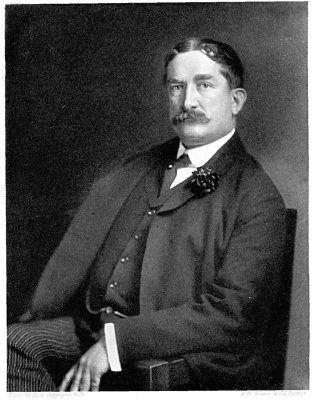

thomas w. lawson after twelve months of "frenzied

finance"

thomas w. lawson after twelve months of "frenzied

finance"

The Project Gutenberg EBook of Frenzied Finance, by Thomas W. Lawson

This eBook is for the use of anyone anywhere at no cost and with

almost no restrictions whatsoever. You may copy it, give it away or

re-use it under the terms of the Project Gutenberg License included

with this eBook or online at www.gutenberg.org

Title: Frenzied Finance

Vol. 1: The Crime of Amalgamated

Author: Thomas W. Lawson

Release Date: August 16, 2008 [EBook #26330]

Language: English

Character set encoding: ISO-8859-1

*** START OF THIS PROJECT GUTENBERG EBOOK FRENZIED FINANCE ***

Produced by Barbara Tozier and the Online Distributed

Proofreading Team at http://www.pgdp.net

Obvious typographical errors have been corrected in this text. For a complete list, please see the bottom of this document.

NEW YORK

THE RIDGWAY-THAYER COMPANY

1905

Copyright, 1905, by

THE RIDGWAY-THAYER COMPANY

These articles are reprinted from "Everybody's Magazine"

Copyright, 1904, by the Ridgway-Thayer Company

Copyright, 1905, by the Ridgway-Thayer Company

All rights reserved

TROW DIRECTORY

PRINTING AND BOOKBINDING COMPANY

NEW YORK

To Penitence: that those whose deviltry is exposed within its pages may see in a true light the wrongs they have wrought—and repent.

To Punishment: that the unpenalized crimes of which it is the chronicle may appear in such hideousness to the world as forever to disgrace their perpetrators.

To Penitence: that the transgressors, learning the error of their ways, may reform.

To Punishment: that the sins of the century crying to heaven for vengeance may on earth be visited with condemnation stern enough to halt greed at the kill.

To Punishment: that public indignation may be so aroused against the practices of high finance that it shall come to be as culpable to graft and cozen within the law as it is lawless to-day to counterfeit and steal.

To Penitence: that in the minds of all who read this eventful history there may grow up a knowledge and a conviction that the gaining of vast wealth is not worth the sacrifice of manhood, and that poverty and abstinence with honor are better worth having than millions and luxury at the cost of candor and rectitude.

Before you enter the confines of "Frenzied Finance," here spread out—for your inspection, at least; enlightenment, perhaps—halt one brief moment. If the men and things to be encountered within are real—did live or live now—you must deal with them one way. If these embodiments are but figments of my mind and pen, you must regard them from a different view-point. Therefore, before turning the page, it behooves you to find for yourself an answer to the grave question:

Is it the truth that is dealt with here? In weighing the evidence remember:

My profession is business. My writing is an incident. "Frenzied Finance" was set down during the twenty-fifth and twenty-sixth hours of busy days. I pass it up as the history of affairs of which I was a part. The men who move within the book's pages are still on the turf. A period of twelve years is covered. So far, eighteen instalments, in all some 400,000 words, have been published. The spigot is still running. I have written from memory, necessarily. While it is true that fiction is expressed in the same forms and phrases as truth, no man ever lived who could shape 400,000 words into the kinds of pictures I have painted and pass them off for aught but what they were. The character of my palette made it mechanically impossible to shade or temper the pigments, for the story was written in instalments, and circumstances were such that often one month's issue was out to the public before the next instalment was on paper. Considering all this, the consistency of the chronicle as it stands is the best evidence of its truth. In submitting it to my readers I desire to reiterate:

It is truth—of the kind that carries its own bell and[vi] candle. Within the narrative itself are the reagents required to test and prove its genuineness. Were man endowed with the propensity of a Münchhausen, the cunning of a Machiavelli, the imagination of Scheherezade, the ability of a Shakespeare, and the hellishness of his Satanic Majesty, he could not play upon 400,000 words, or one-quarter that number, and make the play peal truth for a single hour to the audience who will read this book, or to one-thousandth part the audience that has already read it in Everybody's Magazine.

Such as the story is, it is before you. If in its perusal you fathom my intentions, my hopes, my desires, I shall have been repaid for the pain its writing has brought me. At least you will find the history of a colossal business affair involving millions of dollars and manned by the financial leaders of the moment. It is a fair representation of financial methods and commercial morals as they exist in America at the beginning of the twentieth century. As a contemporary document the narrative should have value; as history it is not, I believe, without interest. As a message it has had its influence. Indeed, it is not an exaggeration to say that no man in his own generation has seen such a crop come forth from seed of his own sowing since the long bygone days when the wandering king planted dragons' teeth on the Phœnician plain and raised up an army of warriors.

There will be set down in this book, in as simple and direct a fashion as I can write it, the story of Amalgamated Copper and of the "System" of which it is the most flagrant example. This "System" is a process or a device for the incubation of wealth from the people's savings in the banks, trust, and insurance companies, and the public funds. Through its workings during the last twenty years there has grown up in this country a set of colossal corporations in which unmeasured success and continued immunity from punishment have bred an insolent disregard of law, of common morality, and of public and private right, together with a grim determination to hold on to, at all hazards, the great possessions they have gulped or captured. It is the same "System" which has taken from the millions of our people billions of dollars, and given them over to a score or two of men with power to use and enjoy them as absolutely as though these billions had been earned dollar by dollar by the labor of their bodies and minds. Yet in telling the story of Amalgamated, the most brazen and voracious maw of this "System," I desire it understood that I take no issue with men; it is with a principle I am concerned. With the men I have had close and intimate intercourse, and from my knowledge of the means they have used, and the manner in which they have used them, and the causes and effects of their performances, I have no hesitation in stating that the good they have done, the evils they have created, and the indelible imprints they have made on mankind are the products of a condition and not of their individualities, and that if not one of them had ever been born the same good and evil would to-day exist. Others would have done what they did, and would have to answer for what has been done, as[viii] they must. So I say the men are merely individuals; the "System" is the thing at fault, and it is the "System" that must be rectified. Better far for me not to tell the story I am going to tell; better far for the victims of Amalgamated not to know who plundered them and how, than to have them know it only to wreak vengeance on individuals and overlook the "System," which, if allowed to continue, surely will in time, a short time, destroy the nation by precipitating fratricidal war.

The enormous losses, millions upon millions—to my personal knowledge over a hundred millions of dollars—which were made because of Amalgamated; the large number of suicides—to my personal knowledge over thirty—which were directly caused by Amalgamated; the large number of previously reputable citizens who were made prison convicts—to my personal knowledge over twenty—directly because of Amalgamated, were caused by acts of this "System" of which Henry H. Rogers and his immediate associates were the direct administrators; and yet Mr. Rogers and his immediate associates, while these great wrongs were occurring, led social lives which, measured by the most rigid yardstick of mental or moral rectitude, were as near perfect as it is possible for human lives to be. As husbands, fathers, brothers, sons, friends, they were ideal, cleanly of body and of mind, with heads filled with sentiment and hearts filled with sympathies; their personal lives were like their homes and their gardens—revealing only the brightest things of this world, the singing, humming, sweet-smelling things which so strongly speak to us of the other world we are yet to know. As workers in the world's vineyards, they labored six days and rested upon the Sabbath, and gave thanks to Him from whom all blessings flow that He allowed them, His humble creatures, to have their earthly being. And yet these men, to whose eyes I have seen come the tears for others' sufferings, and whose voices I have heard grow husky in recounting the woes of their less fortunate brothers—these men under the spell of the brutal code of modern dollar-making are converted into beasts of prey, and put to shame the denizens of the deep which devour their kind that they may live.[ix]

In the harness of the "System" these men knew no Sabbath, no Him; they had no time to offer thanks, no care for earthly or celestial being; from their eyes no human power could squeeze a tear, no suffering wring a pang from their hearts. They were immune to every feeling known to God or man. They knew only dollars. Their relatives of a moment since, their friends of yesterday and long, long ago, they regarded only as lumps of matter with which to feed the whirring, grinding, gnashing mill which poured forth into their bins—dollars.

