifty dollars ($50.00) to A and receives the bicycle. This contract is executed.

A contract may be executed as to one party and executory as to the other. If A agrees to sell and deliver his team of horses to B for five hundred dollars ($500.00) and B pays A five hundred dollars ($500.00) but A does not deliver the team to B, the contract is executed as to B and executory as to A.

12. Contracts of Infants. A person under legal age is known in law as an infant. The legal age is fixed by statute in the different states. In most states this age is twenty-one for males and eighteen for females. In some states the legal age for females is under eighteen in case of marriage.

An infant's contracts are voidable. Voidable does not mean that the contract is illegal. It is not contrary to law for an infant to make contracts. He may lawfully make them. The law will not compel him to carry them out. He may carry them out voluntarily if he chooses.

A competent party, contracting with an infant cannot avoid the contract on the general ground of the infancy of the other party to the contract. The infant, however, may avoid the contract by reason thereof.

An infant may ratify his contract after becoming of legal age. This ratification is effected by the infant's accepting benefits under the contract after attaining his majority. Ratification may also be effected by an infant after he has reached his majority by promising to carry out the contract. To have such a promise amount to a ratification the infant must make the promise with knowledge that he may avoid the contract if he chooses.

An infant is liable on his contracts for necessaries. Necessaries is a variable term, depending upon the social position of the infant. Those articles essential to the health and sometimes to the comfort[21] of the infant are considered necessaries. Food and clothing are the most common examples. A person selling an infant necessaries, cannot recover in excess of their reasonable value regardless of the contract price, and cannot recover at all, if the infant is already supplied. Most courts hold that a party selling necessaries to an infant must determine at his peril that the infant is not supplied. Articles which would be luxuries for one infant, might be necessaries for an infant accustomed to wealth.

An infant is not entitled to his wages unless he has been emancipated. The father or guardian is entitled to the wages. Emancipation may be by written declaration to that effect, on the part of the father. It may also be implied from the refusal or failure on the part of the father to treat the infant as his child.

13. Novation and Contracts for the Benefit of Third Persons. If A owes B one hundred dollars ($100.00) and B owes C one hundred dollars ($100.00), the three parties may agree that A may pay C one hundred dollars ($100.00), discharging the indebtedness of both A and B. This contract is valid in law, and is called novation.

Much of our common or unwritten law was taken from the common law of England. The common law of England did not permit a third party, for whose benefit a contract was made, to enforce the contract. For example, if A and B enter into a contract by which A is to pay C some money, C cannot enforce the contract. This kind of a contract is commonly known as a contract for the benefit of a third person. With a few exceptions, the states of this country refuse to follow the English doctrine. The general American doctrine is that a third party may enforce a contract made for his benefit. For example, A, a furniture dealer was indebted to B for a bill of goods; C purchased A's business, and in a formal written contract, as part of the consideration, agreed to pay B the amount of A's bill. After the transfer of the business, A became insolvent and B, learning of the contract between A and C, sued C thereon and was permitted to recover. The general American doctrine will not permit two parties, making a contract for the benefit of a third, to rescind or avoid the contract after the third party has been notified of it, and has assented thereto. Of course, two parties cannot bind a third party to perform any condition of a contract without his consent. This would[22] violate some of the fundamental principles of contracts. There would be no consent, no meeting of the minds, and sometimes no consideration.

14. Contracts of Insane Persons, Idiots, and Drunkards. An insane person, or one that does not understand the nature of the contract in question, is not bound by his contracts. He may avoid them. Like an infant, he may ratify them when he becomes sane, if he chooses. Statutes of all the states provide for the determination of insanity by judicial decree. Such a judicial determination is presumed to give notice to all. An idiot's contracts are the same as an insane person's.

A drunkard can avoid a contract made while he was intoxicated, and if the drunkenness amounts to insanity, it is regarded in law as such. Contracts made by a drunkard when not drunk, or by a lunatic during a lucid interval are valid and binding.

15. Contracts of Married Women. At common law, upon marriage, the wife lost her legal identity in her husband. Her estate became his, her personal property became his, and she could not thereafter enter into any legal obligation. The statutes of the states generally at the present time permit a married woman to contract as independently as a man, relative to her separate estate. In some states there are a few limitations, such as contracting directly with her husband or as surety for her husband.

