The Project Gutenberg EBook of The History of Currency, 1252 to 1896, by William Arthur Shaw This eBook is for the use of anyone anywhere at no cost and with almost no restrictions whatsoever. You may copy it, give it away or re-use it under the terms of the Project Gutenberg License included with this eBook or online at www.gutenberg.org Title: The History of Currency, 1252 to 1896 Author: William Arthur Shaw Release Date: December 22, 2011 [EBook #38381] Language: English Character set encoding: ISO-8859-1 *** START OF THIS PROJECT GUTENBERG EBOOK THE HISTORY OF CURRENCY *** Produced by Jason Isbell, Brendan Lane and the Online Distributed Proofreading Team at http://www.pgdp.net

[1896]

Reprints of Economic Classics Augustus M. Kelley Publishers NEW YORK 1967

First Edition 1895 (London: Wilsons & Milne, 29 Paternoster Row, 1895)

Reprinted 1967 by AUGUSTUS M. KELLEY PUBLISHERS From Second Edition of 1896

Library of Congress Catalogue Card Number 67-20086

Printed in the United States of America by Sentry Press, New York, N.Y. 10019

Being an Account of the Gold and Silver Moneys and Monetary Standards of Europe and America, together with an Examination of the effects of Currency and Exchange Phenomena on Commercial and National Progress and Well-being

LATE BERKELEY FELLOW OF THE OWENS COLLEGE FELLOW OF THE ROYAL HISTORICAL AND ROYAL STATISTICAL SOCIETIES

Second Edition

New York: G.P. PUTNAM'S SONS London: WILSONS & MILNE 1896

TO

RICHARD COPLEY CHRISTIE

THIS BOOK IS RESPECTFULLY DEDICATED IN MEMORY OF A FRIENDSHIP OF PECULIAR GRACE AND INSPIRATION

The purpose of this book is twofold—first and foremost, to illustrate a question of principle by the aid of historic test and application; secondly, to furnish for the use of historical students an elementary handbook of the currencies of the more important European states from the thirteenth century downwards.

Little need be said as to this latter purpose. The total omission of the historic, reasoned, and consecutive study of currency history—the most important domain of practical economics—from the curriculum of every university in the land is matter for surprise and regret, and can only be attributed to the lack of an initiative and of a handbook.

As to the former purpose, there is no field of history so strewn with scientific (i.e. comparative and prophetic) possibilities as economic history; and in economic history there is no department in which the study of the experience of other times and nations is more necessary and resultful, lesson-full, wisdom-full, than the domain of currency. The verdict of history[Pg viii] on the great problem of the nineteenth century—bimetallism—is clear and crushing and final, and against the evidence of history no gainsaying of theory ought for a moment to stand.

Throughout mediæval Europe and up to the close of the eighteenth century the currency of Europe was practically bimetallic—practically, because actually so without the prescription of a law of tender, and without the allowance of any theoretic grasp or conception of the practice as distinctively what nowadays we understand as bimetallic.

The conception of a law of tender is quite modern. And the evolution of the idea of such a law has gone hand in hand with the evolution of a conception of monetary theory on the part of the legislator—that is, with the bitter experience which for want of such a conception Europe endured for centuries. In all systems of jurisprudence money and minting appertains to the kingly office, and the development of the law of tender is to be traced in royal proclamations of the King in Council for long before it became the subject of parliamentary legislation. For centuries, such proclamations were issued, referring to a prohibition of export of the precious metals, banishing foreign coins from the land, or, again, permitting their circulation, and, in that case, prescribing the rough tariff or rate according to which (foreign) coin for (native) coin they should be current. In such proclamations there is no idea of separating the two metals, gold and[Pg ix] silver; there is no idea of a law of tender; there is no intention to declare a ratio; there is no conception of bullion apart from coin. The two metals had grown to be the circulating and exchange medium; they were actually there, and all that had to be done was to keep them there. The advantage which was to be derived from a trade in bullion, and from an understanding of the effects of differently-prevailing ratios in different countries, was known only to the Jew and the Italian. They plied their trade in secret, and the legislator was only apprised of the result by suddenly finding a slipping away and dearth of coinage. Then the legislator altered the tariff, and gradually rose to the conception of the ratio as underlying this process of seduction. Then, as a further defence of a particular class of coins, he imposed a limitation on the tender of such, so as to prevent bullion operations on it. This limitation was the first development of a law of tender. Throughout, from the thirteenth to the eighteenth century, both gold and silver had been actually employed in European commerce without any idea either of declaring or of restricting the tender, whether of the one or the other.

The final outcome of the application of the law of tender was the development of the modern monometallic system—a system in which alone lay the safeguard against the operation of the bullionist. It was only at the close of the eighteenth century that England evolved this system and flung away the[Pg x] last remains of that mediæval ignorance which had brought with it such a dower of mishap. France has taken almost a century of further experience before arriving at the same point of development.

Another point. At the time that England was shaking off the mediæval system France, too, was accomplishing a reform of her money system. It stopped half-way. The old kingly prerogative of altering the coinage was taken away, the unit of the currency was declared definite and unchangeable, and the seigniorage on minting was abolished. So much was accomplished by her law of 1803. But no further application was made of the law of tender than to throw the sanction of legal enactment over that mediæval system which had been the bane of France since first two metals found circulation in her bounds. As far as tender is concerned, there is no difference between the practice of the French monetary system in 1726 and that of 1803. The system was bimetallic in both cases—in the first case, legally by recognition and as resting on the royal jurisdiction; in the second case, legally by direct legislative or parliamentary enactment. The idea that the law of 1803 created a new system and a new heaven for France is doubly absurd. It was a continuation of a very old and a very danger-fraught system, with its roots deep in mediæval ignorance and practice.

In addition to this—and quite as demonstrably—there was no conception of a theory of bimetallism in[Pg xi] 1803, nor any conception of a bimetallic function to be performed for the good of the human race by bimetallic France. This is a conception of the schools, and bred of later needs and hopes and fears. The modern theory of bimetallism is almost the only instance in history of a theory growing not out of practice, but of the failure of practice; resting not on data verified, but on data falsified and censure-marked. No words can be too strong of condemnation for the theorising of the bimetallist who, by sheer imaginings, tries to justify theoretically what has failed in five centuries of history, and to expound theoretically what has proved itself incapable of solution save by cutting and casting away.

Such a verdict as this of history, negative as it is, must strike many a serious mind with dismay. The following of bimetallism would not be what it is were it not for the despair of any other remedy for the situation at the moment. We are thereby left apparently hopeless and remediless. But the first step to the discovery of a true and possible remedy, if any exists, can only be the casting away of the false and impossible.

The difference between the monetary problem of the seventeenth century and that of to-day lies in this, that while there has been continuity of history and development there has been a change of needs and circumstance. The danger of arbitrage transactions to the mediæval legislator lay in the fact that they stripped the country, which suffered from them,[Pg xii] not, or not merely, of a bullion reserve, but of her actual currency, and rendered even internal trade impossible. He accordingly tried to arrest the drain by threatening imprisonment and death.

To-day the safety and supply of the internal currency of the various states is provided for by a monometallic system or by note issue, while, conversely, trade in the precious metals has become free, and bullion flows automatically from land to land in accordance with the dictates of a now rightly-conceived theory of international trade. Just so far the monetary problem has changed—becoming a question of the evolution of a stable international exchange system. The theoretic pretensions of bimetallism have correspondingly widened, but on any ground, wide or narrow, the only material for the study, comprehension, and judgment of such pretensions lies in the actual experience of Europe during the past five centuries.

A few words of more particular explanation are necessary.

1. To the student of money and monetary standards the perpetually recurring phenomena of reductions of the unit and standard weights and contents of coins will present no difficulty. Three causes underlay the process—(1) the practice of alloying, (2) the competitive and dishonest action of governments, (3) the ideal nature of the unit itself, which permitted, literally, anything in the way of arbitrary manipulation (compare, e.g., the very[Pg xiii] different depreciations of the English shilling and the French sou, being both descendants of the solidus; or again, of the French livre and the Italian lire, being both descendants of the libra).

2. A second and much greater difficulty is presented by the confusion of nomenclature. It is often difficult to determine what particular piece is meant by a given name, or, if the identity of the piece can be fixed, its period may still be uncertain. In French numismatic history, for instance, the term florin d'or or denier d'or is used in documents quite generically for the more specific florins d'or à l'agnel, à l'écu, aux fleurs de lis, à la masse, moutons d'or, etc. This quite indeterminate use of the word "florin" (= denier = "piece," or generally, "coin") may possibly explain the crux to be found on pages 3, 9, 301, and 399 of the text (infra), where florins d'or are mentioned in French history more than seventy years before the first authentic minting of the gold florin at Florence.

3. With regard to the figures of the ratios there is great difference and divergence among the various authorities. The declared ratio may be of a double nature—(1) mercantile, as calculated on the purchase price of gold and silver in the open market; (2) legal, as settled by law in the terms prescribed for Mint purchase and issue. The former is comparatively simple, but it is not until a quite recent date, the opening of the eighteenth century, that it is statistically determinable. The table of the commercial[Pg xiv] ratio (pp. 157-9 infra) is taken from Soetbeer, and was by him calculated on the Hamburg exchange and London market rates. The competing figures of the commercial ratio drawn up by Ingham in his Report to the Senate of the United States (4th May 1830), and by John White, of the same date (see United States Report of the International Monetary Conference of 1878, pp. 583, 647), I regard as comparatively untrustworthy.

With regard to the legal or Mint ratio (see infra, tables, pp. 40, 69-70, 157) there is the greatest discrepancy, and I print the figures with much trepidation and every mental reserve. The differences in the results arrived at by the various authorities are due to the difference in method of calculation, according as the issue price or the purchase price at the Mint is taken (i.e. with or without allowance of seigniorage and remedy), or according as the pure or gross content of the piece is calculated from (i.e. with or without allowance for alloy). As a matter of fact, hardly any two authorities or sets of calculations agree. See, for instance, duplicate sets of figures for Holland in Appendix 1. to Schimmel's Geschiedkundig overzicht; or again, compare Soetbeer's figures with those deduced by Köhler in his Grundliche Nachricht; or by Dr. Arnold Luschin, in the Proceedings of the Congrés International de Numismatique, 1880, p. 443; or with those deducible from Le Blanc's tables (infra, Appendix VI.). It is to this difference that must be attributed the discrepancy[Pg xv] in the statement of the ratio by the French Mint authorities in 1640 (see text, infra, p. 92 and note, ibid.). The difficulty of calculating the European Mint ratio at any moment can be judged from the experience and statements of persons so widely apart as Sir Isaac Newton in England, Mirabeau and Calonne in France, and Morris and Hamilton in the United States (see infra, pp. 172-3, 229-30, and 251).