In telling the story of Amalgamated I hope to have profited by my long and intimate study of this cruel, tigerishly cruel "System," so as to be able to deaden myself to all those human sympathies which I have heard its votaries so many times subordinate to "It's business." I shall try only to keep before me how the Indians of the forest, as our forefathers drove them farther and farther into the unknown West, got bitter consolation out of the oft-chanted precept of their white brethren of civilization, "An eye for an eye, a tooth for a tooth," reminding myself that whatever of misery or unhappiness my story may bring to the few, it will be as nothing to that which they have brought to the many.

In asking for the serious, earnest consideration of the public, I shall be honest in giving to it my qualifications, my motives, and my desires for writing this narrative. For thirty-four years I have been actively connected with matters financial. As banker, broker, and corporation man, I have, from the vantage-point of one who actually handled the things he studied, studied the causes which created the conditions which made possible the "System" which produced the Amalgamated affair. In my thirty-four years of business experience I have seen the great fortunes, which are the motive power of the "System" referred to, come out of the far West as specks upon the financial horizon and grow and grow as they travelled Eastward, until in their length, breadth, and thickness they obscured the rising sun. At short range I have seen the giant money machine put together; I have touched elbows with the men who made it, as they fitted this wheel and adjusted that gear, while at the same time I broke[x] bread and slept with the every-day people who, with the industry of the ant and the patience of the spider, toiled to pile in the pennies, the nickels, and the dimes which have kept the "System's" hopper full.

At my first meeting with the creators of Amalgamated it was clearly and distinctly understood that under no circumstances would I enlist in that "System's" interests other than for such special services as, after due thought and investigation, I should decide to be such as I could in fairness to myself and my clients work for; and when I give the details of this first meeting in my narrative it will be evident to its readers that in telling the story of Amalgamated I am violating no confidence, nor in any way encroaching upon the niceties of that business code which is, and should be, the foundation of all legitimate financial dealings, nor in any way misusing knowledge which, if acquired under other circumstances, might be sacred.

Amalgamated was one service the "System" asked of me. It was created because of my work. It was largely because of my efforts that its foundation was successfully laid. It was very largely because of what I stood for and because of the public's confidence in the fulfilment of the promises I made that the public invested its savings to an extent of over $200,000,000; and it was almost wholly because of the broken promises and trickery of the creators of the "System" that the public lost the enormous sums it did.

My motives for writing the story of Amalgamated are manifold: I have unwittingly been made the instrument by which thousands upon thousands of investors in America and Europe have been plundered. I wish them to know my position as to the past that they may acquit me of intentional wrong-doing; as to the present that they may know that I am using all my powers to right the wrongs that have been committed, and as to the future that they may see how I propose to compel restitution.

My desire in writing the story of Amalgamated, while tinged perhaps with hatred for and revenge against the "System" as a whole and some of its votaries, is more truly pervaded with a strong conviction that the most effective way[xi] to educate the public to realize the evils of which such affairs as the Amalgamated are the direct result, is to expose before it the brutal facts as to the conception, birth, and nursery-breeding of this the foremost of all the unsavory offspring of the "System." Thus it may learn that it is within its power to destroy the brood already in existence and render impossible similar creations.

In the course of my task I shall describe such parts of the general financial structure as will place my readers, especially those unfamiliar with its more complicated conditions, in a mental state to comprehend the methods by which the savings they think are safely guarded in the banks, trust and insurance companies, are so manipulated by the votaries of frenzied finance as to be in constant jeopardy. I shall show them that while the press, the books, the stump, and our halls of statesmanship are full to overflowing with the whys, wherefores, and what-nots of "tariff," "currency," "silver," "gold," and "labor"; while our market systems are perfected educational machines for disseminating accurate statistics about the necessaries and luxuries of life, the water and land carriers, real estate, and other material things which the people have been taught to believe are the only things that vitally affect their savings; that while they imagine they understand the system by which speculation and investments are controlled and worked, and that the causes and effects of this system are at all times get-at-able by them through their bankers and their brokers; there is a tangible, complicated, yet simple trick of financial legerdemain, operated twenty-four hours in each day in the year, and which the press, the books, the politicians, and the statesmen never touch upon—a trick by means of which the savings of the people and the public funds of the Government, whether in the national banks, savings-banks, trust or insurance companies, are always at the absolute service and mercy of the votaries of frenzied finance.

Therefore, in the course of my story of Amalgamated will come a few kindergarten pictures of how the necessaries and luxuries of the people are "incorporated"; of how the evidences of corporation ownership are manufactured; of the[xii] individuals who "manufacture" them; of the individuals who control and make or unmake their values; of the meeting-place of these individuals, within and without the stock-exchanges; of some of the corporations and of some of the signs and tokens of corporation ownership; of some of their histories; of some of their doings, and of some of their contemplated doings. These kindergarten pictures I will endeavor to paint, not in that "over-the-head" verbosity or "under-the-feet" profundity and intricacy of the political economy pedant, which are as the canvases of the Whistler school to the masses; but rather will I use the brush of the artisan who in giving us our white fences, our gray cottages, and our green blinds sets off those things which make up the pictures the people really understand and dearly prize.

In the last few years the public has heard many stories of this Juggernaut "System," which has grown to be the greatest private power in our land—greater almost than the power which governs the nation, because it is not only great within itself but by its peculiar workings is really a part of the power which governs the people. Particularly has it been told the story of Standard Oil by Mr. Henry D. Lloyd in his able work, "Wealth Against Commonwealth," and by Miss Ida M. Tarbell in her recent historical sketches; but however thorough these writers may have been in gathering the facts, statistics, and evidences, however relentless their pens and vivid their pictures, they dealt but with things that are dead; things that to the present generation are but skeletons whose dry and whitened bones cannot possibly bring to the hearts, minds, and souls of the men and women of to-day that all-consuming passion for revenge, that burning desire for justice, without which no movement to benefit the people can be made successful.

In telling my story I shall, for I must, tell it fairly, and to make sure of this I pledge myself to keep to the exact facts as they occurred, not allowing myself to be overawed by their greatness into contracting them, nor to be tempted by their littleness into expanding them. In doing this I know, because of the peculiarity of the subject and my intimate relation to it, no other way than to do it in the first[xiii] person. As I have already stated, I would prefer to deal with my subject through the principles involved rather than with the men concerned; but as I shall be compelled to call spades spades, I must, of necessity, use the names of men and of institutions fearlessly and without favor.

In the beginning it will be necessary, for that clear understanding of the whole subject which is one of my principal objects, to treat at sufficient length the Bay State Gas intricacies and trickeries, in which in a certain sense Amalgamated had its being. This will compel me to devote a chapter to one of the most picturesquely notorious characters of the age, John Edward O'Sullivan Addicks, of Delaware, Everywhere, and Nowhere.

The main part of my narrative must of necessity deal with the two real heads of Standard Oil and Amalgamated, Mr. Henry H. Rogers and Mr. William Rockefeller; and with the biggest financial institution of America, if not of the world, the National City Bank of New York, and its head and dominating spirit, Mr. James Stillman.

An important chapter should be that devoted to the conception and formation of the United Metals Selling Company, which was specially organized to control the copper industry of the world without coming within the restrictions of the laws for the prevention or regulation of monopolies.

I shall also deal at length with a notorious character, who, like the spot upon the sun, looms up in all American copper affairs whenever they appear in the full vision of the public eye—Mr. F. Augustus Heinze, of Montana.

There will be a chapter of more or less length devoted to one of the most important episodes in Amalgamated affairs, wherein I shall describe one of Wall Street's most picturesque, able, and intensely interesting men, Mr. James R. Keene.

I shall touch on a bit of the nation's history in which within a few days of the national election of 1896 a hurry-up call for additional funds to the extent of $5,000,000 was so promptly met as to overturn the people in five States and thereby preserve the destinies of the Republican party, of which I am and have always been a member.[xiv]

I shall draw a picture of two dress-suit cases of money being slipped across the table at the foot of a judge's bench in the court-room, from its custodian to its new owners, upon the rendering of a court decision; and I shall show how the new owners frustrated a plot having for its object their waylaying and the recovery of the bags of money.