16. Custom and Usage as Part of a Contract. Parties may enter into any contracts they choose, so long as the terms are legal. If parties expressly agree, either orally or verbally, on the precise terms of a contract, these terms cannot be varied by usage or custom. Usage and custom may be used, however, to explain the intent of the parties. Merchants and traders recognize various trade customs, without which it would be impossible to interpret their contracts. For example, A ordered five thousand barrels of cement of B, at eighty-five cents a barrel, to be delivered in sacks F. O. B. Mill. In a suit for the purchase price, the court permitted B to show that there was a well-known custom in the cement trade to add to the invoices forty cents per barrel for sacks, making the invoice selling price of the cement and sacks one dollar and twenty-five cents ($1.25) per barrel.

To constitute a part of the contract, usage and custom must be[23] of such a general nature as to be considered within the contemplation of the parties.

17. Contracts in Writing. Parties may make contracts verbally, as well as in writing. A contract is not illegal because it is verbal. It is good business policy to make important contracts in writing. Their terms are easily proven. There is not the temptation to attempt to vary the terms. Parties cannot claim they did not understand each other. It may be laid down as a general rule that oral contracts are as legal as written ones. By the term, legal is meant that the law does not prohibit them. Parties may lawfully make oral contracts, and carry them out if they choose. Some contracts, however, are not enforceable at law unless in writing. These contracts are legal. Parties may lawfully make them and voluntarily carry them out, but they cannot invoke the aid of the law in enforcing their terms.

18. Statute of Frauds. The class of contracts, required by law to be in writing in order that they be enforceable, is said to be within the Statute of Frauds.

The Statute of Frauds originated in England in 1677. It was passed for the purpose of preventing frauds and perjuries. It required that certain important contracts must be made in writing, in order to be enforceable at law. The purpose of the statute was to remove the temptation of fraud and perjury in connection with the making and enforcing of certain contracts. Two sections of the English statute apply especially to contracts; the fourth and the seventeenth. The fourth section is as follows:

"No action shall be brought whereby to charge any executor or administrator, upon any special promise to answer damages out of his own estate; or whereby to charge the defendant upon any special promise, to answer for the debt, default, or miscarriage of another person; or to charge any person upon any agreement made upon consideration of marriage; or any contract or sale of lands, tenements or hereditaments, or any interest in or concerning them; or upon any agreement that is not to be performed within the space of one year from the making thereof; unless the agreement upon which such action shall be brought, or some memorandum or note thereof shall be in writing and signed by the party to be charged therewith, or some other person thereunto by him lawfully authorized."

The seventeenth section of the English Statute of Frauds is as follows:

"No contract for the sale of any goods, wares, or merchandise for the price of ten pounds sterling or upwards, shall be allowed to be good except the buyer shall accept part of the goods so sold, and actually receive the same, or give something in earnest to bind the bargain, or in part payment, or some note or memorandum in writing of the said bargain, be made and signed by the parties to be charged by such contract or their agents thereunto lawfully authorized."

The English Statute of Frauds has been enacted in substance in all the states. Reduced to single propositions the statute provides:

1. That an executor or administrator shall not be bound by contract to pay damages out of his own estate, unless the contract be in writing.

For example, A is executor of B's estate. C is a creditor of B. A orally promises C to pay B's debt. This contract is not enforceable because not in writing.

2. A party promising to answer for the debt, default or miscarriage of another, shall not be bound unless the contract is in writing.

For example, if A owes B $100 and C promises B to pay A's debt, the contract is not enforceable if not in writing. This clause of the statute is discussed more at length in the chapter on suretyship.

3. A contract made in consideration of marriage is not enforceable unless made in writing.

For example, A orally promised B that if he would marry her, she would convey to him her farm. B married A, but could not enforce the contract. A promise to marry is not within this section of the statute.

4. Any contract or sale of lands must be in writing to be enforceable.

For example, A orally promises B to sell his house and lot for ten thousand dollars ($10,000.00). The contract is not enforceable. Most of the states do not require that leases of less than a year's duration be in writing, to be enforceable.