With regard to the scope of the present work, it is confined entirely to the history of metallic currency and standard. There is no reference to the paper-money experience of any country, not even America or Austria. Such a subject must form matter for a separate treatment. The account of Austrian money is, therefore, to be found in Appendix v., under Germany, and on the effects of the latest Austrian reform (as also of the latest development in India and the United States) no opinion whatever is expressed. I content myself with the simple statement of fact and event.

In appending a list of the authorities used, it is difficult to overcome the feeling of humiliation which has come to me from the contrast of the ephemeral, slight, and unworthy treatment of monetary history to-day, with the grand, solid, scholarly works which the eighteenth century produced. With the exception of Soetbeer's magnificent labours, without which the present work would have been simply impossible as far as the statements of production and relativity of[Pg xvi] the precious metals are concerned, and of the similar historic work of M. Ottomar Haupt, the literature of this subject to-day is light and polemic and transitory to a nauseating degree.

GENERAL

Authorities.

J.D. Köhler Grundliche Nachricht von dem Münzwesen insgemein. Helmstadt, 1739 and 1741. Third edition (Leipzig, 1781), enlarged and attributed to Von Praun.

Budelius De monetis et re numaria (with twenty-four other treatises). Coloniæ Agrippinæ, 1591.

Melchior Goldast Catholicon rei monetariæ sive leges monarchichæ generales de rebus numariis, etc. Frankfort, 1620.

Almanach des Monnaies. Paris, 1784.

Münze und Münzwissenschaft (Oec. Techn. Encyc. xcvii.).

Nicole Oresme Traité de la première invention des monnaies, and—

Copernicus Traité de la monnaie, both re-edited by Wolowski. Paris, 1864.

Jean Bodin Descours sur le rehaussement et diminution tant d'or que d'argent et le moyen d'y remedier [en reponse] aux paradoxes du sieur de Malestroict (appended to Bodin's Six Livres de la Republique. Lyons, 1593).[Pg xvii]

H.C. Dittmer Geschichte der ersten Gold-Ausmünzungen zu Lübeck im 14 Jahrhundert (Zeitschrift der Vereins für Lübeckische Geschichte), Heft. i. 885.

J.G. Hall On European Mediæval Gold Coins (Numismatic Chronicle). Third Series, vol. ii. pp. 212-226.

P. Joseph Historisch-kritische Beschreibung des Bretzheimer Goldguldenfundes vergraben um 1390, nebst einem verzeichniss der bisher bekannten Goldgulden vom Florentiner Gepräge. Mainz, 1883.

K.T. Eheberg Über das ältere deutsche Münzwesen und die Hausgenossenschaften. Leipzig, 1879.

Neueste Münzkunde Leipzig, 1853.

A.H. Smith Encyclopædia of Gold and Silver Coins of the World. Philadelphia, 1886.

A. Soetbeer Edelmetall—Produktion und Werthverhältniss zwischen Gold und Silber, seit der Entdeckung Amerika's bis zur Gegenwart. Gotha, 1879.

A. Soetbeer Materialien zur Erklärung und Beurtheilung der wirthschaftlichen Edelmetallverhaltnisse und der währungsfrage. Berlin.[Pg xviii]

A. Soetbeer Litteraturnachweis über Geld—und Münzwesen. Berlin, 1892.

F. Altés Traité comparatif des monnaies, poids et mésures. 1832.

G.K. Chelins Mass and Gewichtsbuch. 1830.

Gerhardt Tafeln, etc. Berlin, 1818.

Doederlein Commentatio Historica de Nummis. 1729.

C.C. Schmiede Handworterbuch der Münzkunde. 1811.

J. Leitzmann Abriss einer Geschichte der gesammten Münzkunde ... aller völker Fursten und Städte der ältern, Mittlern, und neuern Zeit. Erfurt, 1828.

GERMANY

Authorities.

J.P. Ludewig Einleitung zu dem teutschen müntwesen mittler Zeiten, etc. 1709.

J.F. Klotzsch Versuch einer Chur Sächischen Münzgeschichte. 1779.

D.E. Beyschlag Versuch einer Münzgeschichte Augsburgs in dem Mittelalter. 1835.

C. Binder Württembergische Münz und Medaillenkunde. 1848.

C.P.C. Schönemann Zur vaterländischen Münzkunde vom 12-15 Jahrhundert. 1852.

J.D. Köhler Historische Münz Belustigungen, 22 vols. 1729-65.[Pg xix]

H. Pauli Tableaux des monnaies de l'Allemagne, etc. Frankfort, 1846.

J.G. Hirsch Das teutschen Reichs Münz Archiv, etc., 9 vols. folio. 1750-68 (absolutely unequalled and indispensable).

J. Leitzmann Wegweiser auf dem Gebiete den deutschen Münzkunde. Weissensen, 1869.

Euler Verzeichniss und Beschreibung der frankfurter Goldmünzen mit einer geschichtlichen Einleitung etc. (Archiv fur Frankfurts Geschichte und Kunst), Heft iv. 1847.

E.L. Jäger Das Geld nebst einer kurzem Geschichte des deutschen Geldes. Stuttgart, 1877.

Geschichtliche Darstellung des alten und neuen teutschen Münzwesens. Weimar, 1817.

J.F. Hauschild Zur Geschichte des deutschen mass und Münzwesens. Frankfort, 1861.

A. Soetbeer Denkschrift über Hamburgs Münzverhältnisse. Hamburg, 1846.

H.P. Cappe Die Münzen der deutschen Kaiser und Könige das Mettelalters. 1850.

C.P.C. Schoenemann Zur vaterländischen Münzkunde. 1852.

J.P. Graumann Gesammelte Briefe vom dem Gelde, von dem Wechsel, etc. 1762.[Pg xx]

J.G. Hoffmann Die Lehre von Gelde. 1838.

J.G. Hoffmann Die Zeichen der Zeit. 1841.

J. Albrecht Munzgeschichte der Hauses Hohenlohe, vom 13-19 Jahrhundert.

Grote and Hölzermann Lippische Geld und Münzgeschichte, 1867. (Nachtrage by Weingaertner. 1890).

E.J. Bergius Das Geld und Bank wesen in Preussen. 1846.

A. Von Berstett Munzgeschichte des zähringen badischen Fürstenhauses. 1846.

D. Braun Bericht von Pohlnisch und Preussischen Münzwesen. 1722.

E. Bahrfeldt Das Münzwesen der Mark Brandenburg bis zum Anfange der Hohenzollern. 1889.

Köhne Das Münzwesen der Stadt Berlin, 1837.

F.H. Grautoff Historische Schriften, 3 vols. 1836 (for Lübeck Mint).

C.F. Eheberg Über das ältere deutsche Münzwesen. 1879.

J. Newald Beitrag zur Geschichte des Österreichischen Münzwesen im ersten Viertel des 18 Jahrhunderts. Vienna, 1881.

Max Wirth Geschichte der Handelskrisen. Frankfort, 1890.

Max Wirth Das Geld, Geschichte der Umlaufmittel von der altesten Zeit bis an die Gegenwart. Leipzig, 1884.

FRANCE

Authorities.

F. De Saulcy Recueil de Documents relatifs à l'histoire des monnaies frappées par les rois de France depuis Philippe II., jusqu' à François I., 4 vols. 4to. Paris, 1879. (The unique value of this work is sadly impaired by the cutting out of the preambles of the various proclamations, etc.).

Le Blanc Traité historique des monnaies de France. Paris, 1690.

Du Cange Glossarium mediæ et infimæ Latinitatis (Art. Moneta).

J. Adrien Blanchet Documents pour servir à l'histoire monétaire de la Navarre et du Béarn, de 1562-1629. Macon, 1887.

Hubert de Martigny De la Disparition de la monnaie d'argent et de son remplacement par la monnaie d'or (ou Situation Monetaire de la France en 1859). Paris, 1859.

H. Costes Les institutions monétaires de la France avant et depuis, 1789. Paris, 1885.

H. Costes Notes et Tableaux pour servir à l'étude de la question monétaire. Paris, 1884.

Hippolyte Berry Études et recherches historiques sur les Monnaies de France. 1853.

Natalis de Wailly Mémoire sur les variations de la livre tournois depuis S. Louis à la monnaie decimale.[Pg xxii]

C. Bouterouë Recherches curieuses des monnayes de France depuis le commencement de la Monarchie. Paris, 1666.

L. Faucher Recherches sur l'or and l'argent. 1843.

Dupré de St. Maur Essai sur les monnaies ou réflexions sur le rapport entre l'argent et les denrées. Paris, 1746.

Abot de Bazinghen Traité des monnaies et de la jurisdiction de la cour des monnaies. Paris, 1764.

Le Vicomte G. D'Avenel Histoire économique de la propriété, des salaires, des denrées, etc., 1200-1800. Paris, 1894·

For a bibliography of the works treating of the provincial monies of France, see Vicomte D'Avenel, ubi supra, i. pp. 483-91.

ITALY

Authorities.

Ignazio Orsini Storia delle monete della repubblica fiorentina. Firenze, 1760.

Ignazio Orsini Storia delle monete de' Granduchi di Toscana. Firenze, 1766.

Zanetti Nuova raccotta delle monete e zecche d'Italia, 5 vols. folio. 1785-89.

Custodi Scrittori Italiani d'economia politica, vol. xiv.

F. Schweizer Serie delle monete Aquileia. 1818.

Ph. Argelatus Di monetis Italiæ varior. illustr. virorum dissertationes, 6 vols. 1750-9.[Pg xxiii]

A. Cinagli Le monete de' Pape, folio. 1848.

[Fr. Vettori] Il fiorino d'oro antico illustrato. 1738.

Menizzi Delle monete de' Veneziani dal principio al fine della loro repubblica. Venezia, 1818.

Vincenzo Padovan La numografia Veneziana sommario documentato. Venezia, 1882.

Fr. Ed. Ercole Gnecchi Le Monete di Milano.

Catalog einer Sammlung italienischer Munzen aller Zeiten. Munich, 1882.

Nicolo Papadopoli Sulle origini della Veneta zecca, etc. Venezia, 1882.

Nicolo Papadopoli Sul valore della moneta Veneziana. Venezia, 1885.

Nicolo Papadopoli Monete inedite della zecca Veneziana. Venezia, 1881.

G. Carli-Rubbi Delle monete e dell' instituzione delle zecche d'Italia. L'Aja, 4 vols. 1754.

NETHERLANDS

Authorities.

W.F. Schimmel Geschiedkundig overzicht van het muntwezen in Nederland. Amsterdam, 1882.

[Groebe] Handleiding tot de kennis der nederlandsche munten. Amsterdam, 1850.

[Warin] Bijdragen tot de kennis van het muntwezen ('S. Gravenhage). 1843.[Pg xxiv]

P.O. van der Chijs Beknopte verhandeling over het nut der beoefening van de algemeene, dat is oude, meddeleeuwsche en heden daagsche munt en penningkunde. Leiden, 1829.