I shall devote some space to pointing out the evils and dangers of the latter-day methods of corrupting law-makers, and show how one entire Massachusetts Legislature, with the exception of a few members, was dealt with as openly as the fishmongers procure their stock-in-trade upon the wharves; how upon the last day of the Legislature, because their deferred cash payments were not promptly forthcoming, its members turned, and made necessary the hurried departure for foreign shores of a great lawyer and his secretary, with bags of quickly gathered gold, and all evidences of the crimes committed and attempted; how after the ship arrived at an island in foreign seas the great lawyer's dead body received hurried burial, and his secretary's was later dropped, with weights about its feet, to the ocean's depths; and how ever since the natives whisper among themselves their gruesome suspicions.

I shall devote a chapter to the doings of certain financial reputation sandbaggers and blackmailers; show how through their agencies they hold up corporations and their managers for large sums, which upon being paid start into motion a perfected system for the false moulding of public opinion for the purpose of making more easy the plundering of the people. I shall photograph the men and draw accurate diagrams of the machinery through which their nefarious trade is carried on.

My story will carry me down Wall Street, into the Stock Exchange, through its hundred and one or million and one open and hidden passages, and into State Street, that ever-hung hammock of financial somnolence, and into the courts of justice of New York, New Jersey, Pennsylvania, Delaware, Massachusetts, and Montana, and into many other interesting abodes of justice and injustice, of trickery, fraud, and simple, honest trustfulness.[xv]

When my story is ended and the great American people, whose simple but proud boast is that they cannot be fooled in the same place by the same methods and the same instruments twice, know as much as I now know of Amalgamated and its relation to the "System" which has for years as boldly, as coarsely, and as cruelly robbed them as the coolie slaves are robbed by their masters—it will be for them to decide whether my story has been, because of the facts which entered into it, so well told that they will not be satisfied with the restitution of the vast sums which the Amalgamated took from them, which United States Steel took from them, and which other financial enterprises took in lesser amounts but by equally flagrant methods; but will demand the overthrow of the "System" itself. It will be for them to decide; and if their decision should be for a conclusive revolt, I shall be amply repaid for the pains and the miseries which must necessarily follow in the wake of a task such as the one I undertook when I decided to tell the story of Amalgamated.

| page | ||

| Foreword | vii | |

| PART I | ||

| CHAPTER | ||

| I. | The Tortuous Course of Amalgamated | 1 |

| II. | The "System's" Method of Finance and Management | 5 |

| III. | The Men in Power Behind the "System" | 13 |

| IV. | My Own Responsibility | 23 |

| V. | The Power of Dollars | 33 |

| VI. | Construction of "Standard Oil's" "Dollar-Making" Mill | 41 |

| VII. | Juggling with Millions of the People's Money | 52 |

| VIII. | "Standard Oil" Invests "Made Dollars" in Gas | 56 |

| IX. | A Votary of the "System" | 60 |

| X. | Addicks Comes to Boston | 67 |

| XI. | How Addicks Captured Boston Gas | 71 |

| XII. | Stock-Brokers not all Bad | 79 |

| XIII. | The "System" versus Westinghouse | 88 |

| XIV. | The Alliance with Addicks | 93 |

| XV. | The Great Bay State Gas Fight | 103 |

| XVI. | Peace Negotiations with Rogers | 110 |

| XVII. | A Memorable Conference | 113[xviii] |

| XVIII. | The Duplicity of Addicks | 125 |

| XIX. | Enter H. M. Whitney | 133 |

| XX. | An Awkward Attack of Appendicitis | 142 |

| XXI. | Bribing a Legislature | 149 |

| XXII. | Plundered of the Plunder | 162 |

| XXIII. | Two Gentlemen of Frenzied Finance | 170 |

| XXIV. | Buying a Bunch of States | 176 |

| XXV. | Athletics of Finance | 182 |

| XXVI. | The Circling of the Vultures | 187 |

| XXVII. | Court Corruption and Coin | 191 |

| XXVIII. | Peace at Last | 195 |

| PART II | ||

| I. | The Magic World of Finance | 197 |

| II. | The "System" and the Louisiana Lottery Compared | 202 |

| III. | The Fundamentals of Finance | 208 |

| IV. | The Magic "Jimmy" | 213 |

| V. | How the "System" does Business | 217 |

| VI. | How Wall Street's Manipulations Affect the Country | 223 |

| VII. | Economics of Copper | 226 |

| VIII. | My plan for "Coppers" | 233 |

| IX. | Birth of "Coppers" | 237 |

| X. | Rogers Grasps "Coppers" | 245 |

| XI. | The Copper Campaign Opens | 253 |

| XII. | The Buncoing of the Stockholders of Utah | 261 |

| XIII. | The Trap in Finance | 266 |

| XIV. | Lawyer Untermyer Discovers the "Nigger" | 274[xix] |

| XV. | Degrees in Crime | 281 |

| XVI. | Mr. Rogers Unmasks | 283 |

| XVII. | "Extract Every Dollar" | 289 |

| XVIII. | The Biters Bit | 301 |

| XIX. | The Despoiling of Leonard Lewisohn | 307 |

| XX. | The Christening of Amalgamated | 311 |

| XXI. | Fixing the Responsibility | 320 |

| XXII. | The Responsibility Fastened | 332 |

| XXIII. | The First Crime of Amalgamated | 340 |

| XXIV. | The Subscription Opens | 346 |

| XXV. | Dollar Hydrophobia | 351 |

| XXVI. | Deviltry Afoot | 359 |

| XXVII. | The Black Flag Hoisted | 364 |

| XXVIII. | The Bogus Subscription | 370 |

| XXIX. | The Aftermath | 376 |

| XXX. | The Morning After | 385 |

| XXXI. | I Walk the Plank | 389 |

| XXXII. | Perfecting the Double Cross | 397 |

| XXXIII. | A Retrospect and a Moral | 405 |

| LAWSON AND HIS CRITICS | ||

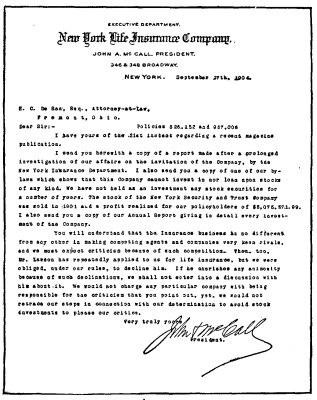

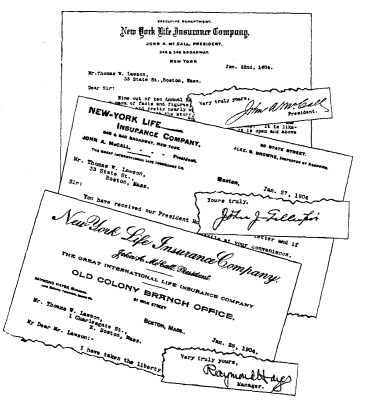

| I. | The Insurance Controversy | 413 |

| II. | The Enemies I Have Made | 487 |

| III. | Explanations | 539 |

Amalgamated Copper was begotten in 1898, born in 1899, and in the first five years of its existence plundered the public to the extent of over one hundred millions of dollars.

It was a creature of that incubator of trust and corporation frauds, the State of New Jersey, and was organized ostensibly to mine, manufacture, buy, sell, and deal in copper, one of the staples, the necessities, of civilization.

It is a corporation with $155,000,000 capital, 1,550,000 shares of the par value of $100 each.

Its entire stock was sold to the public at an average of $115 per share ($100 to $130), and in 1903 the price had declined to $33 per share.

From its inception it was known as a "Standard Oil" creature, because its birthplace was the National City Bank of New York (the "Standard Oil" bank), and its parents the leading "Standard Oil" lights, Henry H. Rogers, William Rockefeller, and James Stillman.

It has from its birth to present writing been responsible for more hell than any other trust or financial thing since the world began. Because of it the people have sustained incalculable losses and have suffered untold miseries.[2]

But for the existence of the National City Bank of New York, the tremendous losses and necessarily corresponding profits could not have been made.