5. An agreement, not to be performed within the space of one year, must be in writing to be enforceable.

For example, A orally promises to work for B as sales agent for three years. This contract is not enforceable.

6. No contract for the sale of goods the price of which exceeds fifty dollars ($50.00) shall be enforceable unless made in writing.

This provision of the English Statute has not been reënacted by[25] all the states. About half the states do not require that contracts for the sale of personal property shall be in writing, regardless of the price involved. Some of the states fix the price as high as two hundred dollars ($200.00) and others, as low as thirty dollars ($30.00).

The details of the entire contract need not be in writing to satisfy the provisions of the statute. A memorandum embodying the substance of the agreement, showing the consideration, and signed by the party to be bound, or by his authorized agent, is sufficient.

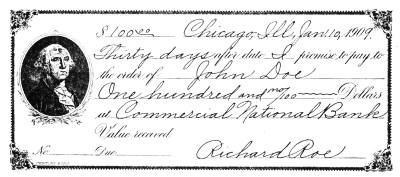

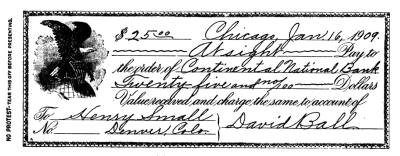

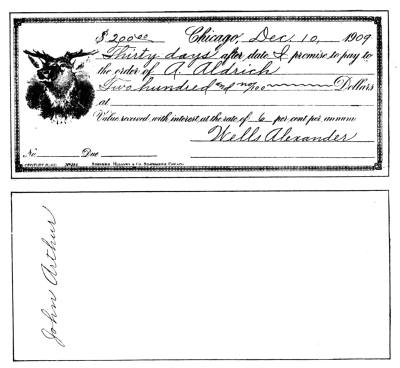

Contracts called specialties, have to be in writing, regardless of the Statute of Frauds. The most common examples are bills and notes, drafts and checks. These special contracts are made to circulate as money, and must be reduced to writing to be enforceable. There can be no such thing as an oral check, or draft, or promissory note. The oral contract for which they are given may be enforced, if not within the provisions of the Statute of Frauds.

19. Contracts by Correspondence and Telegraph. Parties need not meet personally to enter into contracts. They may legally make them by telegraph or by letter.

It is well settled by the courts that a party may make an offer by letter, and that in so doing he impliedly gives the party addressed, the right to accept by letter. In law, the contract is complete the moment the letter of acceptance is mailed, regardless of its ever being received.

The offeror may stipulate in his offer by letter, that the contract shall not be made until he is in receipt of a reply. In this event, the acceptor's letter must actually be received by the offerer, before the contract is complete. But if no such stipulation is made, the contract is complete when the letter of acceptance is mailed.

If no time for acceptance is stipulated in the offerer's letter, the acceptor has a reasonable time in which to accept. What is a reasonable time, depends upon the nature of the transaction, and the circumstances surrounding it. If the offeror stipulates in his letter that the offer must be accepted by any stipulated time, the offer, of itself, lapses at the expiration of that time. If A mails a letter to B, offering to sell one hundred bushels of wheat for one hundred dollars ($100.00), and the following day B mails a letter, properly addressed, postage prepaid, to A, accepting the offer, and the letter is lost, the contract is complete and B may recover from A thereon.

If A, by letter offers to sell B one hundred bushels of wheat for one hundred dollars ($100.00), the offer to remain open until Thursday, and B mails his letter of acceptance Wednesday, and the letter is lost, the contract is binding and A is liable thereon. If A by letter offers to sell B one hundred bushels of wheat for one hundred dollars ($100.00), the offer to be accepted upon receipt of B's reply, and B's reply is lost in the mails, there is no contract.

20. Revocation. It is a well recognized principle of contracts that an offer may be revoked, or withdrawn, at any time before acceptance. In case of revocation by mail, however, the letter of revocation must be received by the acceptor, before he has mailed his letter of acceptance. For example, A mails B a letter offering to sell B one hundred bushels of wheat for one hundred dollars ($100.00). B mails his letter of acceptance. By the next mail B receives a letter of revocation. The contract is valid since the letter of revocation was not received, until after the letter of acceptance was mailed.