V. Gaillard Recherches sur les Monnaies de Flandres. 1857.

Groot Plakkaat Boek (Can & Schelten).

Mieris Beschrijving der Munten van Utrecht. 1726.

A. Vrolik Verslag van al het verrigte tot herstel van het Nederlandsche Muntwezen van 1842-51.

L. Deschamps de Pas Essai sur l'histoire monétaire des Comtes de Flandres de la maison de Bourgogne. 1863.

F. Hénaux Essai sur l'histoire monétaire du pays de Liege. 1845.

W.C. Mees Proeve eener geschiedenis van het Bankwezen en Nederland. Rotterdam, 1838.

Kornelis van Alkemade De goude en zilvere gangbaare penningen der Graaven en Gravinnen van Holland. Delft, 1700.

W.J. de Voogt Bijdragen tot de numismatiek van Gelderland. Arnhem, 1869.

R. Serrure Elements de l'histoire monétaire de Flandres. Gand, 1879.

F. Verachter Documents pour servir a l'histoire monétaire des Pays-Bas. Anvers, 1845.

F. Verachter Histoire monétaire de la ville de Bois le Duc. Anvers, 1845.[Pg xxv]

Revue numismatique Belge.

D. Groebe Beantwoording der Prijswerk over de Munten en hetgeen daartoe betrekking—1500-1621 (Koninklijke Akademie van Wetenschappen. 1835).

Inleiding tot de heedendaagsche penningkunde ofte verhandeling van der Oorsprong van't geld, etc. Amsterdam, 1717.

Fr. van Mieris Beschrijving van der Bisschoplijke munten en zegelen van Utrecht, etc. Leyden, 1726.

Fr. van Houwelingen Penninck-boeck enhondende alle figuren van Silbere und Goude penningen gheslaghen bij de Graven van Hollandt. Leyden, 1591.

J. Ackersdijck Nederlands Muntwezen, etc. Utrecht, 1845.

Ghesquière Memoire sur trois points interessant de l'histoire monétaire des Pays Bas, etc. Bruxelles, 1786.

F. Den Duyts Notice sur les anciennes monnaies des Comtes de Flandres, etc. 1847.

R.H. Chalon Recherches sur les monnaies des Comtes de Hainault. 1843.

P.O. van der Chijs De munten der Voormalige Hertogdommen Braband en Limburg (in vol. xxvi. of Tayler's tweede Genootschap. Haarlem. 1851).

Van den Berg Introductory chapter to "The Silver Question." 1879.

SPAIN

Authorities.

Breve Reseña historico-critica de la moneda Española y reduccion de sus valores a los del sistema metrico vigente (a Government Report of 1862).

Juan de Dios de la Rada y DelgadoBibliografia numismatica Española Madrid, 1886. (A work of unequalled merit.)

Vicente Argüello Memoria Sobre el valor de las monedas de D'Alfonso el Sabio (memorias de la Real Academia de la Historia).

Edward Clarke Letters concerning the Spanish Nation. London, 1773.

J. Salat Tratado de las monedas de Cataluñia. Barcelona, 1818.

Andrea Merim Escuela Paleographica, folio. 1780.

Cascales Discursos historicos de Murcia, folio. 1621.

A. Heiss Descripcion general de las monedas Hispaño-Cristianas, 1865-9. 3 vols. (A model work of immense labour.)

Liciniano Saez Demostracion historica del verdadero valor de las monedas, etc. 1805 (Real Acad. de la historia).

Dr. Clemencin On the Ratio in Spain (in Memorias de la Real Academia de la Historia, vol. vi. p. 525).

ENGLAND AND AMERICA

R. Ruding Annals of the Coinage of Britain.

Hawkins Silver Coins of England.[Pg xxvii]

Kenyon Gold Coins of England.

Numismatic Chronicle.

Lord Liverpool Treatise on the Coins of the Realm.

Sir James Stewart Works.

S.M. Leake A Historical Account of English Money.

H.N. Sealey Coins, Currency, and Banking.

Macpherson Anderson's History of Commerce.

Bishop Fleetwood Chronicon Preciosum, or an Account of English Money, etc. etc. London, 1707

Bishop Nicolson English, Scotch, and Irish Historical Libraries.

Thorold Rogers History of Prices.

Tooke and Newmarch History of Prices.

Sir Dudley North Discourses upon Trade. 1691.

Sir Walter Raleigh Works (Oxford Edition).

Sir Robert Cotton Posthuma.

Harris An Essay upon Money and Coins. London, 1752.

State Papers Foreign (Record Office). (Absolutely invaluable.)

Close Rolls and Patent Rolls (Record Office).

State Papers Domestic (Record Office).

Treasury Papers (Record Office).

Reports of the Deputy-Master of the Mint, 1870-94.

United States Reports of the International Monetary Conference. 1878. (Embodying an invaluable series of reprints.)

J. Laurence Laughlin The History of Bimetallism in the United States. New York, 1894.[Pg xxviii]

Dunbar Laws of the United States on Currency and Banking, etc.

Of the almost endless series of Government Reports, a full bibliography will be found in Soetbeer's Litteraturnachweis.

The American Mint Reports, and the Austrian Statistische Tabellen zur Wahrungs-Frage der Osterreichisch-ungarischen Monarchie (Vienna, 1892), deserve separate and special mention for their unequalled usefulness.

I am deeply indebted to H.C. Maxwell Lyte, C.B., Deputy Keeper of the Records, for references to the Patent and Close Rolls, the Exchequer Records, and other sources, which I have attempted to work into the tables of the French coins (Appendix VI.).

The Index of Coins at the end of the present volume is intended mainly for the purposes of historical research. It has been compiled, along with the General Index, entirely by my sister, Miss Edna Shaw, to whom my warmest thanks are due.[Pg xxix]

Recommencement of gold coinages in Europe, 1; in Italy, 3; Germany, 6; France, 9; Flanders, 10; Holland, Spain, and England, 11; characteristics of the first period, 13; general depreciation of the standard, 15; monetary experience of Italy, 17; the Florentine troubles, 18; monetary experience of Spain, 23; the Cortes of Valladolid, 24; monetary experience of Germany, 25; the Mint conventions, 26; tables of the groschen and gulden, 30, 31; monetary experience of France, 31; arbitrary debasements, 32; course of the monies under Philippe de Valois, 35; the States-General of France, 1420, 37; Charles VII., 38; Louis XI. and Charles VIII., 39; general statement of the ratio, 40; monetary experience of England, 41; Edward III.'s issues of gold, 42; the measures of, 1353, 45; complaints of 1381, and the monetary investigation, 50; recoinage of 1414, 55; recoinage of Henry VI., 58.

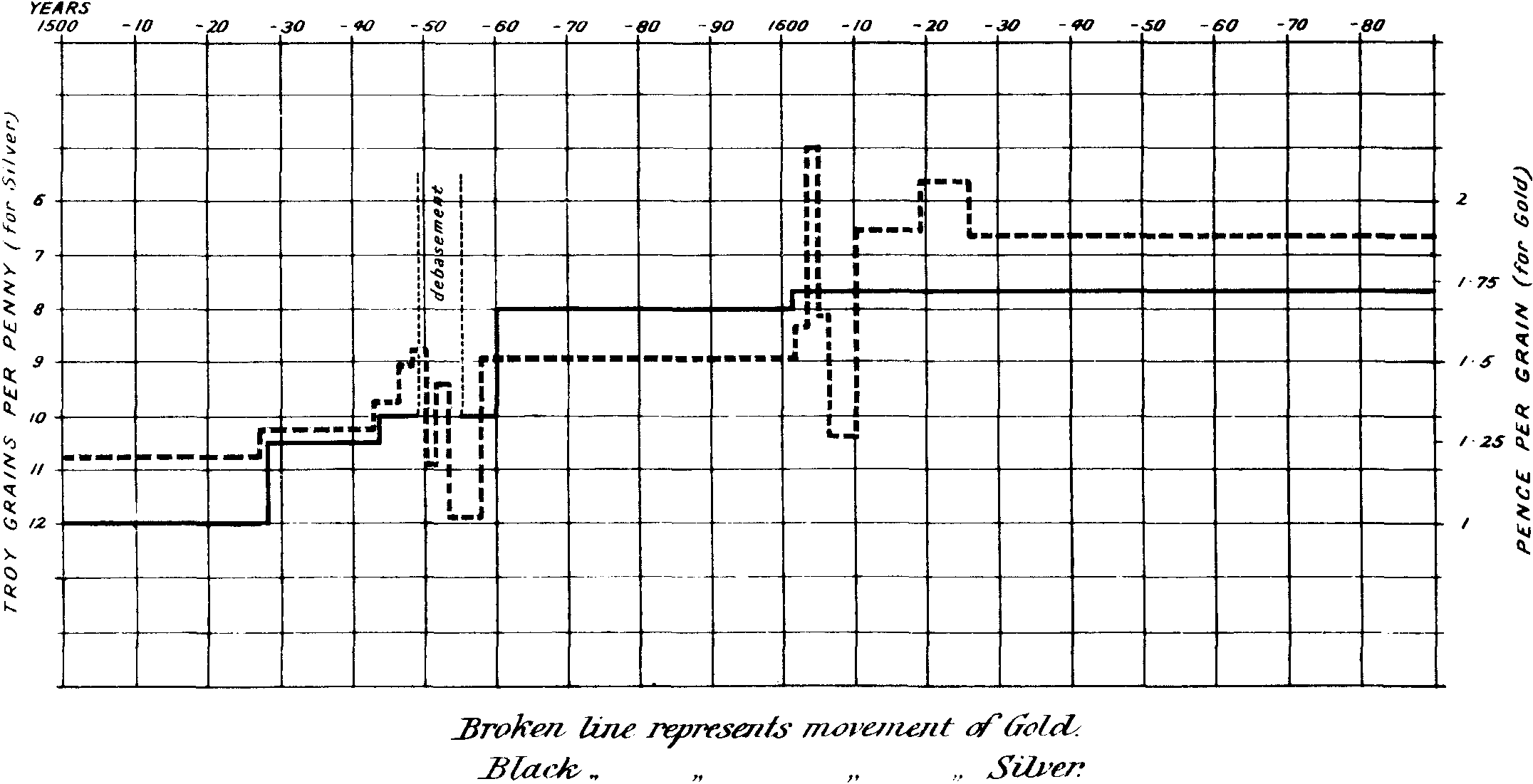

General characteristics: First movement of metals from the New World, 61; mercantile importance of the Netherlands, 63; statistics of the production of the precious metals, 65; statement of the Mint ratio, 69; operation of the Netherlands plakkaats, 71; list of ditto, 76; tables of ditto, 79; monetary experience of France, 83; course of the monies under Henry II. and Charles IX., 84; the States-General of 1575, 87; Henry III.'s reform of 1577, 88; checked by Henry IV., 1602, 89; the monetary experience of 1614, and reform of 1615, 90; recoinage of 1640, 91; Florence, 93; Germany, 95; table of the groschen and gulden, 97; Imperial Mint Ordinances of 1524, 1551, and 1559, 98, 99; Mint disorders, 100; Kipper und Wipper Zeit, 102; Imperial basis of [Pg xxx] 1623, 106; Spain, 107; her function as a distributor, 108; England 113; tables of gold and silver coins, 113; recoinage of 1527, 118; export of 1537, 119; measures of 1544, 121; the Tudor debasement, 123; Elizabeth's recoinage, 1559, 129; the mistake of 1600, remedied by James I., 132; export of 1607 and 1611, Sir Walter Raleigh's opinions, 134; crisis of 1620-22, 139; the State prosecutions of 1638, 148; the troubles of 1649 and 1652, 151.