I laid out the plans upon which Amalgamated was constructed, and, had they been followed, there would have been reared a great financial edifice, immensely profitable, permanently prosperous, one of the world's big institutions.

The conditions of which Amalgamated was the consequence had their birth in Bay State Gas. To explain them I must go back a few years.

In 1894 J. Edward Addicks, of Delaware, Everywhere, and Nowhere, the Boston Gas King, invaded the gas preserves of the "Standard Oil" in Brooklyn, N. Y., and the "Standard Oil," to compel him to withdraw, moved on his pre-empted gas domains in Boston, Mass.

Late in 1894 a fierce battle was raging in Boston between Gas King Addicks and Gas King Rogers; the very air was filled with denunciation and defiance—bribery and municipal corruption; and King Addicks was defeated all along the line and in full retreat, with his ammunition down to the last few rounds.

Early in 1895 I took command of the Addicks forces against "Standard Oil."

By the middle of 1895 the Addicks troopers had the "Standard Oil" invaders "on the run."

In August, 1895, Henry H. Rogers and myself came together for the first time, at his house in New York, and we practically settled the Boston gas war.

Early in 1896 we actually settled the gas war, and "Standard Oil" transferred all its Boston gas properties ($6,000,000) to the Addicks crowd.

In October, 1896, the whole Bay State Gas outfit passed from the control of Addicks and his cohorts into the hands of a receiver, and as a result of this receivership, with its accumulated complications, "Standard Oil," in November, 1896, regained all its old Boston companies, and in addition all the Addicks companies, with the exception of the Bay State Gas Company of Delaware.

In 1896 I perfected and formulated the plans for "Cop[3]pers," a broad and comprehensive project, having for its basis the buying and consolidating of all the best-producing copper properties in Europe and America, and the educating of the world up to their great merits as safe and profitable investments.

In 1897 I laid these plans before "Standard Oil."

In 1898 "Standard Oil" was so far educated up to my plans on "Coppers" as to accept them.

In 1899 Amalgamated, intended to be the second or third section of "Coppers," was suddenly shifted by "Standard Oil" into the first section, and with a full head of steam ran out of the "City Bank" station, carrying the largest and best train-load of passengers ever sent to destruction on any financial trunk-line.

In 1899, after the allotment of the Amalgamated public subscription, the public for the first time, in a dazed and benumbed way, realized it had been "taken in" on this subscription, and a shiver went down America's financial spinal column.

In 1900, after the price of Amalgamated had slumped to 75 instead of advancing to 150, to 200, as had been promised, the "Standard Oil"-Amalgamated-City Bank fraternity called Wall Street's king of manipulators, James R. Keene, to the rescue, and under his adroit handling of the stock in the market Amalgamated was sent soaring over its flotation price of 100.

In 1901 Boston & Montana and Butte & Boston, after long delay, drew out of the "Standard Oil" station as the second section of Amalgamated, carrying an immense load of investors and speculators to what was at that time confidently believed would be Dollar Utopia; and the price of the enlarged Amalgamated fairly flew to 130. These were the stocks which I had originally advertised would be part of the first section of the consolidated "Coppers," and which, after Amalgamated had been run in ahead of them, I advertised would follow in due course.

In the latter part of 1901 President McKinley was assassinated, and the great panic which might have ensued was averted by the marvellous power of J. Pierpont Morgan.[4]

Then the Amalgamated dividend, without warning and in open defiance of the absolute pledges of its creators, was cut, and the public, including even James R. Keene, found itself on that wild toboggan whirl which landed it battered and sore, at the foot of a financial precipice.

This, briefly, is the tortuous course of Amalgamated, and it is along this twisting, winding, up-alley-and-down-lane way I must ask my readers to travel if they would know the story as it is.

At the lower end of the greatest thoroughfare in the greatest city of the New World is a huge structure of plain gray-stone. Solid as a prison, towering as a steeple, its cold and forbidding façade seems to rebuke the heedless levity of the passing crowd, and frown on the frivolity of the stray sunbeams which in the late afternoon play around its impassive cornices. Men point to its stern portals, glance quickly up at the rows of unwinking windows, nudge each other, and hurry onward, as the Spaniards used to do when going by the offices of the Inquisition. The building is No. 26 Broadway.

26 Broadway, New York City, is the home of the Standard Oil. Its countless miles of railroads may zigzag in and out of every State and city in America, and its never-ending twistings of snaky pipe-lines burrow into all parts of the North American continent which are lubricated by nature; its mines may be in the West, its manufactories in the East, its colleges in the South, and its churches in the North; its head-quarters may be in the centre of the universe and its branches on every shore washed by the ocean; its untold millions may levy tribute wherever the voice of man is heard, but its home is the tall stone building in old New York, which under the name "26 Broadway" has become almost as well known wherever dollars are juggled as is "Standard Oil."

Wall Street and the financial world know that there are two "Standard Oils," but to the public there is no clear distinction between Standard Oil, the corporation which deals in oil and things which pertain to the manufacture and transportation of oil, and "Standard Oil," the giant,[6] indefinite system which sometimes embraces all the "Standard Oil" group of individuals and corporations, and sometimes only certain of the individuals.

This giant creature, "Standard Oil," can best be described so that the average man may understand it as a group of money-owners—some individuals and some corporations—who have a right to use the name "Standard Oil" in any business undertakings they engage in. The right to use the name is of priceless value, for it carries with it "assured success."

Standard Oil, the seller of oil to the people, transacts its business as does any other corporation. It plays no part in my story and I shall not hereafter touch upon its affairs, but confine my meaning, wherever I use the name "Standard Oil," to the larger and many times more important "System."

There are only three men who can lend the name "Standard Oil," even in the most remote way to any project, for there is no more heinous crime against the "Standard Oil" decalogue than using the name "Standard Oil" unauthorizedly. The three men are Henry H. Rogers, William Rockefeller, and John D. Rockefeller. Sometimes John D. Rockefeller uses the name alone in projects in which Henry H. Rogers and William Rockefeller have no interests. Henry H. Rogers or William Rockefeller seldom, if ever, uses the name in projects with which neither of the other two is associated. Sometimes, but not often, John D. and William Rockefeller use the name in connection with projects of their own in which Henry H. Rogers has no interest. Henry H. Rogers and John D. Rockefeller, I believe, never are associated in projects in which William Rockefeller has no interest. Henry H. Rogers and William Rockefeller frequently bring to bear the influence of the magic-working syllables in connection with joint affairs in which John D. Rockefeller has no interest—in fact, during the past ten years the name "Standard Oil" has been used more in their combined undertakings than in all others put together.

There are eight distinct groups of individuals and corporations which go to make up the big "Standard Oil":[7]

1st. The Standard Oil, seller of oil to the people, which is made up of many sub-corporations either by actual ownership or by ownership of their stock or bonds. Probably no person other than Henry H. Rogers, William Rockefeller, and John D. Rockefeller knows exactly what the assets of the Standard Oil corporation are, although John D. Rockefeller, Jr., son of John D. Rockefeller, and William G. Rockefeller, that able and excellent business man, son of William Rockefeller and the probable future head of "Standard Oil," are being rapidly educated in this great secret. In this first institution all "Standard Oil" individuals and estates are direct owners.

2d. Henry H. Rogers, William Rockefeller, and John D. Rockefeller, active heads, and included with them their sons.

3d. A large group of active captains and first lieutenants, men who conduct the affairs of the different corporations or sections of corporations in which some or all of the "Standard Oil" are interested. Many of these are the sons or the second generation of men who held like positions in Standard Oil's earlier days. Of these Daniel O'Day and Charles Pratt are fair examples.

4th. A large group of captains retired from active service in the Standard Oil army, who participate only in a general way in the management of its affairs, and whose principal business is looking after their own investments. These men are each worth from $5,000,000 or $10,000,000 to $50,000,000 or $75,000,000. The Paynes and the Flaglers are fair illustrations of this group.

5th. The estates of deceased members of this wonderful "Standard Oil" family, which are still largely controlled by some or all of the prominent "Standard Oil" men.