The only offers that cannot be withdrawn at any time before acceptance, are what are known in law as options. Options are contracts to keep an offer open for a stipulated length of time. They require a consideration, an agreement and all the elements of an ordinary contract. They are contracts. A agrees by letter to sell B one hundred bushels of wheat, and to keep the offer open three days. On the second day, and before B has mailed his acceptance, B receives a letter from A, by which A withdraws his offer. B cannot now accept A's offer, since there was no consideration for A's promise to keep the offer open three days.

A writes B, offering to sell him one hundred bushels of wheat for one hundred dollars ($100.00), and to keep the offer open for ten days. B writes A that he will give him $2.00 if he will keep the offer open ten days. A accepts the offer. On the sixth day B receives a letter from A revoking the offer to sell, and on the following day B mails his letter of acceptance. There is a valid contract in this case, since B had a contract with A based on a valuable consideration to keep the offer open ten days.

Contracts by telegraph are analogous in principle to contracts by letter. An offer by telegraph impliedly authorizes the receiver to accept by telegraph and the offer is accepted when the reply message is deposited with the operator. If lost, or not sent, the contract is not affected in the least.

21. Contracts under Seal. Formerly, at common law, contracts under seal were frequent. At the present time few contracts are made under seal. Originally a seal was an impression made in wax placed on a written document. Sealed instruments differ from other written instruments in that they import a consideration. At common law, no consideration need be proven to a sealed instrument. Formerly, private seals were in common use. Later, a scroll made with the pen or a line or any mark designated as a seal was sufficient.

Private seals have been abolished by statute in many of the states, so that their use is now limited. The modern tendency is not to use sealed instruments, or when used, to regard them as different in no respect from other contracts.

22. Sunday Contracts. All the states of this country have statutes prohibiting the transaction of business on Sunday. These statutes are based on "the Lord's Day Act" of England. The English statute provides that persons shall not do or exercise any worldly labor, business or work of their ordinary callings, upon the Lord's Day, or any part thereof, works of necessity and charity only excepted.

While the statutes of the different states differ in details, they are based upon the English statutes. Under the English statute, it is difficult to determine in many cases what constitute "works of necessity and charity." The duties of clergymen, physicians and of nurses clearly are covered. It is sometimes stated that a person cannot make contracts, within the ordinary scope of his customary business, on Sunday. This is true, if it does not relate to charity or necessity. Deeds, notes and ordinary contracts, made and delivered on Sunday are void. Subscriptions for church funds may legally be made on Sunday.

23. Illegal Contracts. A contract prohibited by law, or made for the purpose of doing something prohibited by law, is illegal, and void. If A promises B one hundred dollars ($100.00) if B will poison C's horse, the contract is contrary to law and illegal. If B poisons C's horse, he cannot recover the one hundred dollars ($100.00) from A.

Contracts which are against public policy are illegal and void. Public policy means the public welfare. Marriage brokerage contracts and contracts in restraint of trade come within this provision. Lobbying contracts, contracts to influence votes, and for railroad rebates are against public policy and void.

24. Wagering or Gambling Contracts. In England, at common law, wagering or gambling contracts were valid. Gambling contracts were recognized as legal by some of the states at one time. At the present time, by statute the states declare gambling contracts illegal and void.

A contract for the sale of goods, to be delivered in the future, even though the seller does not have possession of the goods at the time the contract of sale is made, but expects to purchase them from a third person, is not regarded as a gambling contract, and is valid.

Contracts for the purchase of stocks or goods in which there is no expectation to deliver, but simply an agreement to pay the difference in price at a certain date according to the state of the market, are gambling contracts, and void.

25. Fraud and Duress. Fraud may be said to be misrepresentation of a material fact, known by the party making the misrepresentation to be false, and made for the purpose of influencing the other party to the contract, and acted upon by the other party to his detriment.

For example, A offers to sell B a horse for two hundred and fifty dollars ($250.00). He tells B the horse is sound, knowing that the horse has a disease which renders him worthless. He makes the representation of soundness for the purpose of inducing B to buy. B relies upon the representation, purchases the horse, and afterwards discovers the worthless condition of the horse. B can return the horse and recover the purchase price. This is known as rescinding a contract on the ground of fraud.