Statistics of the production of the precious metals, 154; statement of the ratio, 157; development of theory of international trade, 160; free trade in the precious metals, 163; place of discount and interest rates in the modern system, 165; monetary experience of France, 167; recoinages of 1689, 1726, and 1785, 168; Calonne's ratio, 172; monetary action of Republican France, 173; the law of 1803, 176; bimetallic experiences, 1803-76, 179; movements and mintings of the metals, 183; measures of 1835, 187; French monetary commissions, 188; formation of the Latin Union, 190; its history, 193; Germany, 197; Zinnaische standard, 199; Leipzig standard, 1690, 200; Austrian or Convention standard, 201; South German standard, 202; Prussian standard, 203; Conference of Munich, 1837, 204; Mint conventions of Dresden, 1838, and of Vienna, 1857, 205-212; agitation of 1857-70, 213; new Imperial system, 215; England, 219; recoinage of 1696, 222; Newton's report, 1717, 229; recoinage of 1774, 233; silver legislation, 237; Bank Restriction and the Act of 1816, 240; movements and mintings of the metals, 244; United States, 246; beginnings of a national system, 247; reports of Morris and Hamilton, 249-251; Act of 1792, 253; gold export and the law of 1834, 255; silver export and the law of 1853 and 1873, 259; Acts of 1878, 1890, and 1893, 262; movements and mintings of the metals, 265; Netherlands, 268; Portugal, 272; the international conferences, 274; Paris conferences of 1867, 1878, and 1881, 275-280; Brussels Conference of 1892, 285; India, 293; her historic function, 293; movements and mintings of the metals, 299.

| page | ||||

| APPENDIX | I. | The Monetary System of | Florence, 1272-1530 | 301 |

| " | II. | " | Venice, 1284-1790 | 310 |

| " | III. | " | Spain, 1250-1894 | 319 |

| " | IV. | " | the Netherlands, 1250-1894 | 345 |

| " | V. | " | Germany, Austria, and Prussia, 1250-1894 | 360 |

| " | VI. | " | France, 1140-1894 | 396 |

The monetary history of Europe begins in the thirteenth century, and in the Italian peninsula. Its starting-point is the era of the reintroduction of gold into the coinages of the Western nations, and is definitely marked for us by the minting of the gold florin of Florence in 1252. For all practical purposes gold had gone out of use since the seventh century, and after the submersion of the Roman Empire; and the currencies of the nations of mediæval Europe rested on a silver basis entirely. There are limitations to the truth of this statement, but they are of such a nature as not materially to affect it. In Spain, for instance, the Moors kept up a tradition of gold coinage similar to that of Rome, from the eighth to the middle of the thirteenth century. But its influence on the monetary system of Christian Spain is[Pg 2] not even a matter of question. At the other extremity of the Mediterranean, at Byzantium, seat of the Eastern Empire, the best traditions of the coinage system of Rome were preserved for centuries after the imperial city had fallen before the invasions of the northern barbarians. Indeed, the monetary system of the Eastern empire, by becoming, as it did, the model which Charlemagne copied in his currency enactments, became the basis of all the modern European systems. Further than this, the presence of gold Byzants can be traced here and there, at isolated points and dates, all over the darkness of those early centuries of the Middle Ages, when all coining art seemed forgotten among the races of Central Europe.

Notwithstanding such limitations, however, it still remains true that the monetary history of the modern world dates from the thirteenth and not the seventh century, and from the little commercial states of Italy rather than from Byzantium. Previous to the minting of the gold florin of Florence there is no trace of any independent minting of gold coins on a commercial scale by any state of mediæval central Europe. The currency system of England, for instance, from the time of the Saxons to the days of Henry III. was based entirely on silver. In endless variety and under a diversity of names the silver penny was the unit coin current of the realm. Its equivalent in the Frankish Empire was the silver denarius, which Charlemagne had made the unit of his system, and which so con[Pg 3]tinued for both the kingdom of France and the Holy Roman Empire till the fourteenth century. Finally, among the numerous states of Italy, with each their little independent Mint, there is no trace of the coinage of gold until the days of the commercial greatness of Florence and Venice. For eight centuries or more those races of Europe, which were to turn the course of the modern world and build its civilisation anew, were ignorant of the commercial use of what has been through all history the most potent factor in civilisation—gold.

The explanation of the reintroduction and recoinage of gold is to be found in the history of the Crusades and of the commercial growth of the petty independent states which sprang from the political confusion of Italy. No sooner had they achieved each their little autonomous existence than they threw themselves with feverish energy into the development of the trade with the East. Florence and Venice, Pisa and Genoa, led the way and reaped the fruits; and it was in her most flourishing time, when she had conquered her rivals, Pisa and Siena, and was enjoying a prosperous peace and active trade, that Florence, at the instance of the chief of her merchants, resolved on the coining of the gold florin (1252).[1]

The mere idea of such a gold coinage could only[Pg 4] be derived from the East—from Byzantium. But it is a curious fact that the importation of it should be due in the first place to the Crusades. Frederick II. of Sicily was elected Emperor of the Holy Roman Empire in 1212. Sixteen years later he headed the Fifth Crusade, and the gold coin (Augustale) which he issued some time between his return from that crusade and his death, probably commemorates his wish to rival the appearance of opulence of the Eastern court. This Sicilian coin is the direct ancestor of the florin of Florence, and to it would fitly belong the honour of leading in a new era, were it not that the superior beauty of the Florentine coin gave it universal currency and reputation, and extinguished the memory of its predecessor.

The gold coin of Genoa (Genoviva) is supposed to have issued in the same year as the florin (1252). Five years later (1257) Henry III. of England imitated the florin in his gold pennies, and more than thirty years (31st October 1284) later Venice followed the lead of Florence and instituted a coinage of gold zecchinos, under the dogeship of Giovanni Dandolo.

Two conditions were essential to the bringing about so momentous a revolution as this, however little the mind of contemporaries may have known it as such. In the first place, the foreign trade of the Italian republics must have become so extensive as to demand a currency medium of higher denomination than silver; and, secondly, that trade must have developed in such directions as to tap gold-using or[Pg 5] gold-bearing regions in order to supply the Italian mints. It is a curious fact that both these conditions were realised through the instrumentality of the Crusades. The quickening effect of these vast movements on the trade of the Mediterranean is well known, but their influence in the second direction has not hitherto been pointed out. In the Fourth Crusade Venice lent the force which captured Byzantium (1203), and when, by her arms, Baldwin, Count of Flanders, had been seated on the Eastern throne, Venice reaped her reward in three-eighths of the territories of the Eastern Empire. She received Peloponnesus and a chain of islands in the Ægean, and by the hold she had on Constantinople secured the virtual control of the Black Sea. In its turn the control of the Black Sea brought with it the monopoly of the overland trade with India.

At one and the same moment, therefore, Venice acquired possession of a huge treasure of gold wrested from the conquered city, and of the then only gold-yielding districts—the Crimea—and of an intercolonial trade, demanding a more enhanced currency medium. The result of such a combination of circumstances was irresistible. During the continuance of the "Latin Empire" at Byzantium, Venice and her sister state were practically the only merchants of Europe.

The institution of a gold coinage among the Italian republics, therefore, marks for us an era of commercial expansion which is only fitly to be[Pg 6] compared with that of Holland in the seventeenth century, or of our own country in modern times.

We are not concerned with tracing the effects of this extraordinary movement further than as they bore in their train the dower of a currency of gold.

In the European system, Venice was the intermediary between the spice-laden east and the wool-bearing north. England, the wool-growing country of fourteenth-century Europe; Flanders, the home of the weaving industry; the Hanse Towns of Germany and the gradually forming kingdom of France were successively brought face to face with the new medium of currency; and if the story of the gradual adoption of that new medium could be written, it would form one of the most instructive of all chapters of currency and commercial history.

As it is, we have only uncertain and scattered data.

In the case of Germany—of chief importance in the process by reason of her geographical position midway between the Mediterranean and the north—the first minting of gold in imitation of the Italian states fell in the second quarter of the fourteenth century. Of the two types of gold monies issued by the Emperor Louis IV., surnamed "Bavarian," the first, struck some short time before 1328, was in direct imitation of the florin of Florence. The second, struck some little time later, was a copy of the écu d'or of Philip VI. of France.

In 1337 our own King Edward was made vicar-general and lieutenant to the Emperor, with powers[Pg 7] to coin monies of gold and silver. He accordingly kept his winter at the Castle of Louvain, and caused great sums of money both of gold and silver to be coined at Antwerp. Two years later, this same Emperor Louis, the Bavarian, granted to the Duke Rainhold of Gueldres the right to mint gold coins, "after the valuation of the gold monies of the Archbishop of Cologne, the Duke of Brabant, and the Counts of Hainault and Holland." In the following year he granted to the free state of Lübeck a similar right—the patent expressly stipulating that their gold coins should not exceed in weight or value the gold florin of Florence.

Sixteen years later (1356) the general liberty of coining gold was conceded to the seven Electoral Princes by the Golden Bull of the Emperor Charles IV., and subsequently state after state and free town after free town purchased or were granted the right. Even as late as 1372, in the patent granting to Frederick of Nürnberg this so eagerly solicited liberty, the stipulation is made that the gold gulden to be coined should be of as good gold and weight as "the gulden or florin of Florence."