6th. "Standard Oil" banks and banking institutions, and the system of national banks, trust companies, and insurance companies, of which "Standard Oil" has, by ownership and otherwise, practically absolute control. The head of this group is James Stillman, and it is when these institutions are called into play in connection with "Standard Oil" business that he is one of the "Standard Oil" leaders, second to neither of the Rockefellers nor to Mr. Rogers.[8]

7th. The "Standard Oil" army of followers, capitalists, and workers in all parts of the world, men who require nothing more than the order, "Go ahead," "Pull off," "Buy," "Sell," or "Stand Pat," to render as absolute obedience and enthusiastic cooperation as though they knew, to the smallest detail, the purposes which lay behind the giving of the order.

8th. The countless hordes of politicians, statesmen, law-makers and enforcers, who, at home or as representatives of the nation abroad, go to make up our political structure, and judges and lawyers.

To the world at large, which looks on and sees this giant institution move through the ranks of business without noise or dissension and with the ease and smoothness of a creature one-millionth its size, it would seem that there must be some wonderful and complicated code of rules to guide and control the thousands of lieutenants and privates who conduct its affairs. This is partially true, partially false. "Standard Oil's" governing rules are as rigid as the laws of the Medes and Persians, yet so simple as to be easily understood by any one.

First, there is a fundamental law, from which no one—neither the great nor the small—is exempt. In substance it is: "Every 'Standard Oil' man must wear the 'Standard Oil' collar."

This collar is riveted on to each one as he is taken into "the band," and can only be removed with the head of the wearer.

Here is the code. The penalty for infringing the following rules is instant "removal."

1. Keep your mouth closed, as silence is gold, and gold is what we exist for.

2. Collect our debts to-day. Pay the other fellow's debts to-morrow. To-day is always here, to-morrow may never come.

3. Conduct all our business so that the buyer and the seller must come to us. Keep the seller waiting; the longer he waits the less he'll take. Hurry the buyer, as his money brings us interest.

4. Make all profitable bargains in the name of "Standard Oil," chancy ones in the names of dummies. "Standard Oil" never goes back on a bargain.[9]

5. Never put "Standard Oil" trades in writing, as your memory and the other fellow's forgetfulness will always be re-enforced with our organization. Never forget our Legal Department is paid by the year, and our land is full of courts and judges.

6. As competition is the life of trade—our trade, and monopoly the death of trade—our competitor's trade, employ both judiciously.

7. Never enter into a "butting" contest with the Government. Our Government is by the people and for the people, and we are the people, and those people who are not us can be hired by us.

8. Always do "right." Right makes might, might makes dollars, dollars make right, and we have the dollars.

All business of the gigantic "Standard Oil" system is dealt with through two great departments. Mr. Rogers is head of the executive, and William Rockefeller the head of the financial department. All new schemes, whether suggested by outsiders or initiated within the institution, go to Mr. Rogers. Regardless of their nature or character, he first takes them under advisement. If a scheme prove good enough to run the gantlet of Mr. Rogers' tremendously high standard, the promoter, after he has set forth his plans and estimates, hears with astonishment these words:

"Wait while I go upstairs. I'll say Yes or No upon my return."

And upon his return it is almost always "Yes." If the project, however, does not come up to his exacting requirements, it is turned down without further ado or consultation with any of his associates.

Those intimate with affairs at 26 Broadway have grown curiously familiar with this expression, "I am going upstairs." "Upstairs" means two distinct and separate things. When a matter in Mr. Rogers' department is awaiting his return from "upstairs," it means he has gone to place the scheme before William Rockefeller, on the thirteenth floor, and laying a thing before William Rockefeller by Mr. Rogers consists of a brief, vigorous statement of Mr. Rogers' own conclusions and a request for his associate's judgment of it. William Rockefeller's strong quality is his ability to estimate quickly the practical value of a given scheme. His approval means he will finance it, and William Rockefeller's "say-so" is as absolute in the financing of things as is Mr. Rogers' in[10] passing upon their feasibility. It does not matter whether it is an undertaking calling for the employment of $50,000 capital or $50,000,000 or $500,000,000, Mr. Rockefeller's "Yes" or "No" is all there is to it. He having passed on it, Mr. Rogers supervises its execution.

The other "upstairs" is one that is heard every week-day of the year except summer Saturdays. At 26 Broadway, just before eleven o'clock each morning, there is a flutter in the offices of all the leading heads of departments from Henry H. Rogers down, for going "upstairs" to the eleven o'clock meeting is in the mind of each "Standard Oil" man the one all-important event of every working day.

In the big room, on the fifteenth floor, at 26 Broadway, there gather each day, between the hour of eleven and twelve o'clock, all the active men whose efforts make "Standard Oil" what "Standard Oil" is; here also come to meet and mingle with the active heads the retired captains when "they are in town." Around a large table they sit. Reports are presented, views exchanged, policies talked over, republics and empires made and unmade. If the Recorders in the next world have kept complete minutes of what has happened "upstairs" at 26 Broadway they must have tremendously large fire-proof safes. It is at the meeting "upstairs" that the "melons are cut," and if one of the retired captains were asked why he was in such a rush to be on hand each day when in town, and if he were in a talkative mood—which he would not be—he would answer: "They may be cutting a new melon, and there's nothing like being on hand when the juice runs out."

If a new melon has been cut—an Amalgamated Copper, for instance—it is at one of these meetings that the different "Standard Oil" men are informed for the first time that the scheme, about which they may have read or heard much outside, is far enough along for them to participate in it. Each is told what sized slice he may have if he cares for any. It is a very exceptional thing for any one to ask for more than he has been apportioned, and an unheard-of thing for any one to refuse to take his slice, although there is absolutely no compulsion in the connection.[11]

And here, perhaps, may not come amiss an incident which illustrates what may happen in a few minutes "upstairs."

Before Amalgamated was launched, in bringing together the different properties of which it was composed I negotiated for the acquisition of the Parrott mine, the majority of whose stock was held by certain old and wealthy brass manufacturers in Connecticut. They had never seen any of the Rockefellers nor Henry H. Rogers, but we were several months getting the deal into shape before it was finally arranged, and they became familiar with the great "Standard Oil" institution. So much so that the chief of the owners—to whom was delegated the duty of turning over the securities to my principals—looked forward with much eagerness to the time when he must necessarily meet the mysterious and important personages who guided 26 Broadway's destinies. Finally the day came, and at precisely a quarter of eleven I let him into one of the numerous private offices which are a part of Mr. Rogers' suite. He had under his arm a bundle of papers representing the stocks which he was to exchange for the purchase money, amounting to $4,086,000, and I think he fully expected that in their examination, in the receipting for so large an amount of money, and in the general talkings over, which he thought must of course be a necessary part of the delivery, the greater part of the day would be taken up. It took me some six or seven minutes to get him located, and it was close on to five minutes of eleven when Mr. Rogers stepped into the room. I was well into the introduction, when out came Mr. Rogers' watch, and with what must have appeared to the visitor as astonished consternation.

"I do hope you will excuse me," he exclaimed in the middle of a handshake, "but, my gracious, I am overdue upstairs," and he bolted.

His place was taken fifty seconds after by Mr. Rogers' secretary, who in less than five minutes had exchanged a check of $4,086,000, made out to herself and indorsed in blank, for the bundle of stocks, and in another minute I was ushering the old gentleman into the elevator.

When he came to on the sidewalk he got his breath suffi[12]ciently to say: "Phew! I thought my trade was a big one, but that friend of yours, Rogers, must have had some other fellow upstairs who was going to turn in $40,000,000 of stuff, because he did appear dreadfully excited!"

The success of "Standard Oil" is largely due to two things—to the loyalty of its members to each other and to "Standard Oil," and to the punishment of its enemies. Each member before initiation knows its religion to be reward for friends and extermination for foes. Once within the magic circle, a man realizes he is getting all that any one else on earth can afford to pay him for like services, and still more thrown in for full measure. Moreover, while a "Standard Oil" man's reward is always ample and satisfactory, he is constantly reminded in a thousand and one ways that punishment for disloyalty is sure and terrible, and that in no corner of the earth can he escape it, nor can any power on earth protect him from it.