A fraudulent contract is not void, but voidable. The defrauded party may avoid the contract if he chooses, but the contract itself, is not without effect, simply by reason of the fraud.

A mere failure to disclose facts or conditions, if not accompanied by active measures to distract the defrauded party's attention from the thing to be concealed, ordinarily does not amount to fraud.

If one party by means of threatened or actual violence compels another to enter into a contract, or to part with something of value, the contract is said to have been obtained by duress. Such contracts may be avoided by the injured party, who may recover what he has lost.

A, a police officer, wrongfully arrests and imprisons B and releases[29] him only after B has signed a promissory note for one hundred dollars ($100.00). A cannot recover on the note.

A, who is superior in physical strength to B, by threats of personal violence, compels B to admit that he is indebted to A for one hundred dollars ($100.00), which B pays A. B may recover the money from A. The contract is voidable on account of duress.

26. Mistake. One of the essential elements of a contract is that there must be a meeting of the minds of the contracting parties. If there is a mutual mistake on the part of the contracting parties, their minds do not meet and no contract results. A offers to sell B his farm for five thousand dollars ($5,000.00). A has two farms. A has one in mind, and B the other. Their minds do not meet and there is no contract.

A mistake as to the legal effect of a contract does not avoid it. This is known as a mistake of law.

A mistake on the part of one of the parties only, ordinarily does not avoid the contract.

27. Impossible Contracts. Parties may enter into any kind of a contract they choose, so long as the provisions and conditions are legal. As a general rule, a party is liable in damages to the other party, for failure to observe and carry out the terms of his contract. There is, however, a class of contracts, known in law as impossible contracts. Many contracts are made upon the assumption that the persons making the contract, or the particular thing under consideration will continue to exist until the contract is performed.

A agrees to paint a picture for B, for one thousand dollars ($1,000). A fails in health or dies. A or his estate, is not responsible in damages to B, since the contract contemplated A's remaining in health and life.

A agrees to make B a chair out of a particular piece of walnut lumber. The lumber is destroyed by fire through no fault of A. A is not liable in damages, since the parties contemplated the continued existence of the lumber. If, however, A contracts to build B a walnut chair within ten days for fifty dollars ($50.00) and his factory and walnut lumber are destroyed by fire, A is answerable to B in damages, for failure to deliver the chair. He has entered into a lawful contract, and has not excepted liability on account of fire.

A contract for personal services is rendered of no effect by the[30] failure of health, or by death of the party, who is to perform the services. Where, however, the contract provides for the doing of a certain specific thing, not to be performed by a certain person, and not depending upon the continued existence of a certain thing, the parties are bound to perform, regardless of accident.

Floods, earthquakes or lightning do not excuse performance. These accidents are known in law as Acts of God. (See Acts of God chapter on Carriers.) Acts of God do not excuse performance unless expressly provided against in the contract.

A law changed after the contract is made, making it unlawful to perform the contract, excuses performance.

Strikes do not render it impossible to perform contracts, within contemplation of the law. If a party desires to become exempt from performance by reason of strikes, he must put such a provision in his contract.

If the party to the contract, to whom the performance is due, renders performance impossible for the other party, the latter is excused on the ground of impossibility. For example, A contracts to do the wood finishing on B's house within six months, B to construct the masonry work. B fails to construct the masonry work; this exempts A from liability.

28. Conflict of Laws. The laws of different states differ in some particulars. Where this difference affects the interpretation or enforcement of a contract, the doctrine of conflict of law applies. If a contract is valid in the state where made, it is usually valid everywhere. This rule is subject to the limitation that a state will not enforce a contract clearly against the policy of its own laws. If a contract is made in one state, to be performed in another, the laws of the latter apply. Otherwise, the laws of the state where the contract is made apply. The laws relating merely to the court procedure or the method of enforcing a contract, belong to the state called upon to enforce the contract, and, even though the laws of the state where the contract was made differ, the former will apply.