In the case of Lübeck direct documentary evidence of transactions relating to the introduction of a gold coinage has survived among the archives of that state. The privilege of a Mint and of coining (of silver) was first granted to Lübeck by Frederick II. in 1226. But it was not until a century and more later that Louis the Bavarian, by his bull of 28th November[Pg 8] 1340, conceded the right of coining gold "in pieces which were to be neither heavier nor of higher worth than the florin of Florence." On the 8th September in the following year the Lübeck Mint made its first purchase of gold from a certain Jacob Grell of Zütphen in Holland. The purchase consisted of 4 marks 1 loth 8 pfen. weight of gold (Lübeck weight), and the price paid was 24 solidi the carat. In other parcels, up to Michaelmas of 1341, the authorities remitted to the Mint a total weight of metal of 50 marks 2 oz. 3 1⁄2 ang., varying in fineness from 15 to 23 carats. The consignment yielded in the pot 46 marks 1 oz. 7 ang. of pure metal, and was coined into 3199 pieces of a total weight of 47 marks 5 oz. 10 ang., being 67.08 gold pieces to the Lübeck mark. The coins were issued on the 18th February 1342, and bore on the one side the lily of Florence and on the other the figure of John the Baptist—all in direct imitation of the florin. The total issues made in the immediately succeeding years from the Lübeck Mint were:—

| 1342 | 24,783 | florins | 67.26 | to the mark. |

| " | 5,483 | " | 67.11 | " |

| 1343 | 30,436 | " | " | " |

| 1344 | 32,590 | " | " | " |

With more or less irregularity the earliest German guldens imitated the florin, and maintained something like a steady and uniform denomination quite up to the beginning of the last quarter of the fourteenth century.[Pg 9]

In France, as in Germany, the first coining of gold can only be dated approximately, but for all practical purposes quite safely. The generally accepted view is that the French series of gold coins was initiated in 1254 by Louis IX., "St. Louis," and that the issue was connected with the Sixth Crusade which he had headed five years before. There is documentary evidence extant to disprove this. Florins d'or appelez Florences are mentioned as early as 1180, not vaguely but quite definitely with an exact statement of weight standard and equivalence. Unless the record of the first minting of the gold florin at Florence is untrustworthy the coin here referred to can only be an imitation in gold of the silver florin of Florence. The same document which contains this reference (De Saulcy, i. 115) also specifies petits royaux d'or as minted not only in 1180 by Philip Augustus, but also in the days of his father, Louis VII. Similar mention of at least two gold coins of Louis IX. occurs as early as 1226, one evidently of the florin type, the other a pavillon d'or. It is quite safe to assert, however, that these coins were for show merely, due to an emulation of Byzantine and Italian opulence, and indicate no wide or commercial employment of gold. Of the gold florins of 1226, for instance, thirteen pieces were struck, twelve for twelve peers of France as a gift, the thirteenth for the King himself, "and know you that this is the most beautiful money that can be found, and the finest and best engraved." The interest of such issues is entirely numismatic and not[Pg 10] commercial or monetary.[2] It is not until late in the reign of St. Louis—until 1265 or thereabouts—that there is mention in France of any such gold coinage as could have this commercial rather than merely numismatic importance. For the purposes of metallic or currency history proper the real starting-point for France is marked rather by the gros royaux d'or, coined in 1295 by Philip le Bel, than by the more meagre coinage of St. Louis and his predecessors. The gros royaux of Philip were double the value of the petits royaux of St. Louis, of which latter Philip le Bel speaks thus in his proclamation. "We have commanded to be made in our name money of gold after the petits royaux d'or, which shall be 70 to the Paris mark and cut as the petits royaux have been used to be, being issued at an equivalence of 11 sols Parisi." From this date (1295) onward the gold coinage of the French Mint became one of the most important factors in the monetary history of Europe.

In Flanders the first gold coins were struck in 1357, under the rule of Count Louis II.[3] Both the coins issued by him are copied directly from French types——his real au lion from the French écu of Philip IV., and his mouton d'or from the French coin of the same name. And it was the same[Pg 11] French original which furnished the types to William V., Count of Holland (1356-77), when he followed the fashion and coined gold. Of the six types minted by Count William during his reign, two are an imitation of the French mouton, and the last is derived from the universally prevailing type, the florin.

In Spain the first coining of gold by the Christian powers fell in the same epoch and derived from the same source. Alfonso XI. (1312-50), surnamed the "Noble," was the first King of Castille who coined the oro gran modulo (doblas de oro), while in Aragon Pedro IV. (1336-87), "the Ceremonious," in his oro florines directly imitated the Florentine type, though his later pieces are more original in design.

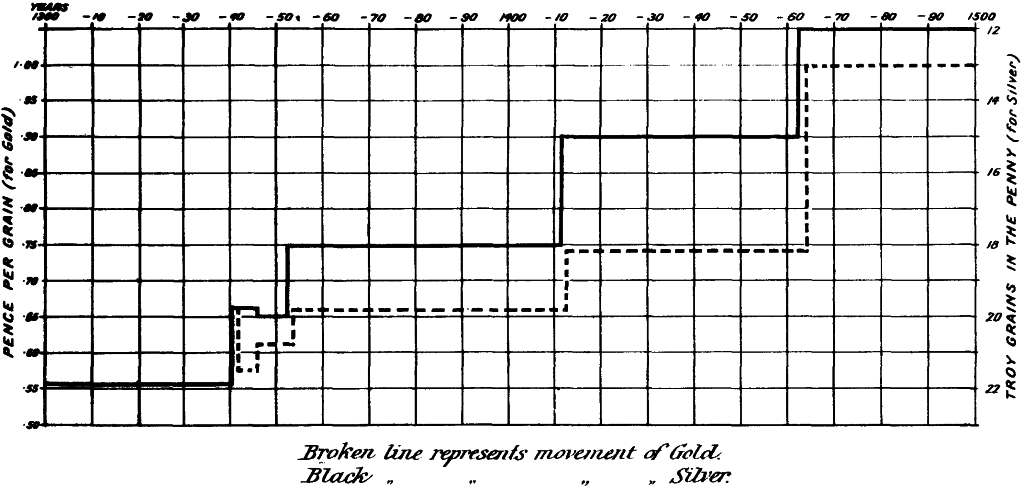

Finally, with regard to England,—to whose monetary history a central importance attaches,—the course of events was most evidently controlled by the revolution in the continental currencies. It is, at the same time, comparatively easy to ascertain. The first of our kings to issue gold coins was Henry III., who in 1257 coined a penny of fine gold, of the weight of two silver pennies of the time, and ordered it to be current for twenty pence.

There can be no doubt that the idea of such a coinage was derived from that of St. Louis of France; and, just as in France, the issue seems to have been premature. Probably neither in the one country nor the other did there exist a sufficient store of the precious metal itself, nor sufficient activity of trade to attract such a store, or[Pg 12] indeed to make a gold coinage at all a matter of mercantile advantage. It is only a developed and active or considerable trade that demands so enhanced a medium of exchange. Accordingly, just as in France, there is a noticeable gap between the first actual minting of gold by the predecessors of St. Louis, and the minting of it in such quantities as to make a factor in commercial and monetary history, in the days of Philip le Bel (1295); so, in England, the first issue of Henry III. was followed by an interval of nearly ninety years, during which no coinage of gold by our kings took place. The real introducer of this metal into English currency and commerce was Edward III., and the first practical issue of it is to be dated in 1344, rather than 1257. It will be seen at a glance what this statement implies. The issue of Henry III. in 1257 had been premature—an act of kingly rivalry and show, rather than of commercial necessity. But the succeeding century saw a rapid development in the commerce of Northern Europe, and a gold coinage had gradually become both a possibility and a necessity. One after the other—in the order of time just detailed—the various commercial states with which England had intercourse had adopted it and profited by it. That England should follow in the movement scarcely more than sixteen years later than Germany, and a year or two before Flanders, is some evidence of the organisation of her trade, as well as of the intimacy of inter-commercial relationships. So[Pg 13] purely a matter of trade and natural growth was this vast movement of the adoption of a gold coinage—a revolution indeed as it proved, though yet unwritten, more momentous in its influence on European civilisation than either the Renaissance or the Reformation.

Approximately, therefore, the fourteenth century may be taken as the starting-point for a history of European bimetallism. The first period of that history embraces all the movements of the previous metals, from such starting-point up to the discovery of America in 1492—a matter of two centuries, roughly speaking.

The characteristics of this period are perfectly well defined, and repeat themselves with almost faithful and exact similarity of recurrence in the several states comprising the Europe of that date. In brief, such characteristics were those of—(1) a period of commercial expanse, necessitating an increasing currency and advancing prices; (2) a period of stationary production of the precious metals, necessitating a struggle among the various states for the possession of those metals; (3) a period of endless change in the ratio between gold and silver, necessitating continual revision of the rate of exchange. Broadly speaking, those characteristics fall into two classes, accordingly as they relate to—(1) the natural movement of prices i.e. having regard merely to the supply of the precious metals; (2) to the unnatural struggle for the metals themselves—for the material[Pg 14] for currency—due to international rivalry and bad or crafty legislation.

With regard to the former of these, the period was distinctly one of insufficient and relatively diminishing production of the metals. During these two centuries, 1300-1500, the main sources of the derivation of gold were the Eastern trade and the finds on the eastern shores and northern interior of Africa. The chief supply of silver came from the mines in Germany. These latter—in Hungary, Transylvania, Saxony, and Bohemia—were of such importance and activity, in the fifteenth century and towards the time of the discovery of America, as partially to keep pace with the general trade expanse of the time, thereby helping to arrest a fall of prices that would have been absolutely disastrous to the civilisation of Europe. The combined production during this period cannot even be conjectured. At the close of it—during the reign of Henry VII.—the total coinage of England, both silver and gold, did not probably exceed £3,000,000, while the total stock of both metals in Europe in 1492 has been estimated at no more than £33,400,000. These figures stand alone, for we have no idea of the extent of the commerce which was worked on so small a monetary basis, and very little idea of the amount of aid which was extended to metallic money by such expedients as bills of exchange. To estimate, therefore, whether the period was one of depreciating, stationary, or appreciating currency, we are[Pg 15] reduced to the testimony of prices and the Mint records.