"Standard Oil" is never loud in its rewards nor its punishments. It does not care for the public's praise nor for its condemnation, but endeavors to avoid both by keeping its "business" to itself. As an instance, in connection with certain gas settlements I made with "Standard Oil," it voluntarily paid one of its agents for a few days' work $250,000. He had expected at the outside $25,000. When I published the fact, as I had a right to, "Standard Oil" was mad as hornets—as upset, indeed, as though it had been detected in cheating the man out of two-thirds of his just due, instead of having paid him ten times what was coming to him.

In the great Thing known to the world as "Standard Oil," the most perfect embodiment of a "system" which I will endeavor to get before my readers in later chapters, there are three heads, Henry H. Rogers, William Rockefeller, and John D. Rockefeller. All the other members are distinctively lieutenants, or subordinate workers, unless possibly I except James Stillman, who, from his peculiar connection with "Standard Oil" and his individually independent position, should perhaps be placed in the category of heads.

Some one has said: "If you would know who is the head of a family, slip into the home." The world, the big, arbitrary, hit-or-miss, too-much-in-a-hurry-to-correct-its-mistakes world, has decided that the master of "Standard Oil" is John D. Rockefeller, and John D. Rockefeller it is to all but those who have a pass-key to the "Standard Oil" home. To those the head of "Standard Oil"—the "Standard Oil" the world knows as it knows St. Paul, Shakespeare, or Jack the Giant-killer, or any of the things it knows well but not at all—is Henry H. Rogers. John D. Rockefeller may have more money, more actual dollars, than Henry H. Rogers, or all other members of the "Standard Oil" family, and in the early days of "Standard Oil" may have been looked up to as the big gun by his partners, and allowed to take the hugest hunks of the profits, and may have so handled and judiciously invested these as to be at the beginning of the twentieth century the richest man on earth, but none of these things alters the fact that the big brain, the big body, the head of "Standard Oil," is Henry H. Rogers.

Take station at the entrance of 26 Broadway and watch the different members of the "Standard Oil" family as they enter the building: you will exclaim once and only once:[14] "There goes the Master!" And the man who calls forth the cry will be Henry H. Rogers.

The big, jovial detective who stands all day long with one foot resting on the sidewalk and one on the first stone step of the home of "Standard Oil" will make oath he shows no different sign to Henry H. Rogers than to a Rockefeller, a Payne, a Flagler, a Pratt, or an O'Day; yet watch him when Mr. Rogers passes up the steps—an unconscious deference marks his salutation—the tribute of the soldier to the commanding general.

Follow through the door bearing the sign, "Henry H. Rogers, President of the National Transit Co.," on the eleventh floor, and pass from the outer office into the beautiful, spacious mahogany apartment beyond, with its decorations of bronze bulls and bears and yacht-models, its walls covered with neatly framed autograph letters from Lincoln, Grant, "Tom" Reed, Mark Twain, and other real, big men, and it will come over you like a flash that here, unmistakably, is the sanctum sanctorum of the mightiest business institution of modern times. If a single doubt lingers, read what the men in the frames have said to Henry H. Rogers, and you will have proof positive that these judges of human nature knew this man, not only as the master of "Standard Oil," but also as a sturdy and resolute friend whose jovial humanity they had recognized and enjoyed.

Did my readers ever hear of the National Transit Company? Very few have—yet the presidency of it is the modest title of Henry H. Rogers. When the world is ladling out honors to the "Standard Oil" kings, and spouting of their wondrous riches, how often is Henry H. Rogers mentioned? Not often, for he is never where the public can get a glimpse of him—he is too busy pulling the wires and playing the buttons in the shadows just behind the throne. Had it not been that that divinity which disposes of men's purposes compelled this man, as he neared the end of his remarkable career, to come into the open on Amalgamated, he might never have been known as the real master of "Standard Oil." But if he is missing when the public is hurrahing, he is sufficiently in evidence when clouds lower[15] or when the danger-signal is run to the masthead at 26 Broadway. He who reads "Standard Oil" history will note that, from its first deal until this day, whenever bricks, cabbages, or aged eggs were being presented to "Standard Oil," always were Henry H. Rogers' towering form and defiant eye to be seen in the foreground where the missiles flew thickest.

During the past twenty years, whenever the great political parties have lined-up for their regular once-in-four-years' tussle, there would be found Henry H. Rogers, calm as a race-track gambler, "sizing-up" the entries, their weights and handicaps. Every twist and turn in the pedigrees and records of Republicans and Democrats are as familiar to him as the "dope-sheets" are to the gambler, for is he not at the receiving end of the greatest information bureau in the world?

A Standard Oil agent is in every hamlet in the country, and who better than these trained and intelligent observers to interpret the varying trends of feelings in their communities? Tabulated and analyzed, these reports enable Rogers, the sagacious politician, to diagnose the drift of the country far ahead of the most astute of campaign managers. He is never in doubt about who will win the election. Before the contest is under way he has picked his winner and is beside him with generous offers of war expenses.

When labor would howl its anathemas at Standard Oil, and the Rockefellers and other stout-hearted generals and captains of this band of merry money-makers would fall to discussing conciliation and retreat, it was always Henry H. Rogers who fired at his associates his now famous panacea for all Standard Oil opposition: "We'll see Standard Oil in hell before we will allow any body of men on earth to dictate how we shall conduct our business!" And the fact that "Standard Oil" still does its business in the Elysian fields of success, where is neither sulphur nor the fumes of sulphur, is additional evidence of whose will it is that sways its destinies.

An impression of the despotic character of the man and of his manner of despatching the infinite details of the multitudinous business he must deal with daily may be gained[16] by a glimpse of Henry H. Rogers at one of the meetings of the long list of giant corporations which number him among their directors. Surrounded though he be by the élite of all financialdom, the very flower of the business brains of America, you will surely hear his sharp, incisive, steel-clicking: "Gentlemen, are we ready for the vote, for I regret to say, I have another important and unavoidable meeting at ——?" You look at your watch. The time he mentions is twelve, or, at the most, fifteen minutes away. There is no chance for further discussion. Cut-and-dried resolutions are promptly put to the vote, and off goes the master to his other engagement which will be disposed of in the same peremptory fashion.

At a meeting of the directors of "financed" Steel, during the brief reign of its late "vacuumized" president, Charlie Schwab, an episode occurred which exhibited the danger of interfering with Mr. Rogers' iron-bound plans. The fact that the steel throne was many sizes too large for Schwab had, about this time, become publicly notorious, but Carnegie and Morgan on the surface, and "Standard Oil" beneath, were so busy preparing their alibis against the crash which even then was overdue that they had neither time nor desire to adjust themselves on the seat.

In advance Mr. Rogers made his invariable plea for quick action on a matter before the board when Schwab, with a tact generated by the wabbling of a misfit Wall Street crown chafing a generous pair of ears, blurted out: "Mr. Rogers will vote on this question after we have talked on it."

In a voice that those who heard it say sounded like a rattlesnake's hiss in a refrigerator, Rogers replied: "All meetings where I sit as director vote first and talk after I am gone."

It is said, and from my knowledge of these and after-events I believe with truth, that this occurrence was the spark that started the terrific explosion in United States Steel, for not long afterward some unknown and mysterious power began that formidable attack on Steel stock which left Wall Street full of the unattached ears, eyes, noses, breastbones, and scalps of hordes of financial potentates and their flambeau carriers. Whether or not Mr. Rogers was the instigator of[17] this movement no man, of course, can positively state, but I can vouch for the fact that about this time he displayed, when talking "Steel" affairs with intimates, a most contemptuous bitterness against "King Charlie" and certain of his associates.

At sixty-five Henry H. Rogers is probably one of the most distinguished-looking men of the time; tall and straight, and as well-proportioned and supple as one of the beautiful American elms which line the streets of his native town. He was born in Fairhaven, a fishing village just over the bridge from the great whaling port, New Bedford. He comes of stalwart New England stock; his father was a sea-captain, and his lot, like that of most of the sons of old New England seaport towns, was cast along those hard, brain-and-body-developing lines which, beginning in the red village school-house, the white meeting-house, and the yellowish-grayish country store, end in unexpected places, often, as in this instance, upon the golden throne of business royalty.

Mr. Rogers' part in the very early days of Standard Oil was that of clerk and bookkeeper. He makes no secret that when he had risen to the height of $8 a week wages he felt as proud and confident as ever in after-life when for the same number of days' labor it was no uncommon occurrence to find himself credited with a hundred thousand times that amount.