The laws of New York permit an express company to limit its liability for loss of goods to fifty dollars ($50.00), if so stipulated in the bill of lading, in case no valuation is fixed by the shipper. The laws of Ohio do not permit an express company to limit its liability in this way. A, in New York, shipped goods valued at four hundred[31] dollars ($400.00) to B, in Cleveland. A placed no valuation on the goods and accepted a receipt limiting the liability of the express company for loss of the goods, to fifty dollars ($50.00). The goods were lost. B sued the express company in Ohio for the value of the goods. The court held that the law of Ohio held, since, by the terms of the contract, the goods were to be delivered in Ohio.

29. Assignments of Contracts. By assignment of a contract, is meant the transfer of one's property rights in the contract. One cannot assign his duties under a contract. For example, A contracts with B to have the latter build him a house, for five thousand dollars ($5,000.00). B cannot transfer to another, the obligation on his part to construct the house. B, may, however, transfer to another, his right to recover the money for the house. A may also transfer to another, his right to have the house constructed.

Contracts for personal service such as the painting of a picture, or the writing of a book, cannot be assigned. In such cases the personal work of a particular person is contracted for and cannot be transferred.

An assignment of a contract is a contract for the sale of a property benefit of a contract. The assignment must contain all the elements of a simple contract. The assignor of a contract can transfer only such property rights as he possesses. The other party to the contract retains any defense against the assignee, which he had against the assignor. A agrees to build a house for B, for five thousand dollars ($5,000.00), according to certain plans. A constructs the house with variations, subjecting him to a reduction in price of five hundred dollars ($500.00). A assigns his rights in the contract to C and C can compel A to pay him only four thousand five hundred dollars ($4,500.00). The defense of B against A is good against A's assignee, C.

Upon assigning a contract, the assignor or assignee must notify the other party to the contract, of the assignment, else payment to the assignor will discharge the other party. For example, A owes B one hundred dollars ($100.00). B assigns the claim to C. C does not notify A of the assignment and A pays B. B is insolvent and C cannot recover from him. C cannot recover from A, since A has received no notice of the assignment.

The following is a recognized legal form of assignment.

For valuable consideration, I

hereby assign all my right,

title and interest in the

annexed (account, contract, or

whatever the instrument may be)

to________

________________

Signature of assignor.

Date________________

30. Joint and Several Liability in Contracts. If A makes a contract with B, only two parties are bound by the contract and are liable for its breach. If A and B contract with C and D, four parties are bound and are liable. A and B may be liable as one party to C and D, or they may be liable as two parties to C and D. If the contract shows by its terms that A and B contract as a unit, and not as separate individuals, their contract is said to be joint. If the terms of the contract show that A and B intend to contract as individuals, as well as a unit, their contract is said to be joint and several. If the terms of the contract show that A and B intend to contract as individuals only, and not as a unit, their liability is said to be several.

The importance of this distinction is that in case of a joint obligation, all the joint obligors must be joined when sued, else the case may be dismissed if objection is made; while in case of a joint and several obligation, or of a several obligation, individual obligors may be sued separately.

A promissory note reads, "We promise to pay" and is signed by A and B. This is a joint obligation, and in a suit thereon A and B must be joined, or the one sued may have the case dismissed, by reason thereof. If, however, judgment is rendered against both, and they hold no joint property, the creditor may enforce his judgment against either. This is known in law as, liability in solido. A promissory note reads, "We or either of us jointly and severally promise to pay," and is signed by A and B. A and B are severally, as well as jointly liable, and may be sued separately.

Where two or more parties sign a contract, binding themselves to do one thing of a series of things, the law presumes the obligation to be joint. If the language used shows, that the parties singly, or individually bind themselves to do the thing, or series of things in[33] common, the contract is several, as well as joint. A owes B three hundred dollars ($300.00) upon a promissory note. C, D and E sign the following guaranty:

If A fails to pay the note when due, C individually promises to pay B one hundred dollars ($100.00), D individually promises to pay B one hundred dollars ($100.00), E individually promises to pay B one hundred dollars ($100.00).

As to each other C, D and E, are severally liable. As to B,—C, D and E respectively are jointly and severally liable, with A for one hundred dollars ($100.00) each.