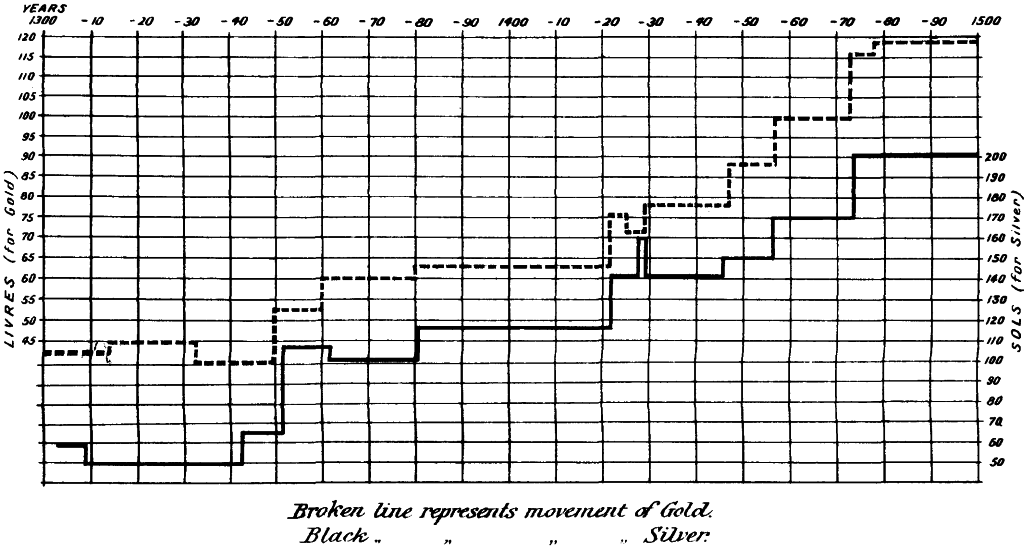

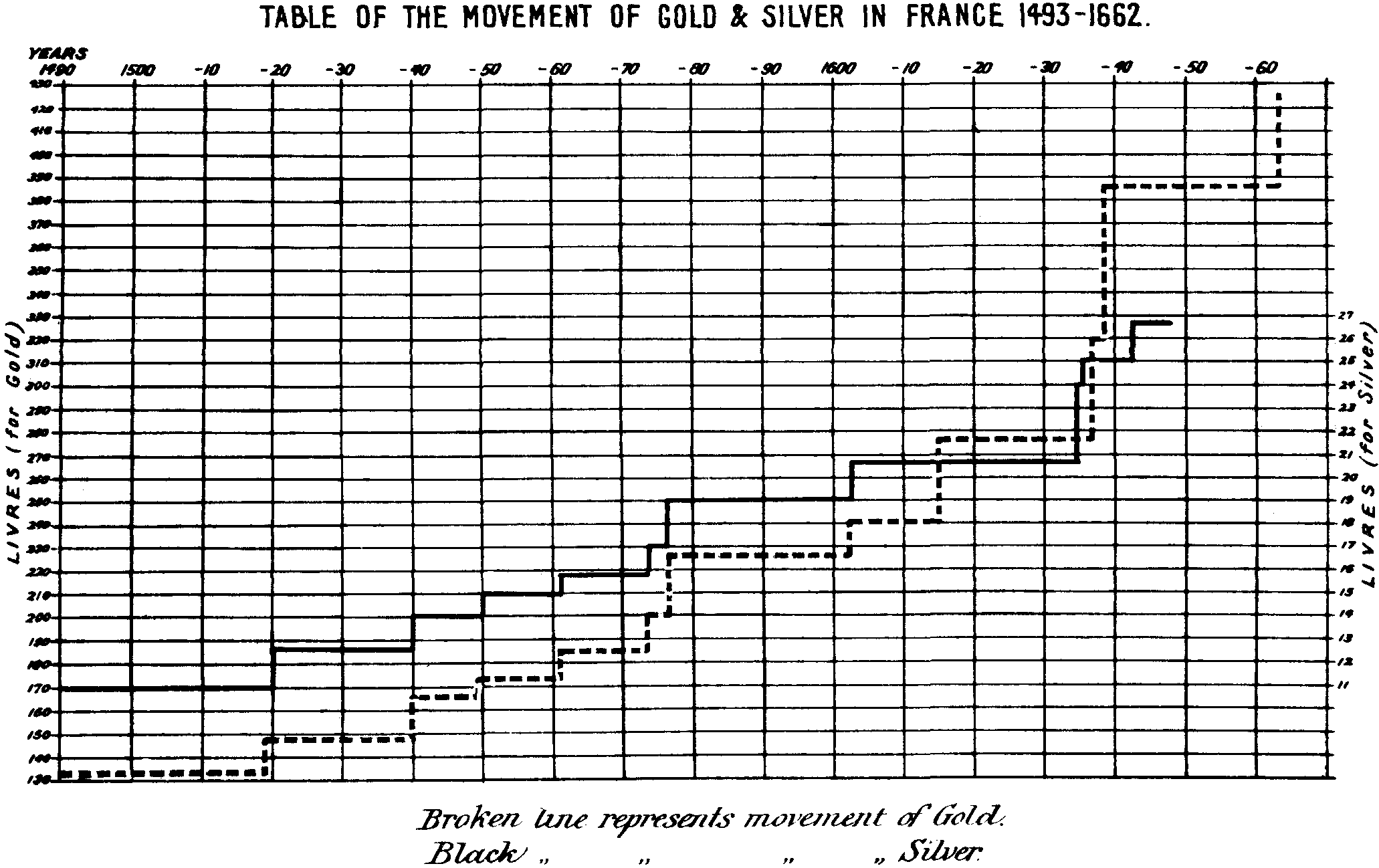

In France, at the beginning of the period (in 1308), the mark of gold was coined into 44 livres, and the mark of silver into 2 livres 19 sols. At the close of the period, or towards it, in 1475, the mark of gold was coined into 118 livres 10 sols, and that of silver into 10 livres.

In Germany the mark of gold was coined into 66 gulden of 23 carats in 1386, and into 71-1⁄3 gulden of 18 1⁄2 carats in 1495—a depreciation of 34.36 per cent. In Spain the mark of silver was coined into 130 maravedis in the year 1312, and into 2210 maravedis in 1474. This latter case is, however, so inextricably complicated with considerations of mere, i.e. arbitrary, debasement, as to render it useless for any estimation of the natural appreciation of the metals. In England our earliest gold coin weighed 128 4⁄7 grains, and was tariffed at 6s. 8d. In 1489, 80 grains of gold were equivalent to the same, 6s. 8d.—a reduction of 37.94 per cent. Within the same period the weight of the silver penny sank from 22 to 12 troy grains, a reduction of 45.45 per cent. Eliminating cases of arbitrary debasement, a rough average for the period might fairly give 40 per cent. of depreciation through the two centuries.

The case need hardly be laboured statistically, for the legislative history of all the countries forming the circle of commercial Europe in the fourteenth and fifteenth centuries witnesses this general downward[Pg 16] movement—this appreciation and restriction of currency—in grim and unmistakable manner; and it is the expression of this general movement in their legislations that gives the test and measure of the earliest bimetallic troubles of Europe. In many ways the problem before the various Governments was a more difficult one than that which besets the modern world. There was, for instance, nothing like an equal and generally recognised ratio of value between gold and silver prevailing at any one single point of time. At one and the same date a ratio of 7 or 8 to 1 prevailed in the Moorish parts of Spain, and 12 to 1 in the Christian parts (the kingdom of Castile). Similarly, at a later period, in 1474, the ratio in England was 11.15, in Germany 11.12, and in France 11.00, in Italy 10.58, and in Spain 9.82.

The natural result of such a state of chaos, if it had been permitted to work itself out unhindered, would have been arbitrage transactions of such a nature—a flux and reflux of the European currencies so perpetual—as would have induced a yearly and universal bankruptcy. In spite of frantic efforts on the part of ruler after ruler, such results did partially come about, and they sufficiently account both for the distraction of Governments and the hatred universally visited upon the Jew in the Middle Ages. The measures which were adopted by the various States to counteract this invisible, insidious, and wasting process, partake of the roughness and unscientific character of the age. The export of gold[Pg 17] and silver was forbidden on pain of death; and it was no mere paper threat, for prominent London merchants were drawn and quartered for the offence. The rates of exchange of foreign coins were fixed by proclamation, and the office of exchanger limited to a particular place. When all this proved ineffectual, the coins were cried down, and violent and sudden changes in the ratio enacted. What made the jerk and friction of such a process worse was that such measures were not merely defensive, but intentionally offensive. The wish of the fourteenth and fifteenth century ruler was not merely to defend his own stock of precious metals from depletion, but—having gained the conviction of the insufficiency of the production of those metals for the needs of Europe—to attract to himself the stock of his neighbours by whatever craft. There was a general struggle for the coverlid of gold, and the methods of that struggle were almost barbaric in their rudeness, violence, craft, and dishonourableness.

On account of their knowledge and practice of the science of exchanges and finance, the metallic history of the Italian states is of chief importance for this earliest period. At a time when the northern nations show signs of an infancy of commerce merely, Italy was advanced in the art and practice of a most highly developed commercial and financial state. It is to her that we owe our system of book-keeping and[Pg 18] the use of bills of exchange, not to speak of the pawnbroking and funding systems; and it is permissible to conjecture that Italy, keeping her finger as she did on the monetary pulsations of Europe, reaped her harvest, and far the largest harvest, from the bimetallic fluctuations of the fourteenth and fifteenth centuries. In their turn those fluctuations acted on herself, and occasionally disastrously. On account of their pre-eminence as the commercial states of the peninsula, Florence and Venice are chosen to illustrate in brief the monetary history of Italy. The account of the general course of depreciation in both these states, and of the fluctuations of Mint rates is given in the Appendix (Nos. I. and II.). As regards the bimetallic influence of these changes of rates, there is one telling record in the history of Florence.

The second quarter of the fourteenth century witnessed a decided rise in the value of silver as against gold. It told immediately upon Florence, on account of her Mint rates. By the regulation of 1324 the ratio in Florence was 13.62, whereas in France the ratio was approximately 12.6, and twenty years later, 1344, hardly more than 11 in both France and England. The result on Florence was immediate, and silver disappeared from circulation. In 1345, says her historian, Villani, there was great scarcity. There was no silver money with the exception of the quattrini. It was all melted down and transported. Silver of the alloy of 11 1⁄2 oz. fine was worth in other parts out of Florence more than 12 lire a fiorino,[Pg 19] whence arose great discontent to the woollen merchants, who feared that the gold florin, in which they received their foreign payments, should fall too much. Being a powerful factor in the little state, they agitated, and the recoinage of 1345 was the result. The precedent evil and the remedy applied by this recoinage may be thus illustrated:—

By law—

| Fiorino d'oro | = 29 soldi. |

| 20 of these soldi | = la lira a fiorino. |

| Therefore 12 lire a fiorino (the price of the libbra of silver as above, purchased abroad) | = 8 fiorini 8 soldi. |

| = 26 lire 8 soldi di piccioli. | |

| One fiorino d'oro being then current for about 3 lire 2 soldi piccioli. | |

The silver species current in Florence in 1345 were quattrini and Guelfi del fiore. These coins were of the same standard as above (11 1⁄2 oz.), were coined at a tale of 167 to the libbra, and issued at an equivalence of 30 piccioli. The libbra of this silver, therefore, by Florentine Mint rate was valued at 20 lire 17 soldi 6 denari di piccioli. Abroad, therefore, the price of silver was a matter of slightly more than 5 lire higher than in Florence.

The same result could be got by taking the billon money of Florence and calculating from its silver contents.[Pg 20]

The natural result was a disappearance of silver. The only remedy was a recoinage, and this was applied by the law of 19th August 1345. By this law the standard of 11 1⁄2 oz. was retained, the tale of the Grossi was increased to 134 pieces to the libbra (132 being rendered to the merchant, and 2 retained for Mint expenses), and each piece issued at an equivalence of 4 soldi.