All able men have some of God's indelible imprints of greatness. This man's every feature bespeaks strength and distinction. When he walks, the active swing of his figure expresses power—realized, confident power. When at rest or in action his square jaw tells of fighting power, bull-dog, hold-on, never-let-go fighting power, and his high, full forehead of intellectual, mightily intellectual power; and they are re-enforced with cheek-bones and nose which suggest that this fighting power has in it something of the grim ruthlessness of the North American Indian. The eyes, however, are the crowning characteristic of the man's physical make-up.

One must see Mr. Rogers' eyes in action and in repose to half appreciate their wonders. I can only say they are red, blue, and black, brown, gray, and green; nor do I want[18] my readers to think I put in colors that are not there, for there must be many others than those I have mentioned. I have seen them when they were so restfully blue that I would think they never could be anything but a part of those skies that come with the August and September afternoons when the bees' hum and the locusts' drone blend with the smell of the new-mown hay to help spell the word "Rest."

I have seen them so green that within their depths I was almost sure the fish were lazily resting in the shadows of those sea-plants which grow only on the ocean's bottom; and I have seen them as black as that thunder-cloud which makes us wonder: "Is He angry?" And then again I have watched them when they were of that fiery red and that glinting yellow which one sees only when at night the doors of a great, roaring furnace are opened.

There is such a kindly good-will in these eyes when they are at rest that the man does not live who would not consider himself favored to be allowed to turn over to Henry H. Rogers his pocket-book without receiving a receipt. They are the eyes of the man you would name in your will to care for your wife's and children's welfare. When their animation is friendly one would rather watch their merry twinkle as they keep time to their owner's inimitable stories and non-duplicatable anecdotes, trying to interpret the rapid and incessant telegraphy of their glances, than sit in a theatre or read an interesting book; but it is when they are active in war that the one privileged to observe them gets his real treat, always provided he can dodge the rain of blazing sparks and the withering hail of wrath that pours out on the offender. To watch them then requires real nerve, for it is only a nimble, stout-hearted, mail-covered individual that can sustain the encounter.

I have seen many forms of human wrath, many men transformed to terrible things by anger, but I have never seen any that were other than jumping-jack imitations of a jungle tiger compared with Henry H. Rogers when he "lets 'er go"—when the instant comes that he realizes some one is balking the accomplishment of his will.

Above all things Henry H. Rogers is a great actor. Had[19] his lot been cast upon the stage, he might easily have eclipsed the fame of Booth or Salvini. He knows the human animal from the soles of his feet to the part in his hair and from his shoulder-blade to his breastbone, and like all great actors is not above getting down to every part he plays. He is likely also so to lose himself in a rôle that he gives it his own force and identity, and then things happen quite at variance with the lines. The original Booth would come upon the stage the cool, calculating, polished actor, but when well into his part was so lost in it that it was often with difficulty he could be brought back to himself when the curtain fell. Once while playing Richard III. at the old Boston Museum, Richmond, by whom he was to be slain, made, at the ordained moment, the thrust which should have laid him low, but instead, Booth in high frenzy parried it, and with the fiendishness of the original Richard, step by step drove Richmond off the stage and through the wings, and it was not until the police seized the great tragedian, two blocks away, that the terrified duke, who had dropped his sword and was running for dear life, was sure he would ever act again.

When in the midst of his important plays, it is doubtful whether Henry H. Rogers realizes until the guardians of the peace appear where the acting begins and the reality should end. His intimate associates can recall many times when his determination to make a hit in his part has caused other actors cast with him to throw aside their dummy swords and run for their lives.

The entire history of "Standard Oil" is strewn with court-scenes, civil and criminal, and in all the important ones Henry H. Rogers, the actor, will be found doing marvellous "stunts." Standard Oil historians are fond of dwelling on the extraordinary testifying abilities of John D. Rockefeller and other members of the band, but the acrobatic feats of ground and lofty tumbling in the way of truth which they have given when before the blinking footlights of the temples of justice are as Punch-and-Judy shows to a Barnum three-ring circus compared to Henry H. Rogers' exhibitions.[20]

His "I will tell the truth, the whole truth, and nothing but the truth, so help me God," sounds absolutely sincere and honest, but as it rings out in the tone of the third solemnest bell in the chime, this is how it is taken down in the unerring short-hand notes of the recording angel and sent by special wireless to the typewriter for His Majesty of the Sulphur Trust: "What I tell shall be the truth and the whole truth, and there shall be no truth but that I tell, and God help the man or woman who tells truth different from my truth." The recording angel never missed catching Henry H. Rogers' court-oaths in this way, and never missed sending them along to the typewriter at Sulphurville, with this postscript: "Keep your wire open, for there'll be things doing now!"

At the recent but now famous sensational Boston "Gas Trial," Henry H. Rogers in the rôle of defendant was the principal witness. I was in court five hours and a half each sitting as day after day he testified. I watched, as the brightest lawyers in the land laid their traps for him in direct and cross-examination, to detect a single sign of fiction replacing truth, or going joint-account with her, or where truth parted company with fiction; and I was compelled, when he stepped from the witness-stand, to admit I had not found what I had watched for. This, too, when I was equipped with actual knowledge and black-and-white proofs of the facts. Weeks before the trial began Attorney Sherman L. Whipple, one of the great cross-examiners of the time, had made his boast that he would break through the "Standard Oil" magnate's heretofore impenetrable bulwarks, and when H. H. Rogers entered the court-room for the first time and let his eagle eye sweep the lawyers, the laymen, and the judge until it finally rested on Whipple, the glance was as absolute a challenge and a defiance as ever knights of old exchanged.

I followed Mr. Rogers on the witness-stand and was compelled to give testimony directly opposite to that which he had given, and at one time, as I glanced at the row of lawyers who were in "Standard Oil's" hire, I felt a cold perspiration start at every pore at the thought of what would[21] happen if I even in a slight detail got mixed in my facts. Then I fully realized the magnificence of Mr. Rogers' acting, for not once in all the hours I had sat and watched him had I detected a single evidence of cold, hot, or lukewarm perspiration coming from his pores.

Yet away from the intoxicating spell of dollar-making this remarkable man is one of the most charming and lovable beings I have ever encountered, a man whom any man or woman would be proud to have for a brother; a man whom any mother or father would give thanks for as a son; a man whom any woman would be happy to know as her husband, and a man whom any boy or girl would rejoice to call father. Once he passes under the baleful influence of "The Machine," however, he becomes a relentless, ravenous creature, pitiless as a shark, knowing no law of God or man in the execution of his purpose. Between him and coveted dollars may come no kindly, humane influences—all are thrust aside, their claims disregarded, in ministering to this strange, cannibalistic money-hunger, which, in truth, grows by what it feeds on.

In describing one head of "Standard Oil," I have necessarily used many words because nature cast him in a most uncommon and chameleon-like mould. The other two require less of my space, for neither is unusual nor remarkable.

John D. Rockefeller, however great his ability or worldly success, can be fully described as a man made in the image of an ideal money-maker and an ideal money-maker made in the image of a man. A foot-note should call attention to the fact that an ideal money-maker is a machine the details of which are diagrammed in the asbestos blue-prints which paper the walls of Hell.

With William Rockefeller it is different. When I read in my Bible that God made man in His own image and likeness, I find myself picturing a certain type of individual—a solid, substantial, sturdy gentleman with the broad shoulders and strong frame of an Englishman, and a cautious, kindly expression of face. And that is the most fitting description I can give of William Rockefeller. A man of few, very few words and most excellent judgment—rather[22] brotherly than friendly, clean of mind and body; and if I have not given you the impression of a good, wholesome man made in the image of his God, I have done William Rockefeller a greater wrong than an honest man can afford to do another.

As to my personal responsibility for the crime of Amalgamated, right here, before proceeding further, I shall briefly explain the transaction, state my share in the deal, and point out how completely I was hoodwinked by the "System."