31. Discharge of Contract by Performance and Tender. A contract is terminated, when the parties thereto perform its provisions. The liability of parties ceases by performance of the provisions of the contract. A promises to construct a house for B, according to certain specifications, within a year. B promises to pay A five thousand dollars ($5,000.00), upon completion of the house according to contract. A, within a year, constructs the house according to the plans and specifications. A's obligation is at an end. B's obligation still requires him to pay A five thousand dollars ($5,000.00), and he is liable to a suit for this amount until it is paid. When B pays A five thousand dollars ($5,000.00), his obligation and the contract are terminated, as to both parties.

Tender of payment is equivalent in law to payment. By tender is meant an offer to pay in recognized legal money. A has an option for the purchase of a house of B, for five thousand dollars ($5,000.00). B desires to have the option lapse, having obtained a better offer. If A offers B legal tender before the option expires, the contract is complete in law.

United States statutes stipulate what constitute legal tender. These statutes provide that the following shall constitute legal tender:

1. Gold coin.

2. Silver dollars.

3. Subsidary silver coin up to ten dollars.

4. Nickels and pennies not exceeding twenty-five cents.

5. United States notes, except for duties on imports, and interest on public debts.

Silver certificates, bank notes and private checks are not legal tender.

32. Discharge of Contract by Subsequent Agreement. Contracts may be terminated by another contract, made after the contract in question has been entered into. For example, A promises to construct, within one year, a house according to certain plans, for B. B promises to pay A five thousand dollars ($5,000.00), upon completion of the house. A completes the excavation of the cellar and B fails in business, and desires not to have the house constructed. He offers A five hundred dollars ($500.00), for the work already done, and to release him from his obligation. A accepts B's proposition. The original contract has been terminated by the subsequent one.

33. Warranty and Remedies for Breach of Warranty. A warranty is a contract collateral to the principal contract, by which a party to a contract specifically covenants certain things. Warranties apply especially to sales of personal property. (See warranty under Sales of Personal Property.) A promises to build a house for B and warrants the paint to stand untarnished and uncracked for one year. The covenant on A's part relating to the paint is a warranty.

Breach of warranty ordinarily does not entitle the other party to rescind the contract. That is, it does not permit him to refuse to carry out his part of the contract, but entitles him to bring an action for damages, for its breach.

34. Recission and Discharge of Contracts by Breach. If a party fails or refuses to carry out a provision of a contract, he is said to have committed a breach of contract. When one party to a contract commits a breach, the other party may accept the breach and sue for damages, or he may refuse to accept the breach and wait until the time for complete performance arrives, and then, if the other party has not performed, sue for damages.

When a party to a contract commits a breach, and notifies the other party of his refusal further to carry out the contract, the other party cannot increase the defaulting party's damages by continuing performance thereafter. For example, A contracts with B to have a fence finished and erected around A's house. After B has half of the fence manufactured and erected, A refuses to go on with the contract. B cannot increase the damages by manufacturing and erecting the balance of the fence. The reason for this is that it would not benefit B at all, but would merely injure A. B is entitled to recover his profit for the entire job, when A breaks the contract.[35] He could recover no more by manufacturing and erecting the balance of the fence.

The law does not recognize trivial things. A party cannot claim breach of contract for failure of the opposite party to a contract, to perform an unimportant thing. The law recognizes substantial performance as actual performance. This does not mean that a party cannot put such terms in a contract as he chooses, but means that, in the absence of any provisions of the contract to the contrary, a party is not presumed by law to contract for trivial things. Time of performance is an illustration of this principle. A contracts with B for the building of a house. B promises to complete it in one year. If completed in one year and a day, there is a substantial performance, unless the contract expressly shows that the precise day of performance was regarded as important.

Where contracts provide for separate performances, a failure or refusal to fulfil one performance will not always amount to a refusal or failure to perform the balance. A agrees to ship B five thousand barrels of cement, in car load lots of one hundred and fifty barrels each to be shipped each week. B receives and refuses to pay for the first car. This may not amount to a breach of the entire contract, so as to justify A in refusing to ship the balance. The tendency of American courts, however, is to treat this as as one contract; that is to treat the promises as dependent, and not independent.