4 x 132 = 528 soldi.

(= 26 lire 8 soldi di piccioli.)

It will be seen at a glance that this equalised the internal and external price of silver.

Rather strangely this enactment of the 19th of August was followed by another no more than four days later (23rd August 1345), by which a slight reactionary change was made in favour of silver. The tale was decreased from 134 to 132 pieces, to be struck from the libbra of the same standard, and issuable at the same equivalence.

Slight as the backward change was, it was sufficient to leave the monetary system exposed to the same influence of differential exchanging, and within two months it had to be repealed by the law of October 1345. Under the name of Nuovi Guelfi a fresh coin was thereby instituted of the same standard and equivalence as above, but at a tale of 142 per libbra (140 being rendered back to the merchant, and 2 retained for expenses of coinage).

140 x 4 = 560 piccioli.

(= 28 lire di piccioli.)

[Pg 21]

This established a considerable advantage, and turned the flow of silver back again to Florence.

The process might in many respects be compared to our raising of the bank rate, were it not that the two operations represent quite different and separated financial epochs. It is noteworthy, too, because the process will be found immediately imitated in both France and England, that these laws of 1345 represent preponderatingly the sense of the class of exchangers of Florence,—i.e. the financiers professed,—men who would profit individually in their exchange operations as much as the state would in its restored currency of silver. "The above lords," says the preamble to the first-cited Act, "considering the numerous petitions made to them by many artificers, merchants, and honourable citizens, of the incredible lack of silver money in the state of Florence, on account of which the citizens of the said state suffer many inconveniences and wants, have determined to have and have had counsel of the twenty-one guilds of the city, who have [by a roundabout method] chosen eight men, skilled and prudent in the aforesaid, who have had counsel with the officers of our Mint and with certain others of the trade of exchangers," etc., with such result as above.

Yet even so, the effort was only temporarily successful. Before two years was out the price of silver abroad, outside of Florence, had advanced to 12 lire 15 soldi a fiorino = 27 lire 14 soldi di piccioli, whereas the price fixed by a fresh Mint law of 1345 had[Pg 22] been again reduced to under 26 lire 10 soldi di piccioli. The result was a second melting down and disappearance of the silver coins of the state, a second agitation on the part of the Florentine woollen merchants, and renewed legislation.

By the Mint regulation of 1347, a new-named money was introduced called Guelfi Grossi, coined at a tale of 117 to the libbra (111 3⁄5 being rendered cash to the merchants, and 5 2⁄5 retained by the Mint for the state), at the same standard as before (11 1⁄2 oz.), but at an equivalence of 5 instead of, as previously, 4 piccioli per piece.

117 x 5 = 585 piccioli.

(= 29 lire 5 soldi di piccioli);

a figure which is considerably above the 27 lire 14 soldi piccioli, which Villani gives as the price of foreign silver at the time. Even taking the lower tale of 111 3⁄5 pieces, which the importer of silver to the Mint got for his bullion, there is a distinct margin of profit.

111 3⁄5 = 558 piccioli.

(= 27 lire 18 soldi di piccioli.)

Indeed, in its entirety, this operation of 1347 has a sinister look. At home the woollen merchants of Florence were obliged to pay wages in silver, abroad to receive payment in gold. It was to their interest to cry down the equivalence of silver; they paid less and received more. The means by which they brought the state to put upon silver a price so far removed from the market price could only be the bribe[Pg 23] contained in the relinquishing of 5 2⁄3 pieces in each libbra. But such a process is in reality the beginning of debasement.

If this is not the true import of the Act of 1347, it testifies all the more to the only other possible motive—the monetary straits of Florence, her want of silver for currency, and the violent effort she was prepared to make to get it.

Whether by way of effect or cause it is hard to say, but certainly silver in the middle of the succeeding century had so far disappeared in the Italian peninsula, or gold so far increased during the fifteenth century, that the commercial ratio remained persistently low—1: 9.25, both in Milan and Florence; and the Mint regulations of 1460 adopted by the latter state (see under table of Florentine silver coins, Appendix), can only be looked upon as a simple repetition of the measures of 1345 and 1347.

The currency history of Spain up to the conquest of America is one long list of alterations in the coinage, and of petitions from merchants and various Cortes for or against changes in the rating of the coins. The oro gran modulo was rated at 100 pesetas, under Alfonso XI. of Castile, 1312-50, and at 1000 under his successor, Peter the Cruel, 1350-69. The oro dobla Castellana was rated at 60 pesetas under Henry II., 1369-74; at 40 under Henry the Crafty, 1390-1406; and at 100 under John II.,[Pg 24] 1406-54. In the case of this country the troubles in the fourteenth century arose from the proximity of France, the circulation of lower-rated French coins, and the consequent depletion of the treasure of the kingdom. In Aragon, for instance, the charter of Peter IV. in 1346 had ordered the coining of gold after the same weight and fineness as of the florin of Florence. It was found too high, and three years later he was obliged to cancel it by another proclamation, ordering his own gold coins to be made of the same weight and fineness as the écus of the French kings. The close of his reign and the early part of that of his successor witnessed acute crisis and distress, which led to Henry II.'s celebrated reduction of the coinage at the Cortes of Medina del Campo in 1371.

In 1391-93 another general proclamation was issued, ordering a reduction of the value of the monies and fixing new rules of exchange, and this was followed by one in 1398, prohibiting the circulation of foreign coins in Spain, except at bullion value. This latter was a common device, as will be seen in the case of our own country. It proved ineffectual to prevent the outflow of the metals, and when re-enacted in 1413 was found to be of as little avail. The Cortes of 1442 (Valladolid) complained bitterly, in a petition, of the money drawn away from the realm by foreign merchants, and in the same year a fresh ordinance was issued to readjust the values of the native monies to the foreign coins. In this schedule, doblas de la Banda[Pg 25] were rated at 100 maravedis, and the florin d'oro d'Aragon at 65 maravedis. In 1473, only thirty or so years later, by the charter of Henry IV., issued at Segovia, these coins were rated at 300 and 200 maravedis respectively. It was only with the advent of the Catholic sovereigns that the internal disorder and want of unity of the Spanish system was effectually remedied, in the very hour of that discovery of a new world which was to put upon Spain the vital function of distributing the new stores of precious metals (see account of Spanish monies, Appendix III.).

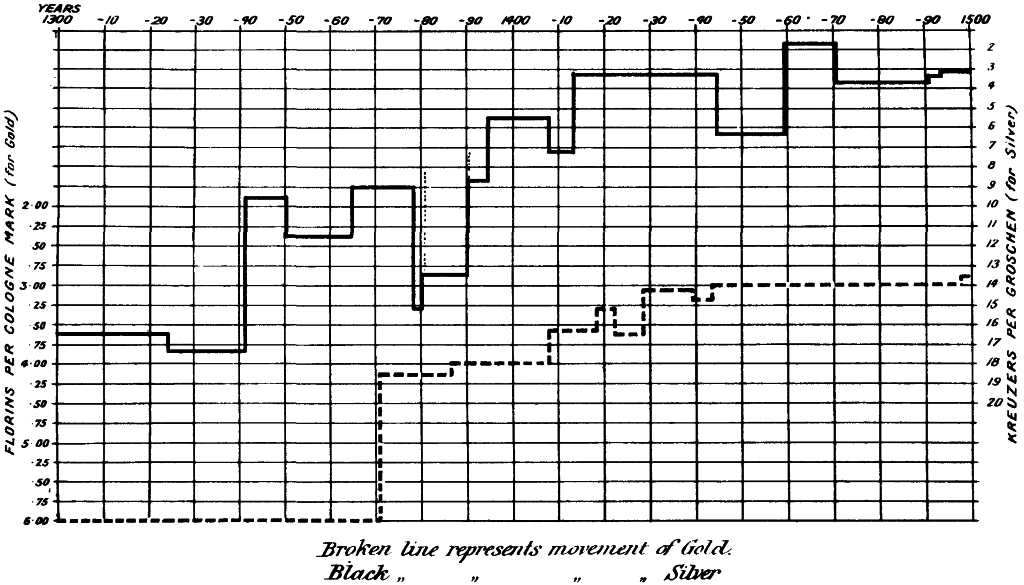

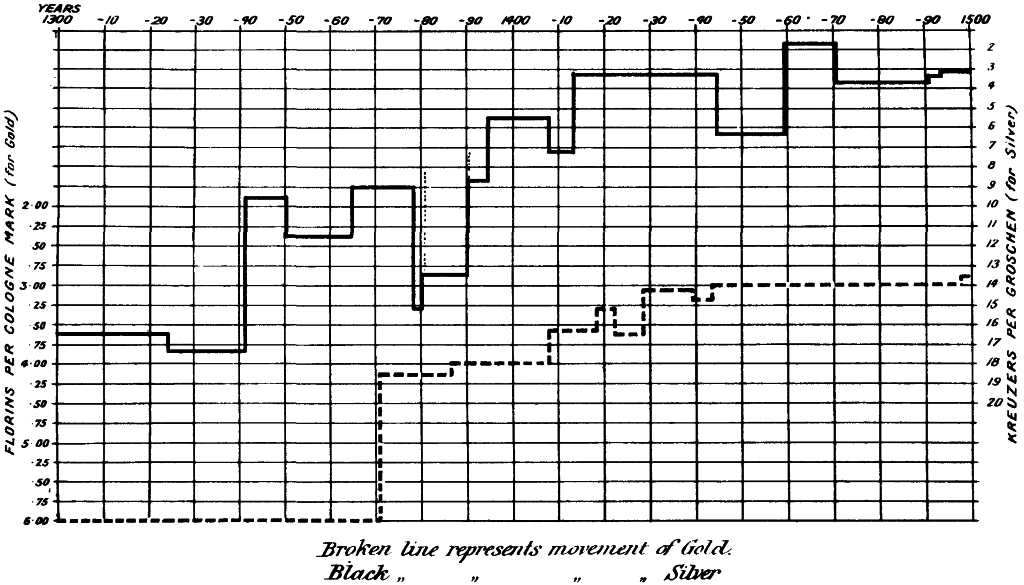

The movements of the precious metals in Germany—which, as far as the ratio of the two metals is concerned, may be held to include the Netherlands up to 1552, when Flanders withdrew from the monetary system of the Holy Roman Empire—is a record of exactly the same process of natural and gradual appreciation of the metal (i.e. depreciation of the weight and fineness of the coin) as in Spain, France, and England. In the accompanying tables the movement of silver is illustrated by means of the groschen, and that of gold by the Rhenish gulden. These coins, it need hardly be said, were not unit coins, nor sole prevailing. They are chosen from the bewildering variety with which the numerous independent Mints of Germany have succeeded in perplexing posterity, as being of relatively greater repute and wider acceptance, and[Pg 26] because it is a simply impossible task to combine all the denominations of these coins, in order to deduce an average.