The great Anaconda mine and affiliated properties, previous to the creation of the Amalgamated, were owned by J. B. Haggin, Lloyd Tevis, and Marcus Daly. The control of the properties and their operations were absolutely vested in Marcus Daly, and he alone knew where the lean veins ended and the fat ones began. For many years he had kept a close guard over the very fat ones, never letting his right eye know what the left one saw when he was examining them. For deep down in his mind Marcus Daly cherished a dream—a dream of immense riches, and it was to be realized in a simple enough way. He would get together the millions to buy out his partners on the basis of a valuation of the "ore in sight," then in supreme ownership himself reap untold profits out of the milling of the plethoric veins he had been so careful to leave unworked. The immense natural endowments of the Anaconda rendered this easy enough, for even the lean veins "in sight" contained a vast store of copper and gold and silver.

Just about the time the world awaited the first section of "Coppers" which I had advertised should consist of the rich Boston & Montana, and Butte & Boston properties, it "happened" that Mr. Rogers "met" Marcus Daly. The result of the conjunction of the two personalities—the whole-souled, trusting miner and the fascinating and persuasive master of Standard Oil—was decisive; the miner confided[24] his dreams and his aspirations to the magnate, who at once magnificently undertook to realize them. The trade was almost instantly made. Mr. Rogers would buy the properties of Daly, Haggin, and Tevis, at "in-sight" prices, and Daly would be his partner, but the partnership must remain secret until the purchase was consummated.

The ownership of the Anaconda Company at the time consisted of 1,200,000 shares, and the purchase of a few shares over the majority at the "in-sight" lean-vein valuation of $24,000,000 would carry the turnover of the management and the control. It took but a very brief time to get together the other properties which were finally included in the first section of Amalgamated. They consisted of the Colorado, Washoe, and Parrott Mining companies and timber, coal, and other lands, and mercantile and like properties situated in the State of Montana, for which Mr. Rogers paid in round figures $15,000,000, a total of $39,000,000 for what within a few days after purchase was capitalized at $75,000,000 in the Amalgamated Company.

No one but Henry H. Rogers, William Rockefeller, myself, and one lawyer knew the actual figures of the cost, although a number of the members of the different groups, including Marcus Daly, the silent partner, were sure they were in the secret.

As soon as the properties were secured, they were capitalized for $75,000,000 as the Amalgamated Copper Company and were immediately offered for sale to the public. It will thus be seen that the profit on this section alone was $36,000,000, probably the largest actual profit ever made by one body of men in a single corporation deal, yet so nicely does "Standard Oil" discriminate in dispensing its generosity that in this case those who received the $36,000,000 profit refused to deduct from it $77,000 of expenses connected with the formation of the company, thereby compelling it to start $77,000 in debt. This was something Marcus Daly never forgave and to the day of his death he repeatedly referred to the act as the personification of corporation meanness.

In the organization of the Amalgamated Corporation cer[25]tain individuals and institutions, for various considerations, were entitled to some share in the profits of the deal. First there was Marcus Daly who knew what the major portion of the property had cost and was a silent partner in the winnings as he knew them. The Amalgamated Company was organized in and floated on the public from the National City Bank, and so James Stillman, its president and head, who is also one of the inner circle of "Standard Oil" chiefs, should participate. Something was due also to J. Pierpont Morgan & Co., and to Frederick Olcott, president of the Central Trust Company of New York, who were on the board of directors. On the board of directors, too, was Governor Flower, of the banking and brokerage house of Flower & Co., who had acted as fiscal agents for the corporation at its formation. Nor must I forget the Lewisohn Brothers, who had been compelled to turn in all their copper business at a fraction of its worth—or at just the aggregate of its cost and raw material—to be incorporated in the United Metals Selling Company, a part of the Amalgamated scheme, but not included in the corporation. Every one of these men had elaborate assurances that he was in on the cellar floor.

This is what actually occurred. Before Mr. Rogers and William Rockefeller let any one at all in, they built a superbly designed water-, air-, and light-proof structure (particularly light-proof), consisting of five floors, each one being the exact duplicate of the $39,000,000 one upon which they, and they only, stood. Marcus Daly alone was ushered in on the first floor, elevated just a few million dollars above their own. James Stillman and Leonard Lewisohn, of Lewisohn Brothers, were admitted to the next one, the $50,000,000 floor. In other words, Mr. Stillman and Mr. Lewisohn were given an unnamed percentage, the percentage to be arranged later by Mr. Rogers, in all profits above actual cost, and such actual cost was called $50,000,000 and was arrived at by adding the $11,000,000 of secret profits to the actual $39,000,000 cost. Then J. P. Morgan & Co., Frederick Olcott, Governor Flower, and one or two of the dearest friends and closest associates, were let in on the $60,000,000 floor—were[26] given an unnamed percentage, the percentage to be arranged by Mr. Rogers, in all profits above actual cost, and such actual cost was called $60,000,000, and was arrived at by adding $21,000,000 of secret profits to the actual $39,000,000 cost. Then selected ones from the eight different groups of "Standard Oil" were allowed to move in to the fifth, or underwriters' floor, which was affirmed to be $70,000,000 cost; and then, as a solid phalanx, all the different floor-dwellers marched upon the dear public to the tune of $75,000,000, in the front ranks of which were those of the eight groups of the Standard Oil army who had not already been admitted to any of the secret floors.

Right here the crime of Amalgamated was born, not so much the legal crime but the great moral crime. In the ethics of Wall Street the heinousness of the transaction lies not in the fact that the public was compelled to pay $36,000,000 profit to a few men who had invested but $39,000,000—and, as I shall show when I approach this part of my story, the $39,000,000 did not even belong to them—but in the fact that Mr. Rogers and Mr. Rockefeller had given to their associates what, in the vernacular of "the Street," is termed "the double cross."

The every-day people, the millions who do not know Wall Street, realm of the royal American dollar; Wall Street, its sidewalks inlaid with gold coin and paved from curb to curb with solid gold bricks; Wall Street, lined with huge money-mills where hearts and souls are ground into gold-dust, whose gutters run full to overflowing with strangled, mangled, sand-bagged wrecks of human hopes, to be poured, in a never-ending stream, into the brimming waters of the river at its foot, for deposit at the poor-houses, insane asylums, States' prisons, and suicides' graves, washed daily by that grim flood's ebb and flow—the every-day people, I am sure, will not take in the blackness of this transaction at this stage of my story, but before it is ended I will lay this and many more of an equally hellish nature before them in such A B C simplicity that all can read the portent as clearly as the Prophet Daniel read the writing on the wall in the banquet-hall of Belshazzar.[27]

When I consented to allow property which had cost only $39,000,000 to be sold to the public for $75,000,000, it was under a pressure which it was practically impossible for me to withstand. I do not think I use too strong a word when I say "pressure." For three years I had been advertising to the world the great merits of "Coppers," and for over a year I had announced that when the public was given an opportunity to participate in the consolidated "Coppers" it would be upon a basis most carefully worked out: that the properties included in the first section would surely be worth more than the price at which they would be offered to the public, and that all the power, capital, and ability of "Standard Oil" were behind the promises I made. I did this advertising openly and in the frankest possible way, and in all of my announcements, whether printed, oral, or otherwise, used the names of Henry H. Rogers, William Rockefeller, James Stillman, the National City Bank of New York, and "Standard Oil" as freely as I did my own, and in many ways led the public to believe that the very rich Boston & Montana and Butte & Boston companies were to be included in this section of "Coppers."

At that time my alliance with "Standard Oil" was close. A business connection had developed into a strong personal relation between Mr. Rogers and myself. We were engaged, together with William Rockefeller, on a great financial deal which was based on certain conclusions I had worked out in regard to the copper industry. These men were to me the embodiment of success, success won in the fiercest commercial conflict of the age. Their position at the helm of the greatest financial institution in the world gave weight and importance to their judgment and opinions. Nor had aught occurred between us to suggest they would dare perpetrate the crimes they did. Besides all this, indeed an integral part of it, my personal resources were completely involved in the transaction, for the most part pledged with Mr. Rogers and William Rockefeller in stocks of the Butte & Boston and Boston & Montana corporations.

This was, then, the nature of our connection when Mr. Rogers, suddenly and without previous intimation of his[28] schemes, notified me of his purchase of the Daly-Haggin-Tevis properties, and practically ordered me to put them upon the tray which I was preparing and take them to the eagerly waiting public, who by this time were fairly howling for the good things we had been promising them.