The acceptance by one party, of a breach of contract made by the other, and the refusal on the part of the former further to carry out the contract, is known in law as recission. To rescind a contract, a party must return what he has received thereunder, called putting the other party in statu quo. He must also accept the breach promptly. For example, A promises to sell B three horses to be delivered one each day, upon the three following days. A delivers one and fails to deliver the second. To rescind the contract, B must return promptly to A the horse already delivered. He may then sue A for damages suffered. If B does not promptly return the horse to A, he must permit A to go on with the contract, waiving the delay, or pay for the horse already delivered, less damages for A's breach of contract.

35. Discharge by Bankruptcy. By a United States' statute, certain persons may become bankrupts and thereby be discharged[36] from their obligations. By the terms of this act, the bankrupt's property is turned over to an officer, called a trustee in bankruptcy who disposes of it, and distributes it pro rata among the bankrupt's creditors. Any person except a corporation, who owes debts, may become a voluntary bankrupt.

The United States statute further provides that certain persons may be declared bankrupts at the instance of their creditors. The United States statute provides that:

"Any natural person, except a wage earner, or a person engaged chiefly in farming or the tillage of the soil, any unincorporated company and any corporation engaged principally in manufacturing, trading, printing, publishing, mining or mercantile pursuits, owing debts to the amount of one thousand dollars ($1,000.00) or over, may be adjudged an involuntary bankrupt, upon default, or on impartial trial and shall be subject to the provisions and entitled to the benefits of this act. Private bankers, but not national banks or banks incorporated under state or territorial laws may be adjudged involuntary bankrupts."

Any of the above enumerated parties may be made an involuntary bankrupt at the instance of creditors if he has committed an act of bankruptcy.

The bankruptcy statute defines an act of bankruptcy as follows:

"Acts of bankruptcy by a person shall consist of his having (1) conveyed, transferred concealed or removed, or permitted to be concealed or removed, any part of his property with intent to hinder, delay or defraud his creditors or any of them; (2) transferred, while insolvent any portion of his property to one or more of his creditors with intent to prefer such creditors over his other creditors; or (3) suffered or permitted, while insolvent, any creditor to obtain a preference through legal proceedings and not having at least five days before a sale or final disposition of any property affected by such preference vacated or discharged such preference; or (4) made a general assignment for the benefit of his creditors, or being insolvent, applied for a receiver or trustee for his property, or because of insolvency a receiver or trustee has been put in charge of his property under the laws of a state, of a territory, or of the United States; or (5) admitted in writing his inability to pay his debts, and his willingness to be adjudged a bankrupt on that ground."

Bankruptcy discharges a bankrupt from his contracts.

36. Remedies for Breach of Contract. Originally, at common law, there was no power given a party to a contract, to compel the other party specifically to perform the provisions of the contract. For example, A promises to pay B one thousand dollars ($1,000.00) for one thousand bushels of wheat, to be delivered within ten days. B fails and refuses to deliver the wheat. A could not at common law,[37] and cannot under the present rules of law, compel B to deliver the wheat. A's remedy is an action for damages. A may go into the market at the time and place of delivery, provided for in the contract, and purchase one thousand bushels of wheat of the quality provided for in the contract, and collect as damages from B the advance in price, if any, together with expenses connected therewith. If A is obliged to pay one thousand five hundred dollars ($1,500.00) for the wheat, which by the terms of the contract, he had purchased for one thousand dollars ($1,000.00) from B, he may recover five hundred dollars ($500.00) damages from B. If A succeeds in obtaining the wheat for nine hundred dollars ($900.00), he can only recover nominal damages from B, commonly five cents, for breach of contract. In case A obtains the wheat for nine hundred dollars ($900.00), B cannot recover one hundred dollars ($100.00) from A, since he has violated the contract, and cannot take advantage of his own wrong.

Parties frequently fix the amount of damages for a possible breach at the time the contract is made. This is known in law as liquidated damages. If reasonably compensatory, the courts will recognize and enforce liquidated damages; if clearly unreasonable they are regarded as penal, and the courts will not enforce them. For example, A agrees to construct a rolling mill for B, for fifty thousand dollars ($50,000.00), and to complete the structure within one year, and to pay damages of two hundred dollars ($200.00) per day, for each and every day consumed, in excess of a year in finishing the structure. If this is a reasonable loss to B, for the failure to have the use of the mill, the courts will enforce the provisions; otherwise they will remit the excess over the fair value of B's loss.