Up to 1375 the German gold coin was minted in close imitation of the Florentine florin. The weight was 53 grs., as was that of the Florentine piece; and the lily and St. John, the guardian saint of Florence, were both employed in the two coins, the German piece being indeed issued at first under the denomination, Florin d'or.

From the above-named date, however, and onwards, each succeeding and various power altered type, weight, or alloy, with more or less arbitrariness, but always to the increasing of the confusion of the system as a whole. And it was to remedy this confusion, or to reduce it somewhat, that the monetary union of the four electoral princes of the Rhine was established (8th June 1386), under the lead of the three towns, Frankfort, Speyer, and Worms; under which the four princes, Frederick, Archbishop of Cologne, Carl, Archbishop of Treves, Adolf, Archbishop of Mainz, and Rupert, Count Palatine of the Rhine, agreed upon a common minting of gold gulden. According to the treaty, 66 such gulden were to be minted from the Cologne mark of gold, each of the alloy of 22 carats 6 grs. gold, and 1 carat 6 grs. silver. In 1402 this coinage was confirmed at Mainz by the Mint edict of Rupert II.[4]

Seven years later, 1409, the three spiritual electors, Frederick, Archbishop of Cologne, John, Archbishop of Mainz, and Werner, Archbishop of Treves, made a new and slightly different treaty, for the purpose of again reducing the alloy of the gulden from 22 1⁄2 to 22 carats.

At this rate the system was, in the same year, at Speyer, formally accepted for themselves by the Netherlands, and at Cologne also, in 1409, by the Empire generally.

The detailed and various changes which the independent princes and powers of Germany subsequently made, it is out of the question to follow. To instance only in brief. In 1419 Frederick of Brandenburg ordered the coining of gulden for his own states, at the rate of 64 1⁄2 to the Cologne mark, and of the fineness of 19 carats—a very considerable reduction in the metal value of the coin. In 1422, only three years later, Sigismund was coining gulden 66 1⁄2 to the mark and 22 carats 6 grs. fine—a value somewhat higher than that accepted for the empire in 1409. In 1428-29, accordingly, the Emperor Sigismund issued an imperial order, which was formally adopted by the Reichstag meeting at Eger (1437) and Nürnberg (1438), by which the Cologne mark was to be coined into 68 gulden and the fineness reduced to 19 carats. Four years later, 1442, the Emperor Frederick IV. projected a further reform and reduction, proposing to coin 72 pieces of 19 carats fine, but this was not carried into effect, probably as exaggerat[Pg 28]ing the average depreciation of the content of the coin (or appreciation of the metal). The rate, therefore, established by Sigismund practically remained in force for a matter of sixty years.

In the diet of 1495-97 (at Worms), however, a further slight reduction in weight and fineness took place, 69 1⁄3 pieces being struck out of the Cologne mark, and the fineness lowered to 18 carats 10 grs.

On the whole, therefore, the movement of gold during these two centuries is remarkably sluggish in Germany, putting aside, i.e., the internal variations between state and state; and remarkably corresponding to, and confirmatory of, that in England. And in all probability the mean of the quantities in the two countries would aptly measure the perfectly natural or normal appreciation of gold (depreciation of the content of fine metal in the current gold coin) throughout the period.

The movement of silver during the same two hundred years, 1300-1500, is much more excited, but shows an average or mean appreciation that tallies remarkably with that of gold just described, as also with that of silver in England. The various denominations of silver coins which arose in Germany, in those years, make it a work of extreme difficulty even to attempt averages. In the accompanying tables, therefore, the groschen is taken as most fairly averaging and widely current in the empire. In its first form, the Gros Tournois, struck at Tours, in France, this coin contained 55 1⁄10 parts of a[Pg 29] Cologne mark, and was of the fineness of 15 loth 6 grs. In 1296, when it was first adopted in Germany (in Bohemia, and Meissen), 63 1⁄2 pieces were struck from the mark, and the fineness had been reduced to 15 loth. Its subsequent variations, up to the time of the discovery of America, are detailed in the accompanying table and in Appendix No. V., the principal points in which are marked by the years 1341, 1378 (a notable attempt at reformation by Charles IV. and Wenceslaus), 1390, 1412, and 1444 (marking also an attempt at reformation by treaty between the Duke of Saxony and the Margrave of Meissen).[Pg 30]

| Date. | The Cologne Mark coined into | Of Alloy | Equivalent Value (as expressed in the 20-Florin Standard). | ||

|---|---|---|---|---|---|

| Pieces. | Loth. | Qr. | Kreutzers. | Pfennige. | |

| 1226 (Gros Tournois of France) | 55 1⁄10 | 5 | 6 | 21 | 0 216⁄551 |

| 1296 | 63 1⁄2 | 15 | 0 | 17 | 2 110⁄127 |

| 1309 | 63 1⁄2 | 14 | 0 | 16 | 2 18⁄127 |

| 1324 (Meissen) | 64 1⁄2 | 15 | 0 | 17 | 1 33⁄48 |

| 1341 | 78 | 10 | 0 | 9 | 2 6⁄13 |

| 1350 | 91 | 14 | 0 | 11 | 2 14⁄91 |

| 1364 | 74 1⁄2 | 9 | 0 | 9 | 0 36⁄149 |

| 1378 | 70 | 14 | 1 | 15 | 1 1⁄14 |

| 1380 | 72 | 13 | 0 | 13 | 2 1⁄6 |

| — (Meissen) | 91 | 11 | 0 | 9 | 0 24⁄91 |

| 1390 | 85 | 10 | 0 | 8 | 3 5⁄17 |

| — (Meissen) | 90 | 9 | 0 | 7 | 2 |

| 1407 | 72 40⁄131 | 8 | 0 | 8 | 1 57⁄296 |

| 1412 | 82 | 4 | 0 | 3 | 2 26⁄41 |

| 1444 | 88 | 7 | 13 | 6 | 2 43⁄132 |

| — | 160 | 16 | 0 | 7 | 2 |

| 1459 | 101 | 5 | 9 | 4 | 0 34⁄101 |

| 1470 | 100 20⁄307 | 5 | 0 | 3 | 2 507⁄512 |

| 1490 | 103 | 5 | 0 | 3 | 2 58⁄103 |

| Date. | Cologne Mark coined into | Alloy. | Equivalent Value (as expressed in the 20-Florin Standard). |

|||

|---|---|---|---|---|---|---|

| Pieces. | Carats. | Grains. | Florins. | Kreutzers. | Pfennige. | |

| 1252 (Florentine Florin). | 44 3⁄8 | 24 | 0 | 6 | 22 | 3 405⁄2911 |

| 1371 | 66 | 23 | 1 | 4 | 6 | 2 434⁄781 |

| 1386 | 66 | 22 | 6 | 4 | 1 | 1 85⁄781 |

| 1409 | 66 | 22 | 0 | 3 | 55 | 3 517⁄781 |

| 1419 | 64 1⁄2 | 19 | 0 | 3 | 28 | 1 2851⁄3053 |

| 1428 | 68 | 19 | 0 | 3 | 17 | 3 18⁄1207 |

| 1442 | 72 | 19 | 0 | 3 | 6 | 3 14⁄213 |

| 1477 | 69 1⁄3 | 18 | 10 | 3 | 3 | 2 3104⁄15194 |

In France during this same period the ratio of gold to silver was changed in a single century more than a hundred and fifty times, and with a roughness that is quite inconceivable to the modern mind. To take a period of ten years for example:—

| In | 1303 | the ratio was | 10.26 |

| " | 1305 | " | 15.90 |

| " | 1308 | " | 14.46 |

| " | 1310 | " | 15.64 |

| " | 1311 | " | 19.55 |

| " | 1313 | " | 14.37 |

France presents the utmost difficulty to the student of metallic money during this earliest period, by reason of these violent and arbitrary alterations of the coinage. The extreme diversity of the coins, and the perpetual changing of the composition or alloy, make it almost impossible to estimate the fluctuations in the value of money in relation to goods, or gold in relation to silver. Apart from the international struggle for the precious metals, France was torn and ruined by the English invasions, and debasement after debasement of the coinage was resorted to as a means of raising money to continue the struggle. Such debasements mark the reign of Philip le Bel, 1285-1314, and of each succeeding king, from his days to the final ejection of the English invaders, and after. A single instance will serve to show their nature. In 1342 the mark of gold, which in a normal time just preceding was valued at 41 livres 13 sols, was proclaimed equal to 117 livres, and in 1360 the mark of silver, valued normally at 5 livres, rose to 102 livres.[5] It stands to reason that such abnormal movements must be neglected in any attempt to determine the course of such fluctuations in value of the metals, and the ratio of gold and silver, as arose naturally from the metallic and currency history of the time. Eliminating, therefore, this element of forced and accidental debasements, due to political circumstance, the natural history, if it may[Pg 33] be so styled, of the French coinage displays the same tendency to an appreciation of money metal which marks the history of the other European countries.

| Date. | The Mark of Silver coined into | The Mark of Gold coined into | |||

|---|---|---|---|---|---|

| Livres (Tournois). |

Sols. | Livres (Tournois). |

Sols. | Deniers. | |

| 1309 (Philp le Bel.) | 2 | 19 | 44 | 0 | 0 |

| 1315 | 2 | 14 | 45 | 0 | 0 |

| 1343 | 3 | 4 | 43 | 6 | 8 |

| 1350 | 5 | 5 | 53 | 18 | 9 |

| 1361 | 5 | 0 | 60 | 0 | 0 |

| 1381 | 5 | 8 | 60 | 10 | 0 |

| 1422 | 7 | 0 | 76 | 5 | 0 |

| 1427 | 8 | 0 | 72 | 0 | 0 |

| 1429 | 7 | 0 | 77 | 10 | 0 |

| 1446 | 7 | 10 | 88 | 2 | 6 |

| 1456 | 8 | 10 | 100 | 0 | 0 |

| 1473 | 10 | 0 | 110 | 0 | 0 |

| 1475 | 10 | 0 | 118 | 10 | 0 |

In this table each of the points or dates taken marks a period of return to good money after a period of debasement, and in the mind of the legislator such return to good money (monnaie forte) can only be construed as based on an estimated general or normal rate of monetary values, for each particular succeeding point of time. At[Pg 34] every return to good money a proclamation was issued, expressing the determination of the administration to adhere to good money, as in the halcyon days of St. Louis, etc. etc., and fixing the rate at which the monies should be coined and current. By taking these points or dates of return to good money, therefore, we eliminate the arbitrary action of the Government in periods of debasement, and arrive at a net result showing the natural movement of the metals.